Basic Loan Application Letter

I-Save, punan ang mga blanko, i-printa, Tapos na!

What are the steps involved in writing a basic loan application letter? How to write an effective loan application letter to a bank? Download this Basic Loan Application Letter template now!

Mga magagamit na premium na format ng file:

.docx- Itong dokumento ay sertipikado ng isang Propesyonal

- 100% pwedeng i-customize

Business Negosyo Finance Pananalapi Letter sulat loan 贷款 From Application letters loan application letter Modification Loan Application

What are the steps involved in writing a basic loan application letter? Are you looking for an example of a basic loan application letter? Our sample loan application letter template is designed to help you quickly and easily write a compelling application letter. It includes all the necessary sections, such as your personal information, the purpose of the loan, and your repayment schedule.

While composing loan applications to banks, it is significant to consider many important aspects to ensure that your appeal is clear, formal, and convincing. Below are some vital points which should be borne in mind:

- Clarity and Specificity: Mention the purpose of the loan and your requested amount. Be particular about how the funds will be spent. This helps the lender understand your needs and assess your application appropriately.

- Personal and Financial Information: Include essential personal information such as your full name, address, and contact details. Financial information should cover your employment status, income, financial obligations, and any assets you might have. This helps the bank evaluate your creditworthiness and ability to repay the loan.

- Documentation: Reference any documents you are attaching or have previously submitted that support your application. This may include proof of income, tax returns, employment verification, financial statements, and a list of assets and liabilities.

- Credit History: Be honest about your credit situation. If there are issues, such as a low credit score or previous defaults, address these upfront and explain any mitigating circumstances. This openness can help build trust with the lender.

- Reason for the Loan: You should clarify why you need it and the significance of the loan to you. The details on how the investment will contribute to your financial stability or growth should be included if it is for something like a business investment.

- Repayment Plan: Define how you plan to pay off the loan. Strategies for income generation and budgets that will help you make monthly payments should be part of this presentation. This shows the bank that you are committed and able to handle the loan responsibly.

- Professional Tone: Use appropriate language and stay respectful in the whole letter. Use suitable titles when writing to them and include an appropriate final statement.

- Request for Action: End by politely asking the lender to take note of your application before suggesting that a follow-up meeting or phone call could give more details about it.

- Proofreading: Check over the letter one last time before submission, making sure that there aren’t any grammatical errors and that everything looks fine. Mistakes can undermine your credibility and decrease your chances of getting approved.

When you emphasize these aspects, an impressive loan application may be created, thereby making your specifications and abilities clear to the financial institution.

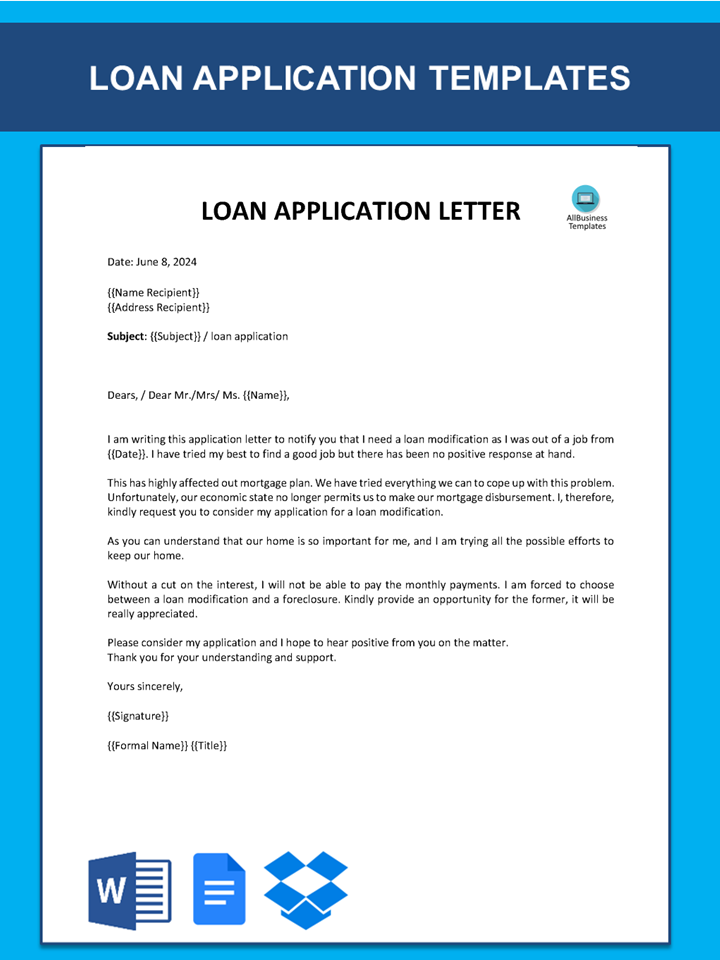

Sample Loan Application Letter:

I hope this letter finds you well. I am writing to formally request a modification of my current loan terms due to an extended period of unemployment. Since March 2024, I have been without a job and, despite diligent efforts to secure employment, I have yet to receive a favorable response.

This prolonged joblessness has significantly impacted our financial stability, making it increasingly difficult to meet our mortgage obligations. We have exhausted all available means to manage this situation; however, our financial resources are now depleted, and we can no longer fulfill our monthly mortgage payments.

Our home holds immense importance to us, and I am committed to doing everything within my power to retain it. Unfortunately, without a reduction in the interest rate, I am unable to continue with the current payment terms. I am faced with the distressing choice between requesting a loan modification and facing foreclosure. I earnestly request your consideration to allow for a modification, which would provide us with a viable path to maintain our home and avoid...

You can download our basic loan application letter template now as a Word template or directly open it with Google Docs. We look forward to helping you write an effective and well-structured application letter.

DISCLAIMER

Wala sa 'site' na ito ang dapat ituring na legal na payo at walang abogado-kliyenteng relasyon na itinatag.

Mag-iwan ng tugon. Kung mayroon kang anumang mga katanungan o mga komento, maaari mong ilagay ang mga ito sa ibaba.