HTML Preview Printable Mortgage Budget Planner page number 1.

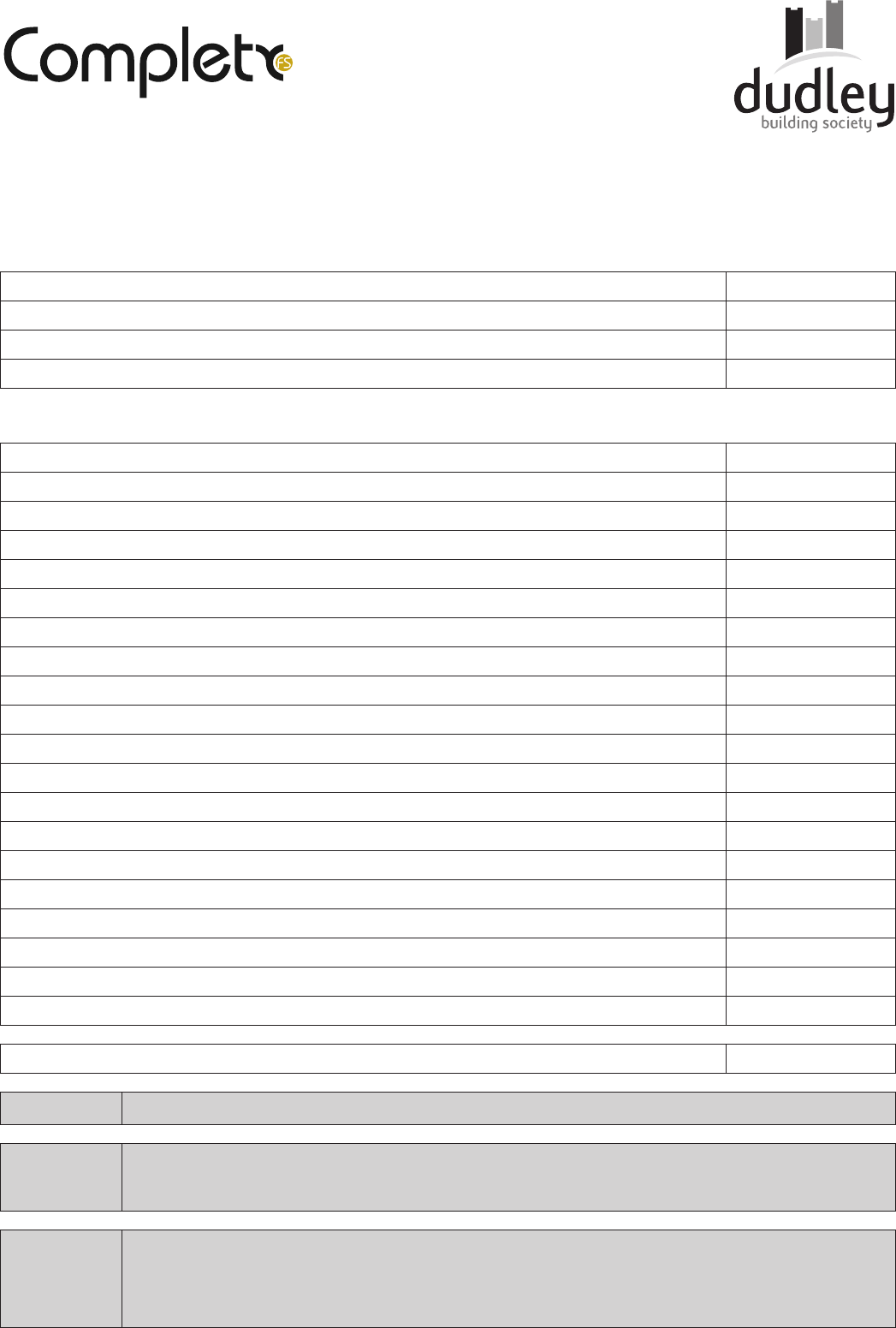

Mortgage Budget Planner

Version 1.2 August 2014

Before you enter into any new mortgage commitment, you need to be sure that it is aordable on your own personal budget.

Use this planner to work out what you can aord to pay each month.

Income:

“Take Home” Monthly Pay - Applicant 1 £

“Take Home” Monthly Pay - Applicant 2 £

Other Monthly Income £

Total Monthly Income £

Monthly Expenses:

Credit Card / Store Card Payments £

Loan Repayments £

Other Standings Orders & Direct Debits £

Maintenance / CSA Payments £

Shared Ownership / Equity Rent (For New Property) £

Cost of Repayment Strategy (If Applicable) £

Utilities (Gas / Water / Electric)

£

Telephone £

Council Tax £

Buildings and Contents Insurance Premiums (For New Property) £

Nursery / School / University Fees £

Housekeeping (Food etc.) £

Alcohol / Cigarettes £

Clothing / Footwear £

Car Tax / MOT / Insurance / Petrol / Travel £

Life Assurance £

Regular Savings and Pensions £

Recreation (Entertainment & Holidays) £

Any Other Expenses £

Total Monthly Expenses £

Spare Income Each Month £

Application:

Name(s):

Signed: