HTML Preview Sales Expense Report Sample page number 1.

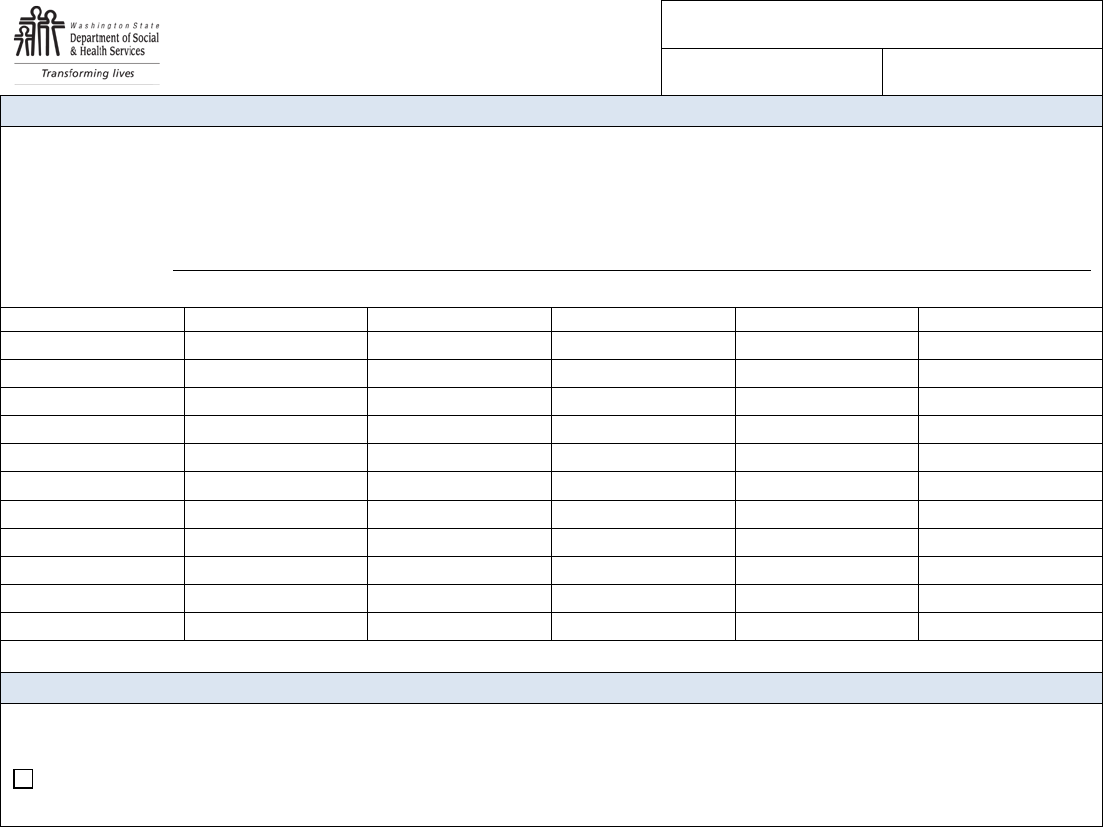

SELF EMPLOYMENT – MONTHLY SALES AND EXPENSE WORKSHEET

DSHS 07-098 (REV. 09/2015)

Self Employment

Monthly Sales and Expense

Worksheet

NAME

MONTH

CLIENT ID NUMBER

1. Self Employment Income

You must tell us about your monthly self employment income.

• If you provide us copies of your business ledgers or profit and loss statements, you do not need to use this form.

• If you do not have these business records available, you may use this form to tell us about your income and expenses.

You must sign the back of this form.

Business Name:

List your total daily income from sales of goods and services:

DATE

TOTAL SALES

DATE

TOTAL SALES

DATE

TOTAL SALES

Monthly Total Self Employment Income $

2. Deducting Business Expenses

If you want to claim business expenses, you must list the expenses on the following page

and give us documentation of the

expense. (WAC 388-450-0085, 182-512-0840)

For cash and food only: I choose to take the 50% standard deduction instead of listing my expenses on the next

page. (Sign the back page.)

Business Expenses. Generally, you may claim any business expense that is allowed by the Internal Revenue Service

(IRS), with the exception that we don’t allow a deduction for depreciation.

Examples of business expenses are:

• Materials used to produce goods or services

• Chemicals and supplies used to produce goods or

services

• Business Loans (interest and principle)

• Banking fees

• Legal, accounting, or other professional fees

• Space rent and business utilities

• Maintenance of business property

• Payroll or wages

• Vehicle expenses for business purposes with

documentation

• Business phone

Examples of line items we don’t count as an expense are:

• Depreciation

• Guaranteed payments

• Health insurance for you and your family

• Money set aside for retirement purposes

• Personal utilities (phone, electricity, etc.)

• Rent or mortgage of your home

• Personal work expenses (travel to/from work, clothing)

• Vehicle expenses without documentation for cash and

food

Examples of allowable documentation of expenses are:

• Receipts for expense claimed

• Itemized bank statements that match expenses claimed

• Itemized bank card statements that match expense

claimed

• Mileage logs