HTML Preview Personal Accounts Fee Schedule page number 1.

Personal Accounts Fee Schedule

SunTrust Bank: Alabama, Arkansas, Florida, Georgia, Tennessee, Maryland, Mississippi, North Carolina, South Carolina, Virginia, Washington D.C.,

West Virginia

SunTrust Bank, Member FDIC. ©2011 SunTrust Banks, Inc. SunTrust is a federally registered service mark of SunTrust Banks, Inc. Effective September 1, 2011.

1

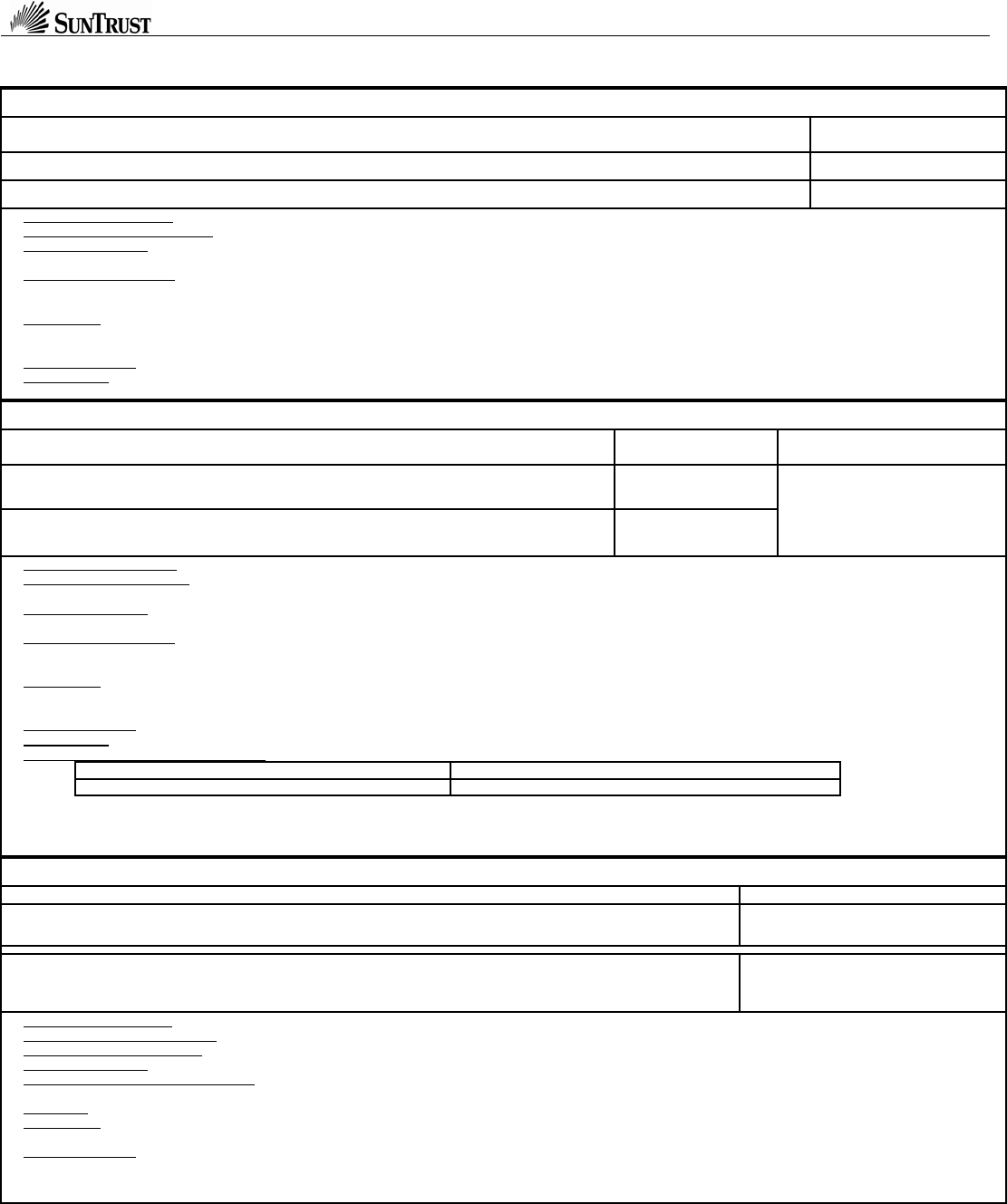

Signature Advantage Banking

SM

Minimum Daily Collected Balance Total Deposit Balance

Total Relationship Balance

(includes loans)

Monthly Maintenance Fee

$25,000 or more OR $50,000 or more OR $250,000 or more None

$24,999.99 or less AND $49,999.99 or less AND $249,999.99 or less $25.00

- Minimum Opening Deposit: $100

- Minimum Daily Collected Balance

: The sum of cash balances in the Signature Advantage Banking checking account.

- Total Deposit Balance: The sum of balances in the Signature Advantage Banking checking account PLUS statement linked SunTrust deposit accounts (checking, savings,

money market, or CDs), Trust accounts, and IRA or Brokerage accounts introduced through SunTrust Investment Services, Inc. (excludes annuities).

- Total Relationship Balance

: The sum of balances in the Signature Advantage Banking checking account PLUS statement linked SunTrust deposit accounts (checking,

savings, money market, or CDs), Trust accounts, IRA or Brokerage accounts introduced through SunTrust Investment Services, Inc. (excludes annuities), SunTrust

installment loans and equity lines of credit, including credit card, and SunTrust mortgage.

