HTML Preview Example Of Investment page number 1.

INFORMATION SHEET

PHILLIP INVESTMENT

CUSTODIAN

ACCOUNT

250 North Bridge Road #06-00

Raffles City Tower Singapore 179101

Tel: 65336001 Fax: 65353834 www.phillip.com.sg

Co.Reg.No. 197501035Z GST Reg. No. M2-0021956-2

For more information, please visit www.poems.com.sg or

drop us an email at talktophillip@phillip.com.sg

Phillip Investment Custodian Account

is a

trading account that allows you to trade Shares,

Unit Trusts, Treasury Bills and other investment

products via POEMS Internet, POEMS Mobile as

well as via your trading representative.

1. Custody of Shares

All equities transacted through this custodian

account will be cleared through this trading

account. All shares purchases and subsequent

sales must be conducted through this account.

All Corporate actions, including dividends, will be

processed under this account.

Accounts with multicurrency facility will receive

the cash dividend in declared currency unless

otherwise determined by the issuer/Phillip

Securities Pte Ltd (PSPL).

2. Excess Funds Management Facility

You may wish to opt-in for the excess funds

management facility to enjoy potentially greater

earnings on the excess fund parked in this

account. By opting in, your excess SGD and USD

funds will be invested on a discretionary basis in

Phillip Money Market Funds (MMF) and Phillip

USD MMF respectively. Please refer to the

section on Excess Funds Management under

important notice for more information.

To opt-in, simply log into your POEMS account, go to:

STOCKS> ACCT MGMT> Online Forms> Excess

Fund Authorization

Otherwise, idle funds residing in this account will

be automatically deposited in a trust account.

Interest, if any, will only be paid on the dollar in

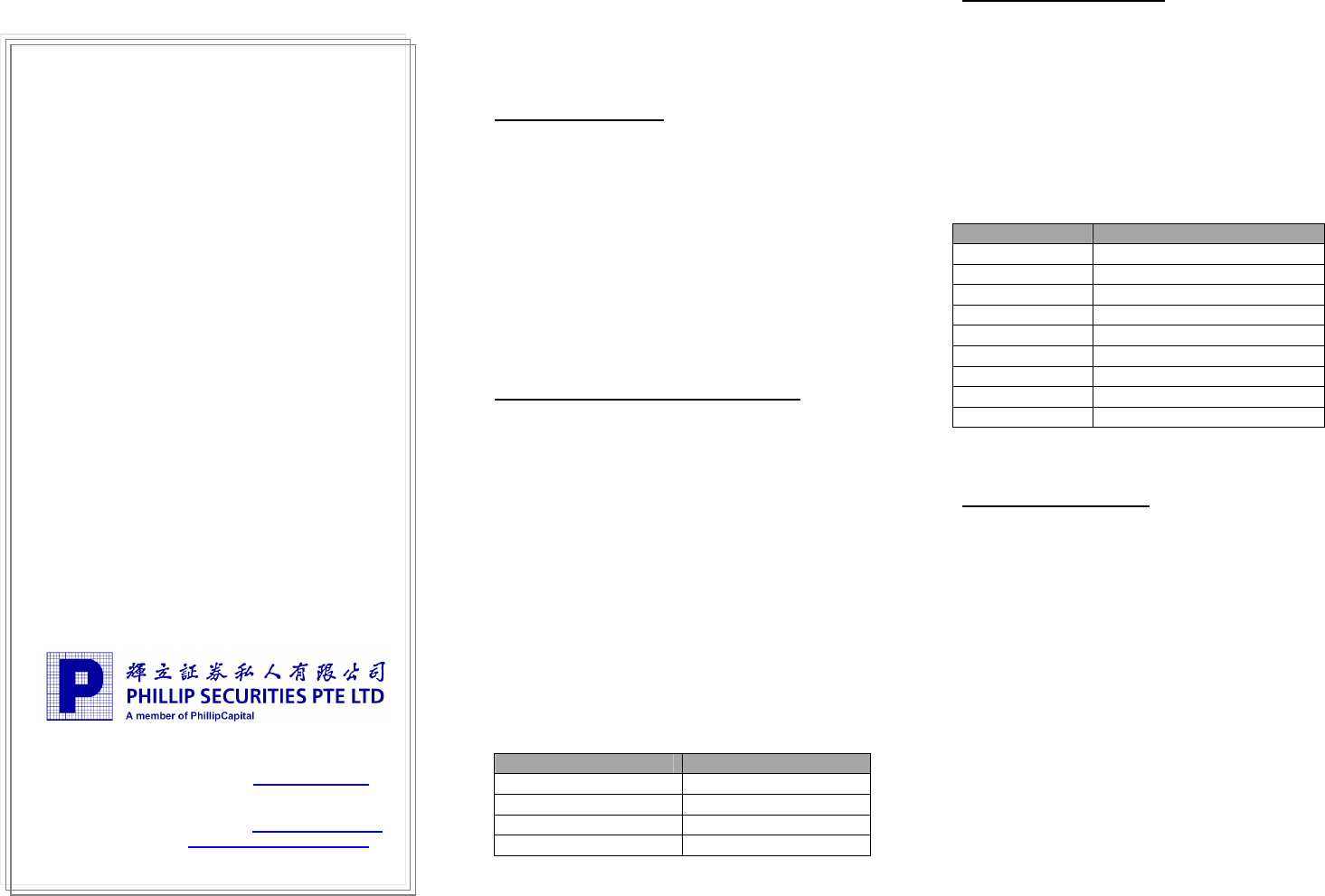

excess of stipulated limit as follow:-.

Amount Interest*

> S$50,000 0.10% p.a

> US$50,000 0.15% p.a

> HK$50,000 0.10% p.a

> AUD$50,000 1.50% p.a

*

PSPL reserves the right to change the rates without

prior notice.

3. Multi-Currency Facility

As an added advantage, you also have the option

of maintaining foreign currency balances (USD,

HKD, MYR, JPY, AUD, GBP, EUR and CAD) in

your account for ease of trading and efficient

management of your foreign currency-

denominated investments. Settlement for these

shares can either be in the traded currency or in

SGD. However, your account must have

sufficient funds in the settlement currency to

avoid incurring interest on debit balances.

Currency Interest* on Debit Balance

SGD 6.00% p.a.

USD 7.00% p.a.

HKD 7.00% p.a.

JPY 4.20% p.a.

AUD 8.75% p.a.

GBP 4.50% p.a.

EUR 7.00% p.a.

CAD 7.00% p.a.

MYR No debit balance allowed

* PSPL reserves the right to change the rates without

prior notice.

4. Settlement of Trades

As long as you have sufficient funds (base

amount) in your trading account, you enjoy

automatic settlement for trades done in shares,

unit trusts, treasury bills and more.

You may make use of any of the payment modes

set out in Section 7 of this information sheet to

transfer money into the trading account before

you do a purchase or latest by contract due date.

Clients with multi-currency ledgers may settle

their foreign-denominated trades in the traded

currency or in SGD.

For non multi-currency account holders, trades

will be settled in SGD.

Settlement of Purchase Contracts:

Purchase contracts will be settled on contract due

date+1. There will be no partial settlement.