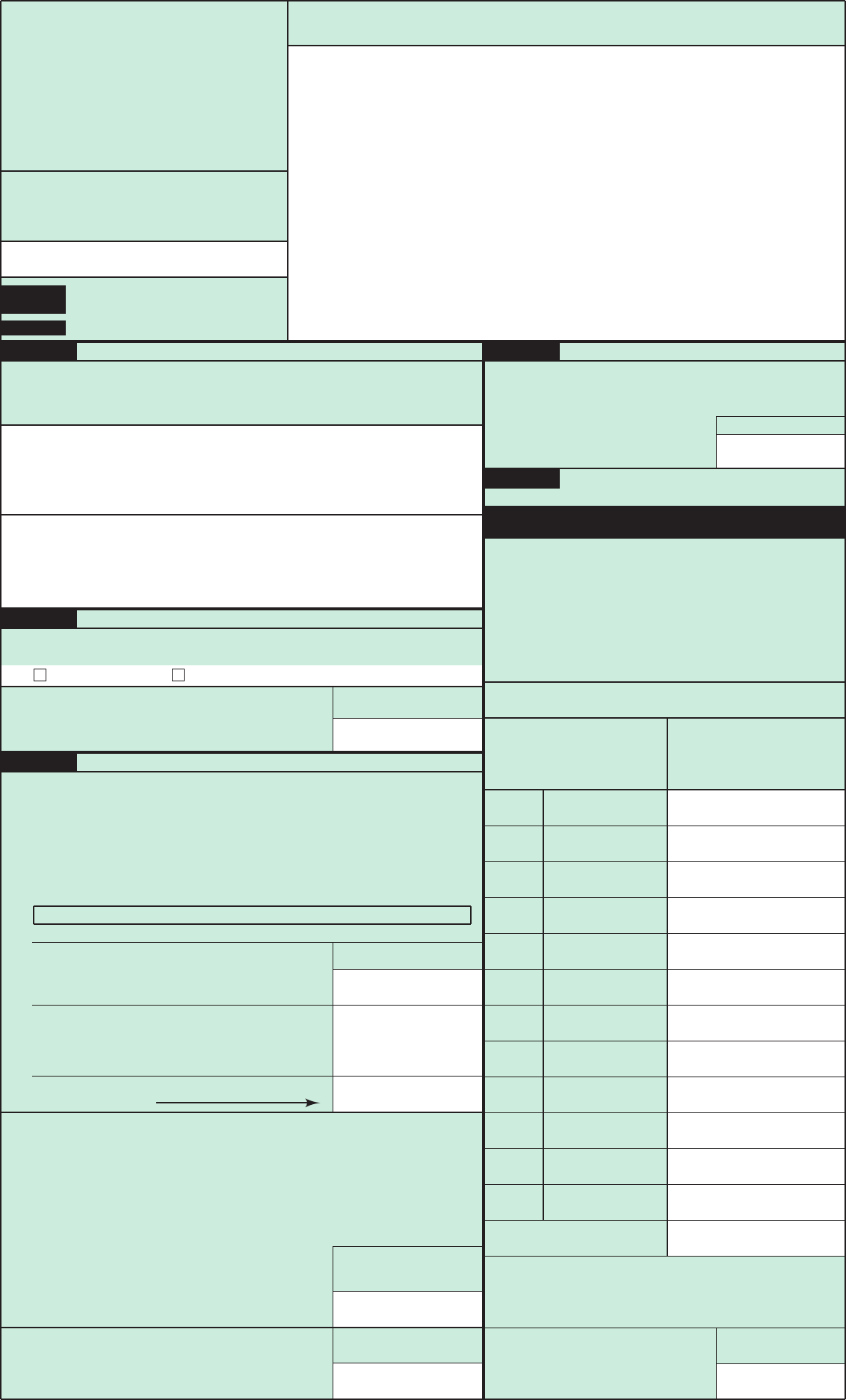

HTML Preview Construction Project Report page number 1.

FORM

(6-7-2010)

C-700

U.S. DEPARTMENT OF COMMERCE

Economics and Statistics Administration

NOTICE – Your report to the Census Bureau is confidential by law (title 13, U.S. Code). It may be seen only

by persons sworn to uphold the confidentiality of Census Bureau information and may be used only for

statistical purposes. The law also provides that copies retained in your files are immune from legal process.

In any correspondence pertaining to this report,

refer to the control number shown below.

PRIVATE CONSTRUCTION PROJECTS

IMPORTANT

Please refer to the Reporting Instructions

on the back of the form.