- Interest Rate:

The interest rate earned is based on the following ledger balance tiers: Tier 1- $9,999.99 or less, Tier 2- $10,000 to $24,999.99, Tier 3- $25,000 to $49,999.99,

Tier 4- $50,000 to $99,999.99, Tier 5- $100,000 to $249,999.99, Tier 6- $250,000 to $499,999.99, Tier 7- $500,000 to $999,999.99, Tier 8- $1,000,000 to $1,999,999.99, Tier

9- $2,000,000 or more.

- Interest Calculation:

Interest is calculated and compounded daily on the collected balance and credited to your account monthly.

- Check Images: Check images are returned with the combined statement and paid checks cannot be returned.

Signature Advantage

®

Brokerage

Minimum

Combined Balance

Total

Deposit Balance

Total Relationship Balance

(includes loans)

Monthly

Maintenance Fee

Annual Maintenance Fee

$25,000 or more OR $50,000 or more OR $250,000 or more None

$100.00

(waived with $250,000 or more in

Minimum Combined Balance OR

$500,000 or more in Total

Relationship Balance)

$24,999.99 or less AND $49,999.99 or less AND $249,999.99 or less $25.00

- Minimum Opening Deposit: $100

- Minimum Combined Balance: The sum of cash balances in the Signature Advantage Banking checking account and the market value of the associated Brokerage account

introduced through SunTrust Investment Services, Inc. (Annuities included. IRA accounts excluded).

- Total Deposit Balance

: The sum of balances in the Signature Advantage Banking checking account PLUS statement linked SunTrust deposit accounts (checking, savings,

money market, or CDs), Trust accounts, and IRA or Brokerage accounts introduced through SunTrust Investment Services, Inc. (includes annuities).

- Total Relationship Balance

: The sum of balances in the Signature Advantage Banking checking account PLUS statement linked SunTrust deposit accounts (checking,

savings, money market, or CDs), Trust accounts, IRA or Brokerage accounts introduced through SunTrust Investment Services, Inc. (includes annuities), SunTrust

installment and equity loans or lines of credit, including credit card, and SunTrust mortgage.

- Interest Rate:

The interest rate earned is based on the following ledger balance tiers: Tier 1- $9,999.99 or less, Tier 2- $10,000 to $24,999.99, Tier 3- $25,000 to $49,999.99,

Tier 4- $50,000 to $99,999.99, Tier 5- $100,000 to $249,999.99, Tier 6- $250,000 to $499,999.99, Tier 7- $500,000 to $999,999.99, Tier 8- $1,000,000 to $1,999,999.99, Tier

9- $2,000,000 or more.

- Interest Calculation:

Interest for the FDIC-Insured interest bearing option is calculated and compounded daily on the collected balance and credited to your account monthly.

- Check Images:

Check images are returned with the combined statement and paid checks cannot be returned.

- Brokerage Commission and Fee Schedule: Refer to your SunTrust Investment Services, Inc. Commission and Fee Schedule for commissions and fees that may apply.

Securities and Insurance products and services Are not FDIC or any other government agency insured

Are not Bank Guaranteed May Lose Value

Services provided by the following affiliates of SunTrust Banks, Inc.: Banking and trust products (including checking accounts) and services are provided by SunTrust Bank.

Securities, insurance (including annuities and certain life insurance) and other investment services (including Brokerage accounts) are offered by SunTrust Investment

Services, Inc., a SEC registered investment adviser and broker/dealer and a member of the FINRA and SIPC.

Solid Choice Banking

SM

Balance Requirements Monthly Maintenance Fee

Effective through

November 9, 2011

• $5,000 or more Minimum Daily Collected Balance OR

• $15,000 or more Other Linked Deposit Balances

$14.00

(waived with Balance Requirement)

Effective

November 10, 2011

• $5,000 or more Minimum Daily Collected Balance OR

• $10,000 Total Deposit Balance OR

• SunTrust First Mortgage with SurePay

SM

$17.00

(waived with Balance Requirement)

- Minimum opening deposit: $100.

- Minimum Daily Collected Balance:

The balances in the Solid Choice Banking account.

- Other Linked Deposit Balances:

The sum of balances in other linked checking, savings, money market accounts, CDs and IRAs.

- Total Deposit Balance

: The sum of balances in the Solid Choice Banking account and other linked checking, savings, money market, CDs, or IRA accounts.

- SunTrust First Mortgage with SurePay

SM

: Purchase first mortgage loans financed through SunTrust Mortgage, Inc. with payment automatically deducted* from this account

using SurePay

SM

.

- SurePay

SM

: Monthly electronic debit* via ACH of SunTrust Mortgage loan payment from this account.

- Interest Rate:

The interest rate earned is based on the following ledger balance tiers: Tier 1 - $2,499.99 or less, Tier 2 - $2,500 to $9,999.99, Tier 3 - $10,000 to $24,999.99,

Tier 4 - $25,000 or more.

- Interest Calculation:

Interest is calculated and compounded daily on the collected balance and credited to your account monthly.

- Check Safekeeping is a standard feature of this product. Check Image Statement is available for no charge.

*Sufficient funds must be in your bank account at time of automatic debit.