HTML Preview Rate Chart Format page number 1.

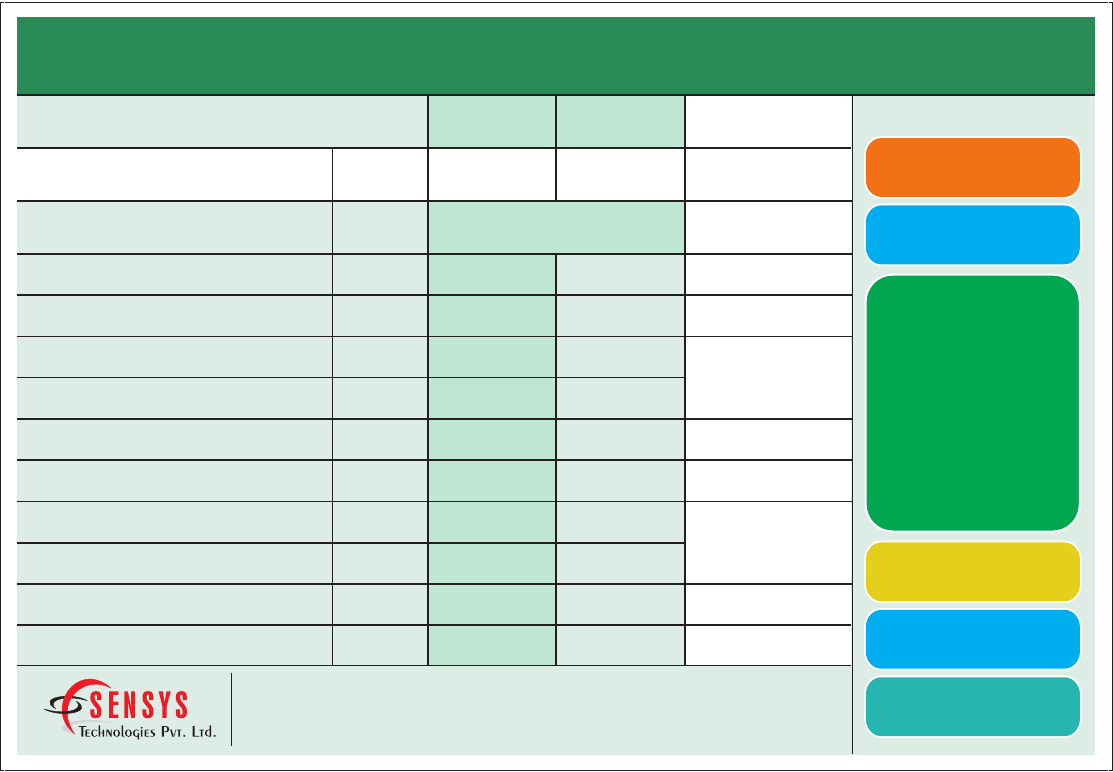

TDS Rate Chart

Assessment Year : 2016-2017 Financial Year : 2015-2016

Mumbai: Tel.: 022-662 786 00 Mob.: 09867307971 / 09769468105

Delhi: Mob.: 09867646408 Other Cities: 09867573715

Email : [email protected] l Website : http://www.sensysindia.com

Please SMS to 09867307971 / 09769468105 SOFTWARE

Individual /

HUF

Domestic

Company / Firm

Criteria for

Deduction

Rate Rate

As per the prescribed rates applicable to

Individual / Women & Senior Citizens

10

30

1

1

10

10

10

2

10 10

10

30

2

2

10

10

10

2

Banking Rs. 10,000/- p.a.

Others Rs. 5,000/- p.a.

Rs. 30,000/- per

contract or

Rs. 75,000/- p.a.

Rs. 5,000/- p.a.

Rs. 1,80,000/- p.a.

Rs. 30,000/- p.a.

Particulars

4.1 Payment to Advertising / Sub Contractors

Section

Code

192

Nature of Payments

1. Salary

2. Interest other than Interest on Securities

3. Winning from Lotteries & Puzzles

4. Payment to Contractors

5. Insurance Commision

6. Commision & Brokerage

7. Rent - Land & Building

7.1 Rent - Plant & Machinery

8. Professional Fees & Technical Services

194A

194B

194C

194C

194D

194H

194Ib

194Ia

194J

Rs. 20,000/- p.a.

Rs. 10,000/- p.a.

Payment in excess of

Our Products

EasyTDS

TDS Management Software

EasyPAY

Payroll Management Software

9. Immovable Property other than

Agricultural Land

194IA

1 1

AssetExpert

Asset Management Software

eFormExpert

IT Return e-Filing Software

InstantXBRL

XBRL Software

Rs. 50,00,000/-

Web Based Payroll & HR Software

a. myVetan - Payroll Management

b. trackHour - Time & Attendance

c. recruitArt - Recruitment Software

d. talentTrace - PMS Software

e. skillSpread - Training Software

f. timeOrbit - Time Sheet Software

g. Attendance Machines with

Realtime Integration

HRThread