HTML Preview Monthly Performance Report page number 1.

Investment Management

Macquarie Income Opportunities Fund

Monthly Report – March 2017

STRICTLY CONFIDENTIAL

Investment objective

The Fund aims to outperform the Bloomberg AusBond Bank Bill Index over the medium

term (before fees). It aims to provide higher income returns than traditional cash

investments at all stages of interest rate and economic cycles.

Fund performance to 31 March 2017

Fund highlights

The Fund outperformed the benchmark in March, despite performance in global credit

markets slightly diverging during the month. Excess returns were driven by the Fund’s

holdings in the Australian credit market, as spreads for Australian bank debt and

mortgaged-backed securities both outperformed. However, volatility in the US credit

market increased which driven by a midmonth fall in oil prices and the failure of President

Trump to pass the healthcare bill. The Fund reduced its high yield position during the

month, as valuations for the sector have become less attractive.

US issuance volumes increased, with Verizon Communications the largest issuer at $11bn

and Siemen AG issued $7.5bn of debt. In financials, both HSBC Holdings and UBS Group

issued. The Fund participated in the new issues by HSBC Holdings and Siemen AG.

Issuance volumes in Australia were moderate in March, and the Fund participated in a new

bond issue from AMP and a credit card ABS issued by Latitude Financial Services.

Markets finished March on a mixed note overall. Risk markets that had rallied strongly for

the last 12 months took a small backward step. The volatility proved to be modest and

short-lived, and by the end of the month, much of the spread widening had been reversed.

There were a number of drivers of the initial weakness, including weakness in oil prices, an

earlier than expected US Federal Reserve (Fed) hike, and a setback to Trump’s reform

agenda in the US. By the end of March, though, a ‘chase for yield’ mentality began to

return to markets, and both credit and government bond markets attracted buyers.

The Fed hiked the federal funds rate in March for the third time since the financial crisis.

The move was exceptional, as only three weeks earlier markets had priced only a 30%

chance of a rate move. While the move may have unsettled markets, the Federal Open

Market Committee statement and Fed Chairperson Yellen’s post-meeting press conference

underlined a gradual approach to raising rates, calming market uncertainty.

Oil prices weakened over the month, breaking back down through $US50/barrel as US

supply continued to grow and OPEC’s production cuts looked less rigidly applied than had

been hoped. The price moves were only moderate however, it was enough to be a strong

contributor to a widening of 50bps in global high yield credit spreads. With valuations in

high yield credit generally unattractive, any reason to not hold the asset class has

understandably been met with significant outflows from the sector, and this was reflected in

investor withdrawals from high yield credit picking up in March.

The Trump administration stumbled at its first significant legislative hurdle during March,

with the Republican Party’s amendments to the Affordable Care Act failing to find enough

1 month (%)

0.47 0.43 0.15 0.28

3 months (%)

1.53 1.41 0.44 0.97

1 year (%)

5.94 5.42 1.94 3.48

2 years (% pa)

3.48 2.97 2.09 0.88

3 years (% pa)

3.63 3.13 2.30 0.83

5 years (% pa)

4.83 4.32 2.65 1.67

Since inception (% pa)***

5.79 5.27 4.47 0.80

Total gross

fund returns

Total net excess

returns

Total net fund

returns*

Benchmark

returns **

Past performance is no indication of future performance.

** The benchmark is the Bloomberg AusBond Bank Bill Index.

*Total net returns are quoted after the deduction of all fees and expenses. Total returns are calculated based on changes in net

asset values and assumes the reinvestment of distributions. Due to individual investor circumstances, your net returns may differ

