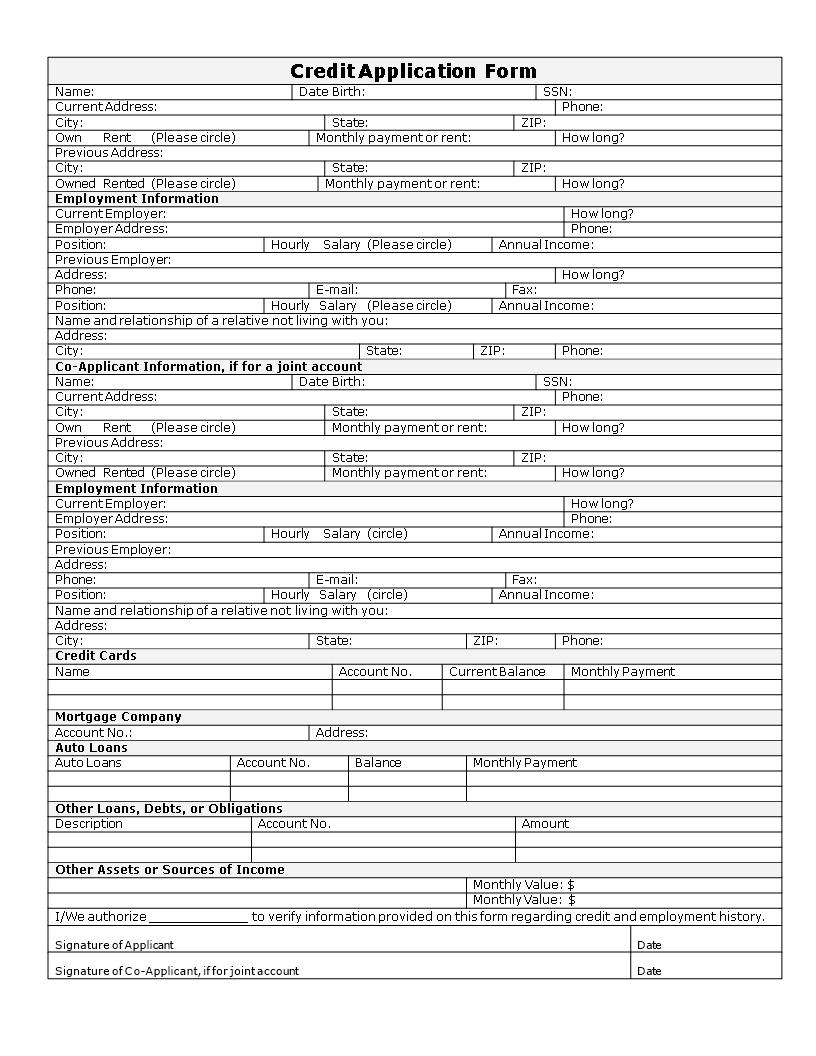

Printable business credit application form

I-Save, punan ang mga blanko, i-printa, Tapos na!

How to make business credit application form? Download this Printable business credit application form now and improve your credit application process!

Mga magagamit na premium na format ng file:

.docx- Itong dokumento ay sertipikado ng isang Propesyonal

- 100% pwedeng i-customize

Finance Pananalapi business credit application form form ng aplikasyon ng kredito sa negosyo printable business credit application form napi-print ng aplikasyon ng kredito sa negosyo business credit application business credit application form template business credit application pdf business credit application form pdf blank credit application form for business business account credit application form business credit application form business credit application personal guarantee printable business credit application form free business credit application form credit application forms for business template business credit application forms form for applying a business credit application application form business credit credit template finance credit apply template

Where to download free printable business credit application forms?

You found it! Here you can find useful templates that will help you creating a Business Credit Application Form, that is essential for evaluating the creditworthiness of potential clients. This form collects key financial and personal information, enabling informed decisions about extending credit. Download our professional template now to simplify this process and ensure consistency.

Importance of Accurate Financial Communication

Accurate financial communication is crucial for managing finances and seeking funds from investors or lenders. Maintaining clear accounting records is vital for daily operations and business growth. Our template will help you consistently track your business's financial status.

Key Elements of a Business Credit Application Form

A Business Credit Application Form is used by lenders, suppliers, and vendors to collect information from credit applicants. It evaluates creditworthiness and determines suitable credit terms, such as limits and interest rates, while establishing a formal agreement between the lender and borrower.

Streamlined Credit Application Process

A standardized form helps streamline the credit application process. Typical elements include:

- Business Information: Name, address, phone number, and industry type.

- Contact Information: Name, address, phone number, and email.

- Operational Details: Number of employees, trade payment references, and bank references.

- Principal Details: Identifying details of the business's owners or principals.

- Financial Information: Bankruptcy history, financial ratios, profitability, debt levels, and cash flows.

Using our template saves time, reduces costs, and enhances your success rate by providing up-to-date insights into your business's financial standing.

Utilizing Accounting Reports

Accounting reports are essential for monitoring business activities and making strategic decisions. Common reports include:

- Balance Sheets: Show financial health at a specific moment.

- Profit and Loss Statements: Display results of operations over time.

- Cash Flow Statements: Highlight cash inflows and outflows.

- Owner Equity Statements: Indicate the owner's equity in the business.

- Benefits of Using Our Templates

Our templates, available in PDF, Word, PPT, and Excel, are crafted by industry professionals to meet the needs of small business owners and finance staff. They are intuitive, customizable, and ready to use.

Save Time and Effort

Transitioning to digital workflows, including online credit applications, offers several benefits:

- Efficiency: Streamlines the process and reduces errors.

- Accessibility: Makes it easier to apply and manage applications.

- Cost-Effective: Reduces the need for paper-based processes.

- Steps to Fill Out a Business Credit Application

- Review the Credit Agreement: Understand the terms and conditions.

- Input Personal and Business Details: Provide accurate information.

- Provide Employment and Financial Information: Demonstrate financial stability.

- Submit the Application: Review for errors, sign, and submit.

- Wait for Feedback: The lender will respond with approval, requests for more information, or a rejection.

Download this editable Credit Application Form in Microsoft Word (.docx) or open it in Google Docs now and streamline your credit application process! For more templates, browse our website and gain instant access to thousands of ready-made, easy-to-find, and intuitive business documents, forms, and letters.

Start today to improve your credit application process!

DISCLAIMER

Wala sa 'site' na ito ang dapat ituring na legal na payo at walang abogado-kliyenteng relasyon na itinatag.

Mag-iwan ng tugon. Kung mayroon kang anumang mga katanungan o mga komento, maaari mong ilagay ang mga ito sa ibaba.