DUE DATE:

U.S. Census Bureau

1201 East 10th Street

Jeffersonville, IN 47132-0001

1–800–845–8245

CONSTRUCTION

PROJECT REPORT

RETURN

FORM TO

Section A

PROJECT IDENTIFICATION

The construction project described below is associated with your

organization according to published sources. Please correct any errors or

fill in any blanks in items 1 and 2. If necessary, make your corrections in

item 11, Remarks, or use a separate sheet. IF YOU HAVE ANY QUESTIONS

CONCERNING THIS FORM, PLEASE CALL 1–800–845–8246.

FAX

1. PROJECT DESCRIPTION

2. PROJECT LOCATION

Section B

OWNERSHIP AND START DATE

Section C

COST ESTIMATES

3. TYPE OF OWNERSHIP – Mark (X) one box.

Will this project be privately or government owned during construction?

Privately owned Government owned

4. START DATE OF CONSTRUCTION

When did actual construction work on the

site start, or when do you estimate it will

start? Enter month and year.

INCLUDE

EXCLUDE

Site preparation and outside construction such as sidewalks

and roadways

Mechanical and electrical installations which are integral parts

of the structure, such as elevators, heating equipment, etc.

Land and pre-existing structures

Architectural, engineering, and owner’s overhead and

miscellaneous costs – See item 6

•

•

•

•

Furniture, furnishings, and other movable equipment – See item 7

•

Contingency funds

•

FOR INDUSTRIAL STRUCTURES SEE SPECIAL INSTRUCTIONS ON BACK

NOTE: If project is on a "cost plus" basis, enter your best estimate of the final cost.

Month and year of actual

or expected start date

5a. CONTRACT CONSTRUCTION COST

NOTE: Be sure to complete section F on the reverse side.

(Amounts to be paid to contractors and

subcontractors)

Construction costs

(Thousands of dollars)

,000.00$

5b.OWNER SUPPLIED MATERIALS

AND LABOR

(Construction materials supplied by owner and the

value of work done by project owner’s own

construction employees assigned to the project.)

,000.00$

,000.00$

5c. TOTAL CONSTRUCTION COST

(Sum of 5a + 5b)

6. ARCHITECTURAL, ENGINEERING, AND

MISCELLANEOUS COSTS

INCLUDE

EXCLUDE

All fees for architectural and engineering services except fees for

designing production machinery and equipment. If contractor

was authorized to "design and construct" this project, such cost

should be included in item 5a.

Cost of design work by owner’s staff

•

•

Project owner’s overhead and office costs•

Interest and taxes to be paid during

construction

•

Fees and other miscellaneous costs

allocated on owner’s books to this project

•

Cost of production machinery and

equipment, land, and furniture and

furnishings – See item 7

•

Architectural, engineering,

and miscellaneous costs

(Thousands of dollars)

,000.00$

,000.00$

Other capital expenditures

(Thousands of dollars)

7. ESTIMATED AMOUNT OF ALL OTHER

CAPITAL EXPENDITURES

INCLUDE Production machinery and equipment,

furniture and office equipment.

•

EXCLUDE

Expenditures for land

•

Section D

SQUARE FEET

8.

Based on exterior dimensions, how many square

feet of enclosed floor area (including basements)

will be created by this project?

10.

Exclude nonbuilding projects

and existing floor space

that is being remodeled.

If none, enter "0."

Square feet

Section E

MONTHLY CONSTRUCTION

PROGRESS REPORT

This form will be returned to you EACH MONTH

until the project is completed.

Continue with item 9 if project has started; otherwise,

skip to section F.

•

Report the value of construction put in place each month.

Include only those construction costs defined in item 5c.

DO NOT include costs reported in items 6 and 7.

•

Report costs in the month in which work was done

(including any monthly retainage being withheld

from contractors) rather than in the month in which

payment was made.

•

When project is completed, enter month and year in item 10.

•

9.

MONTHLY VALUE OF CONSTRUCTION PUT IN

PLACE ON PROJECT DESCRIBED IN ITEM 1

(a)

Value of construction put

in place during month

as defined in item 5c

(Thousands of dollars)

Month and year

report period

(b)

,000.00$

,000.00$

,000.00$

,000.00$

,000.00$

,000.00$

,000.00$

,000.00$

,000.00$

,000.00$

,000.00$

,000.00$

,000.00$

Month and year

of completion

COMPLETION DATE

Enter date when all

construction is

actually completed

(Please correct any error in name and address including ZIP Code, telephone and fax number)

OMB No. 0607-0153: Approval Expires 05/31/2013

U.S. CENSUS BUREAU

▲

▲

USCENSUSBUREAU