Expense Tracker Template

I-Save, punan ang mga blanko, i-printa, Tapos na!

How do I set up an expense tracker in Excel? How do you track expenses on a spreadsheet? Easy to download and use expense tracker template

Mga magagamit na premium na format ng file:

.xlsx- Itong dokumento ay sertipikado ng isang Propesyonal

- 100% pwedeng i-customize

Business Negosyo Excel xls xlsx expense tracker

How do I set up an expense tracker in Excel? How do you track expenses on a spreadsheet?

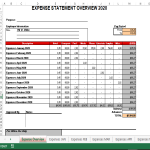

By using this Expense tracker template, you are able to keep learning to improve and manage your expenses in an effective way. It’s a crucial step that allows you to monitor the growth of your business, build financial statements, keep track of deductible expenses, prepare tax returns, and support what you report on your tax return. This Excel spreadsheet is a simple business budget that states all business expenses into categories. We provide an advanced Microsoft Excel template which enables you to:

- manage business expense spreadsheets to keep track of your monthly

- several subcategories (meals, hotel, transport, samples, misc, etc).

- Expense Tracker fields:

- Budget

- % Spent

- Remaining

- Date

- Payment

- Type

- Description

- Categories

- Other

- Subtotal

- Total

This spreadsheet contains two parts. Another part is a full summary of each month with totals with expenses spend on items such as (which can be easily modified). In the beginning, you should implement such a tracking system by providing it to your employees and monthly authorize the expenses you bring in. There are five types of expense receipts that you should pay extra attention to:

- Business travels: The authorities are always studying such business travels. They might ask extra details to explain why those are not also personal activities, and merely business expenses. Therefore it’s important to keep track of your receipts, which also provide a paper trail of your business activities while your employees or yourself are away.

- Meals and entertainment: When you are conducting business meetings on a regular basis, in a hotel, cafe or restaurant, it’s a pleasant option to discuss business and bond with relations as well. Just make sure that you keep track of these expenses (on a daily basis). A helpful suggestion is to write on the back of the receipt the basic information about meeting or connection, in order to record who attended and the purpose of the meal or outing.

- Vehicle-related expenses: Make sure to record when, where, and why you used the automobile for business purposes, and then apply a percentage of the usage of this vehicle as related expenses.

- Receipts for gifts: When you buy gifts for your business relations, for example, tickets to a football match it matters whether the gift giver goes to the event with the recipient. If they do, it’s better to mention those expenses are categorized as “entertainment”, rather than a gift. Note these details on the back of the receipt as well.

- Home office receipts: Keeping your office receipts is similar to the vehicle expenses. You need to calculate what percentage of your home is used for business and then apply that percentage to home-related expenses. When you are starting your business from your own home, it provides a good way to keep your overhead low, and it also might qualify you for some unique tax breaks (depending on your country of residence and business). You’re able to deduct the portion of your home that’s used for business, as well as your internet connection, cell phone, and transportation to and from work sites and for business errands.

When you create a budget template in MS Excel, you can fully customize your budget to track your monthly income and expenses. As the budget process can feel slightly overwhelming at first, this guide will help create your own Excel budget.

Make sure that any of those expenses that are used partially for private usage and business usage. For example: if you have a phone connection for a phone number that is used for private and business, you can deduct the percentage that you use this device for business. Also, fuel mileage costs are 100% deductible, just be sure to hold on to all the receipts and keep a log of your business mileage (where you’re going and the purpose of the trip).

This business expense spreadsheet generates automatically an annual report, each time you update the monthly expenses for all the subcategories that you defined. The subcategories are fairly comprehensive, but it is also easy to add, remove, and modify the categories.

An easy way to keep track of those expenses is to create your own personalized business expenses template in Excel. It is one of the most popular and affordable ways to create a digital budget is with Microsoft Excel.

Keeping track of your business expenses is the foundation of a solid business. Create your own personalized Monthly Business Expense template now. Try out our online Free and Premium Professional templates, forms and contracts today. By making your own version, based on this pre-made template, you can start tracking your finances directly! Save, fill-In the blanks, print …and done!

Download this small businesses keep track of expenses and income tracker template now.

DISCLAIMER

Wala sa 'site' na ito ang dapat ituring na legal na payo at walang abogado-kliyenteng relasyon na itinatag.

Mag-iwan ng tugon. Kung mayroon kang anumang mga katanungan o mga komento, maaari mong ilagay ang mga ito sa ibaba.