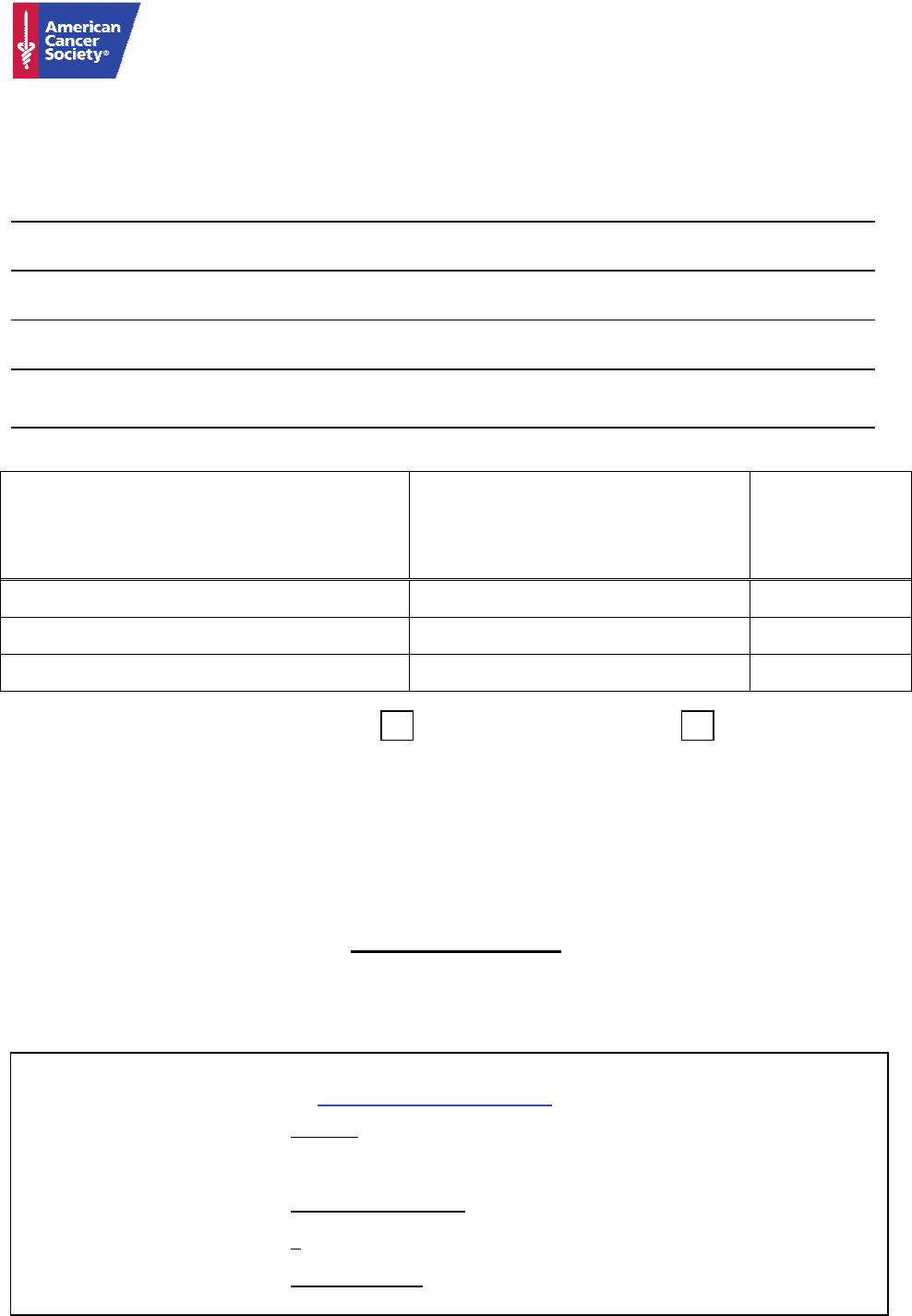

HTML Preview In Kind Gift Receipt page number 1.

In Kind Gift Receipt

In Kind refers to donations of goods or services instead of cash.

Please note that according to IRS regulations, establishing a dollar value on donated goods or

services is the exclusive responsibility of the donor. Donated services are not tax deductible.

Company/Individual

Company Contact

Address

City/State/Zip

Phone (Home) Phone (Business) Email Address

Describe the donation

List condition of the good.

Leave blank for contributed

services.

Donor’s

estimate of fair

market value

Please check event donation is for: The MKE Experience Inspiration Soiree

PLEASE NOTE: The American Cancer Society cannot attach a proper dollar value to your

gift. Federal tax laws impose certain reporting obligations for charitable contributions of property

other than cash. IRS Form 8283 and its instructions can assist you with your reporting obligations.

The American Cancer Society gratefully acknowledges the In Kind gift(s) described above. Please

keep this receipt. Your contribution is tax deductible to the extent allowed by law.

Please return form to:

Kelsey Chapman, N19 W24350 Riverwood Drive, Waukesha, WI 53188

Email: [email protected]g | Phone: 608.662.7553 | Fax: 262.523.9433

For Office Use Only: Please make a copy of this receipt, complete the following and

send to the SSBC GL Team at [email protected].

Division Receiving Credit: Midwest

Please complete the following only if the donor specified an event or program for their gift(s):

Event/Program: The MKE Experience

Fund: 1

Activity: MWWMWKGAL