HTML Preview Household Budget Printable page number 1.

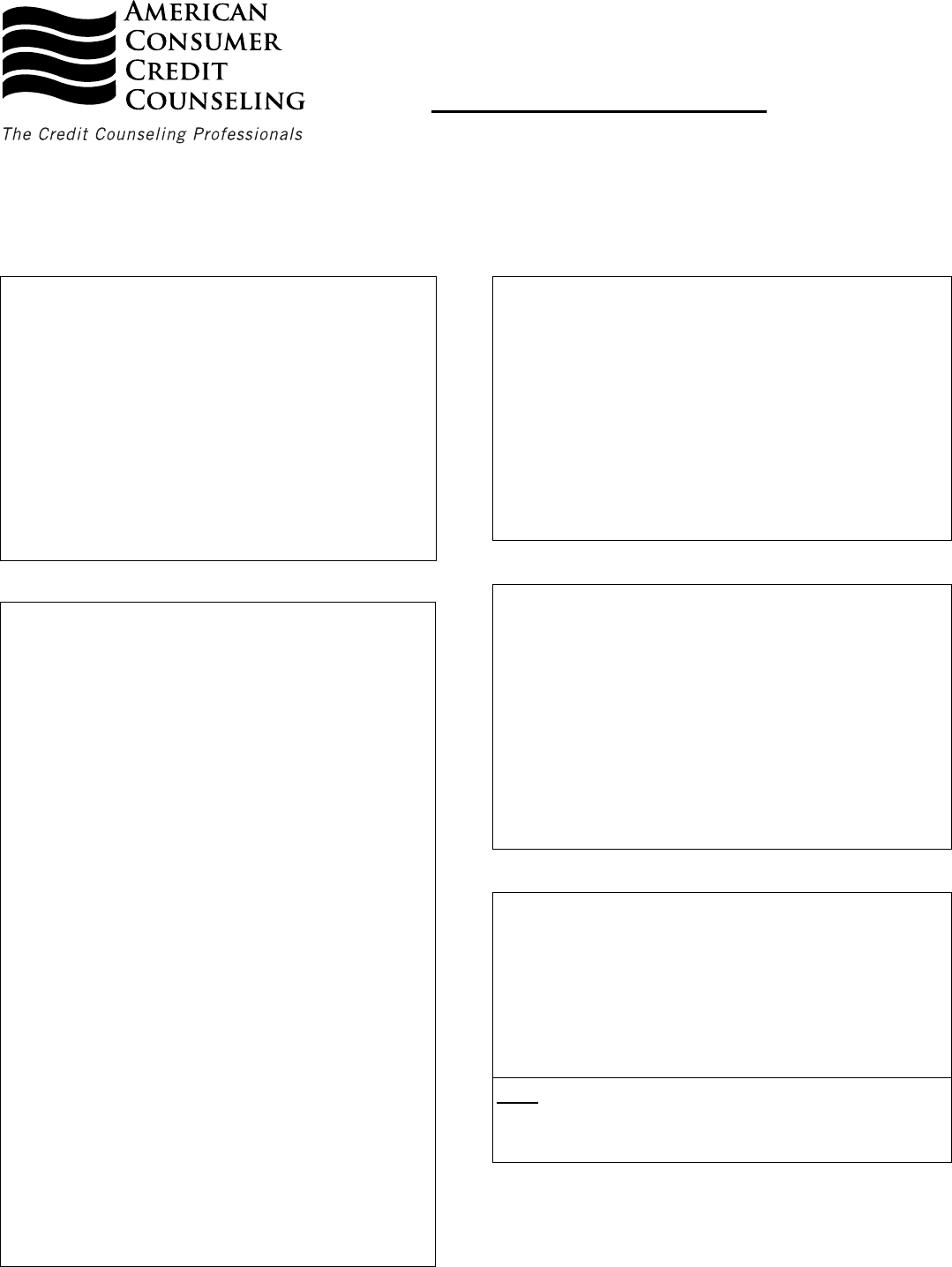

Household Budgeting Worksheet

Photocopy this sheet before using it

Make sure that you include all take-home income and expenses as accurately as possible. The information you provide

will be used to compute your household budgeting plan. Try not to inate the numbers, but do not underestimate either.

If a monthly expense is automatically deducted from your take-home income, do not enter it below.

Salary/Wages

Salary/Wages (Spouse)

Social Security

Military Pay

Pension Plan/Retirement

Interest Income

Alimony/Child Support

Real Estate (Rent)

Dividends (Investments)

Unemployment/Food Stamps

Royalties/Other Income

Total Income

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

Monthly Take-Home Income

Rent (Apartment, etc)

1st Mortgage/Taxes/Insurance

2nd Mortgage/Taxes/Insurance

Trailer Park Space Rent

Student Loans

Auto Loans/Leases

Recreation Toys (Watercraft, etc.)

Past-Due Taxes

Other Secured Debts

Other Secured Loans

Total Secured Debt

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

Monthly Secured Debts

Credit Card

Credit Card

Credit Card

Credit Card

Credit Card

Credit Card

Personal Loan

Personal Loan

Medical/Dental Bills

Other Unsecured Loans

Total Unsecured Debt

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

Monthly Unsecured Debts

Total Take-Home Income

Total Living Expense Payments

Total Secured Debt Payments

Total Unsecured Debt Payments

Your Disposable Income or Decit

$__________

(minus)

$__________

$__________

$__________

(equals)

$__________

Summary of Budget

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

$__________

Food (Home, Work, School)

Household Items

Clothing

Laundry/Dry Cleaning

Telephone (Home, Cell, Pager)

Internet Service

Cable TV/Satellite

Electric

Gas/Oil

Water/In-Home Service

Trash Service

Auto Gas/Maintenence

Auto Insurance

Health & Dental Insurance

Life & Disability Insurance

Homeowners/Renters Insurance

Education (Tuition, Supplies)

Personal Care (Hair, Nails, etc)

Medical Care (Prescriptions, etc.)

Child Care (Nanny, Day Care)

Children Activities (Sports, etc.)

Alimony/Child Support

Gardener/Pool/Alarm Service

Entertainment

Homeowner Dues

Subscriptions

Health Club Membership

Contributions/Donations/Gifts

Other Expenses (Misc.)

Total Expenses

Monthly Living Expenses

130 Rumford Ave, Suite 202, Auburndale, MA 02466-1371

Toll Free: 1-800-769-3571 ~ Fax: 617-244-1116

ConsumerCredit.com

Note: If you have a decit, you should seek the help of a credit

counseling agency to help you reduce expenses as well as create

a workable budget for you and your family.