*** Inception date is 19/09/2003

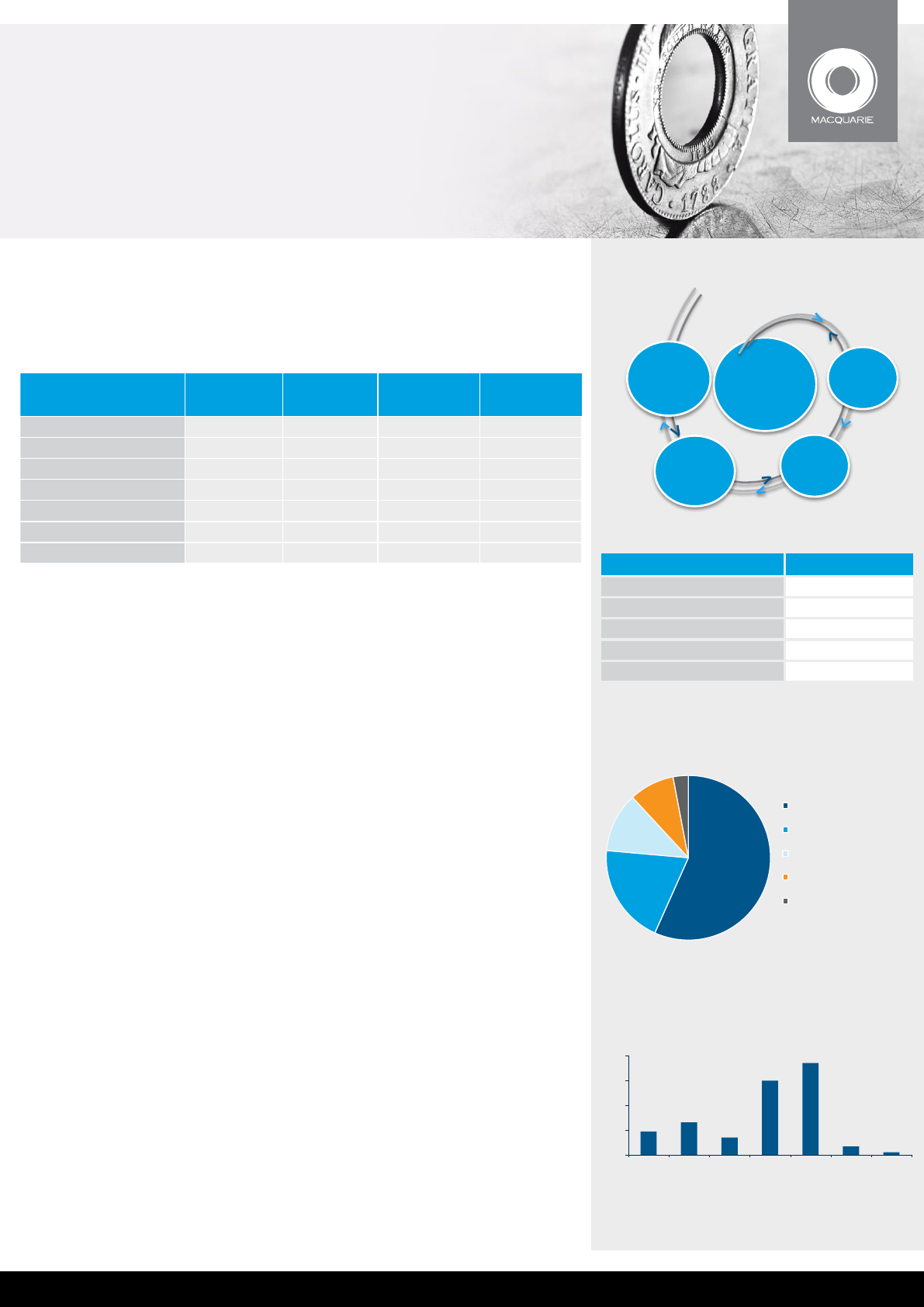

Sector breakdown

4.3%

Credit

opportunities

Emerging

market debt

High

yield

Hybrid

securities

0.3%

Investment

grade

94.4%

1.0%

0.0%

Sector limits (%) (min/max)

Investment grade

20/100

Hybrid securities

0/10

High yield

0/15

Emerging market debt

0/15

Credit opportunities

0/20

Region breakdown

Australia - 56.7%

United States - 19.7%

Others - 11.7%

Europe (ex UK) - 8.9%

UK - 3.0%

Credit profile breakdown

* Cash consists of physical cash and cash exposure through credit hedges

Average credit rating: A-

'Less than BBB' includes 1.2% of residual exposure to issuers held via our global

Investment Grade allocation

0

10

20

30

40

Cash* AAA AA A BBB Less than

BBB

Unrated

%