HTML Preview Employee Payroll Deduction page number 1.

Instructions

Please complete this form to establish, change or

delete payroll deduction instructions on your existing

Scholar’s Edge

®

account(s). If you do not have an account,

please attach a completed application for each beneficiary.

Before completing this form, check with your payroll

department regarding the availability of this service.

Your payroll department must complete an Employer

Authorization Payroll Deduction Form before you can

begin payroll deduction.

Please print clearly in all CAPITAL LETTERS using black ink.

Color in circles completely. For example: not not

If you have any questions about this form, please call

1.866.529.SAVE (7283).

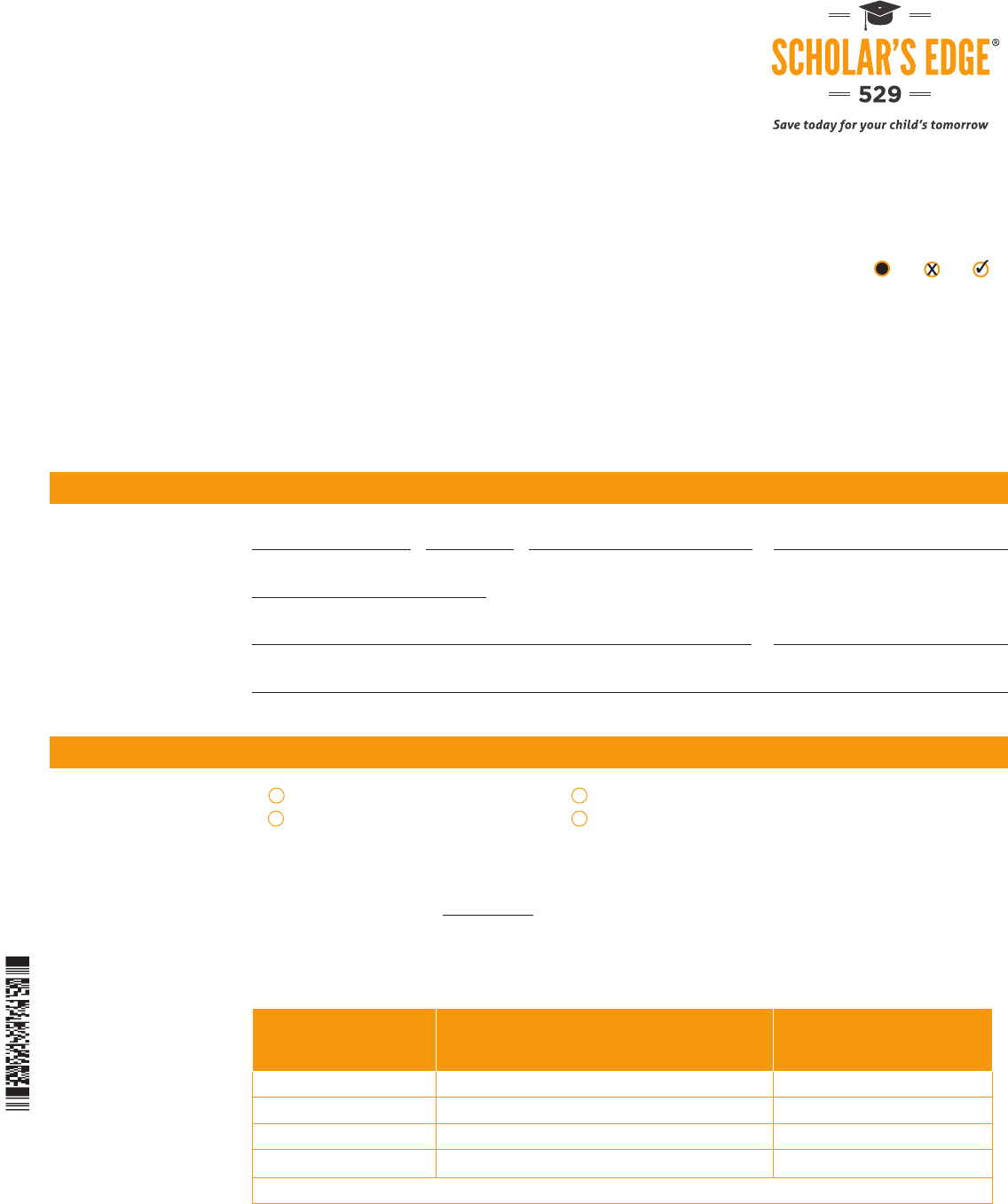

1 | Employee/Company Information

Employee’s first name Middle initial Last name Social Security number

( )

Employee phone number

( )

Company name Company phone number

Company contact

2 | Payroll Deduction Information

A.

Establish a new payroll deduction Cancel existing deduction

Change allocation percentage Change deduction amount

B. Payroll Deduction Amount

Indicate the amount to be deducted from your paycheck each pay period. The minimum investment is $25 per

month per portfolio.

Total Deduction Amount $

This dollar amount will be invested according to your Elected Investment Allocation on file at the time the assets

are received. If you are establishing a new account, the assets will be invested according to your instructions on

the Account Application.

Account number Beneficiary’s name

Percentage of deduction to

be allocated to each account

(full % only)

.00%

.00%

.00%

.00%

Total 100.00%

Continued on next page

SCHOLAR’S EDGE

®

Employee Payroll

Deduction Form

All dollar allocations

will be stored as

percentages. Payroll

dollars will be invested

based on the stored

percentages until the

account owner submits

a new form.