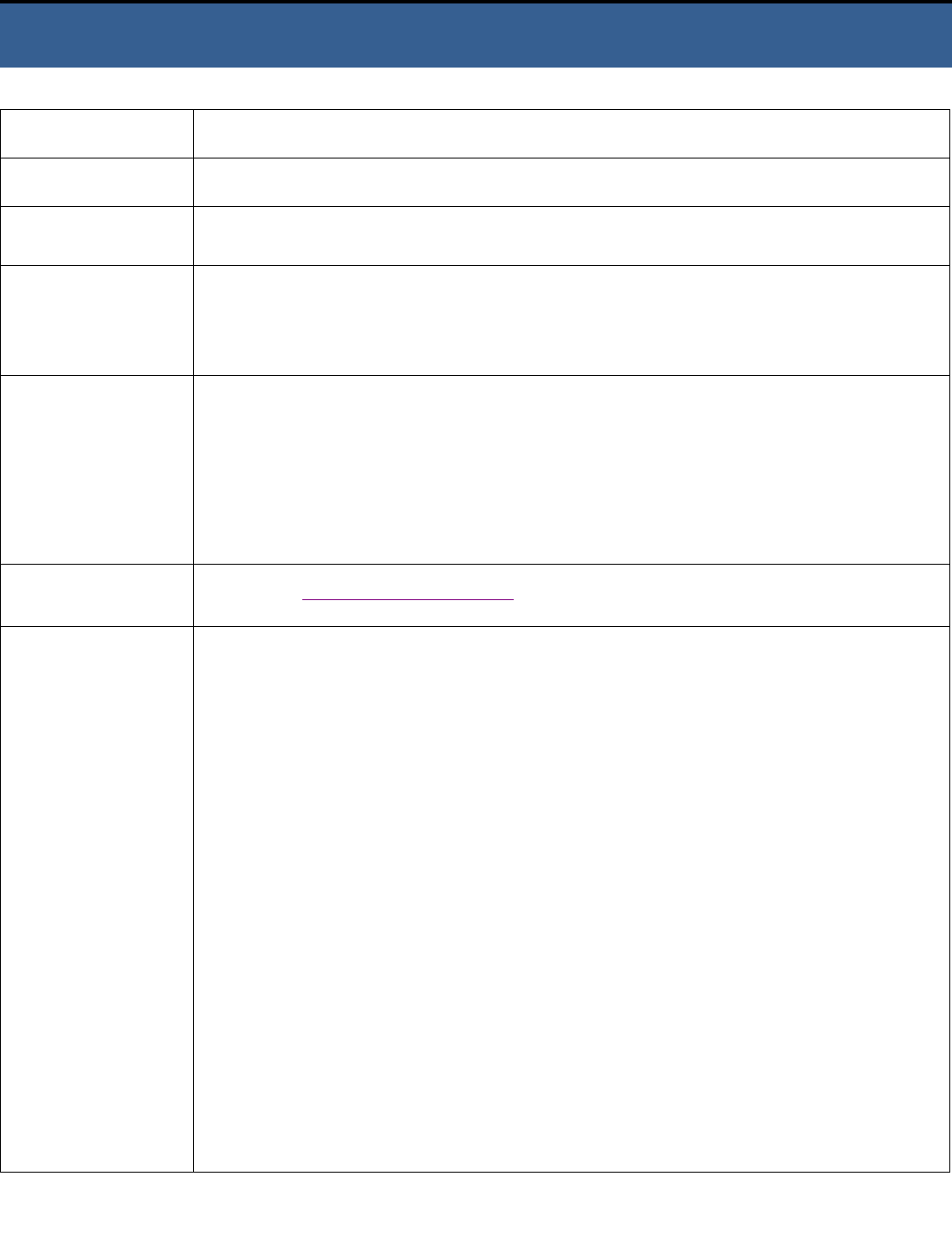

HTML Preview Program Term Sheet page number 1.

Oregon Bond Loan: First Time Homebuyer Program

Oregon Housing and Community Services

Program Term Sheet

Oregon Housing and Community Services | Oregon Bond Program | (503) 986-2000 | Revised 5/6/2016

Program Sponsor

Oregon Bond

Participating Lenders

Currently not accepting new lenders.

Program Overview

The Program is designed to increase homeownership opportunities for low-to-moderate income, first time

home buyers.

Mortgage Loan Types and

Terms

• 30 year fixed with full amortization, 80% LTV max

• FHA; in accordance with FHA guidelines

• USDA; in accordance with USDA guidelines

• Fannie and Freddie guidelines apply to all loans purchased by Oregon Bond.

Borrower Eligibility

Borrower must meet the following requirements:

• Occupy the residence as their primary residence; non-occupant co-borrowers are not

allowed

• Cannot have owned a home in the last 3 years unless purchasing in a target area.

• Must meet Fannie Mae and Freddie Mac guidelines and be approved and funded with

lender/servicer

• Cannot exceed program income limits

Maximum Loan

Amount

Cannot exceed property purchase price limits

Reservations

Online reservation system is here: https://egov.hcs.state.or.us/reser/login.jsp

Program Manger shall publish the Mortgage Rate on its Reservation Portal.

The published Mortgage Rate is subject to change at any time.

Participating Lender shall register Qualifying Mortgage Loans using the Reservation Portal.

Purchase agreements should be e-mailed to: hcs.Reservati[email protected]

For access to the Reservation Portal, a Lender needs to fill out the Loan Officer Application Form.

Modifications to a reservation will require approval.

Reservation locks are valid for 90 days.

A 90 day lock extension is allowed, any more will need approval by Program Manager.

Lender may cancel the loan registration via the Reservation Portal, which will provide electronic

confirmation of cancellation to lenders.

If a Lender cancels a loan, lenders may re-register the loan only after 30 calendar days from cancellation

date via the Reservation Portal.

Lender automatically reserves fund for Cash Advantage and Rate Advantage programs at the time of loan

registration via the Reservation Portal