Balance Sheet and General Ledger

I-Save, punan ang mga blanko, i-printa, Tapos na!

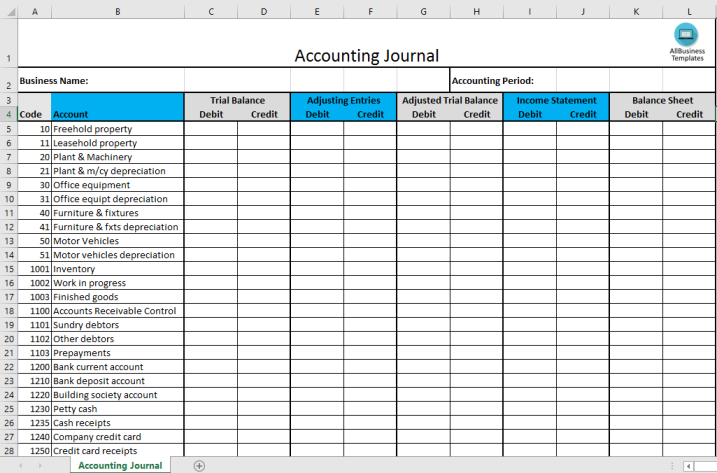

How to set up a Balance Sheet and General Ledger spreadsheet in Excel? How do the balance sheet and general ledger work? Download this Balance Sheet and General Ledger Excel template now!

Mga magagamit na premium na format ng file:

.xls- Itong dokumento ay sertipikado ng isang Propesyonal

- 100% pwedeng i-customize

Finance Pananalapi accounting ledger balance balance sheet administration balance sheet sample sample ng balanse bookkeeping balance sheet example halimbawa ng balanse sample balance sheet sample na balanse sheet balance sheet finance General Ledger Example general ledger example pdf general ledger example excel ledger account format posting to the ledger example general ledger vs trial balance general ledger book general ledger accounts list general ledger entries

How to set up a Balance Sheet and General Ledger spreadsheet in Excel? How do the balance sheet and general ledger work? We have a sample template available that can help you quickly and easily create financial statements. Our templates are easy to use and can be customized to fit your needs. Download this sample template now and get started!

A balance sheet and a general ledger are two fundamental accounting tools used by businesses to track and manage their financial information. They serve different purposes within the accounting and financial reporting process.

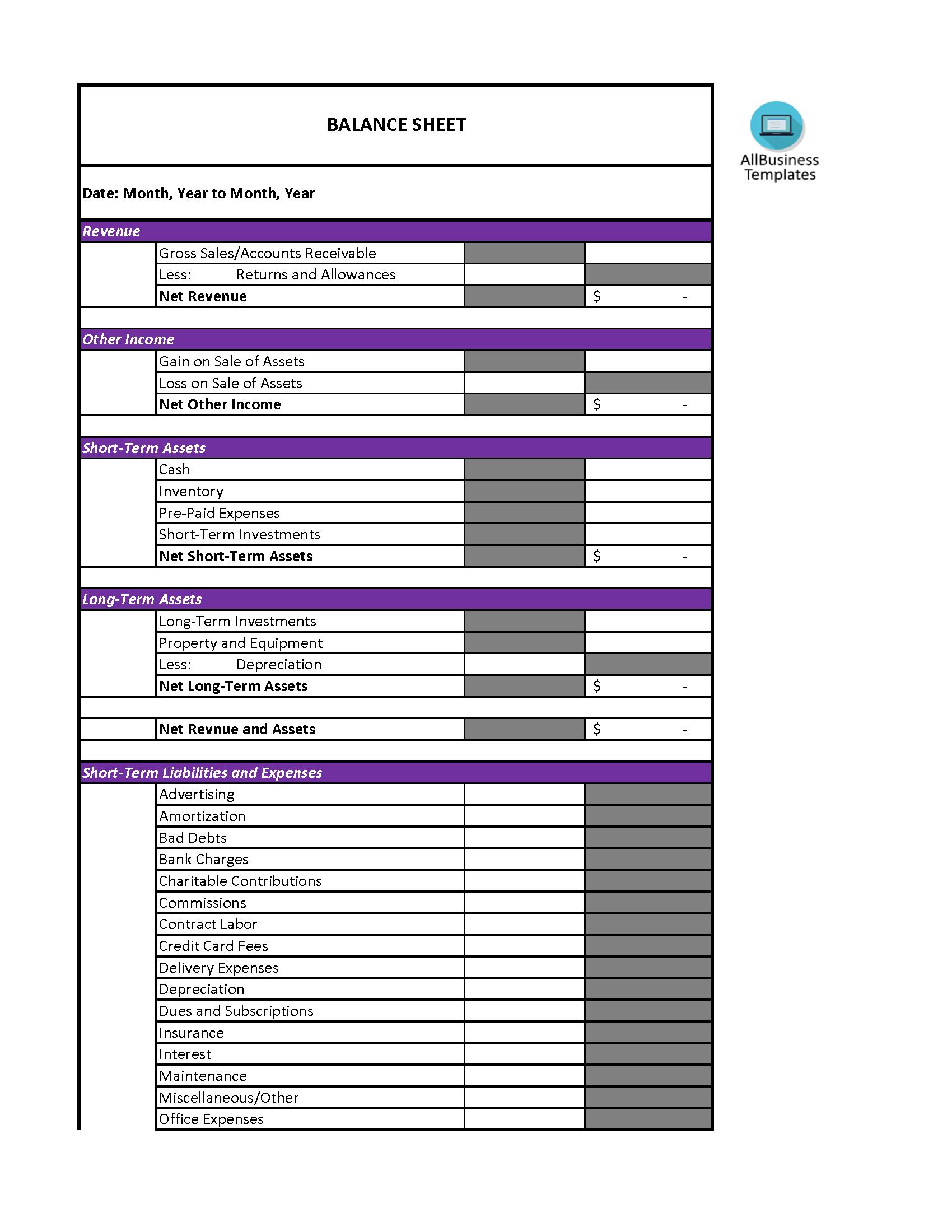

Balance Sheet:

- A balance sheet, also known as a "statement of financial position," is one of the three primary financial statements used in accounting (the other two being the income statement and the cash flow statement). The balance sheet provides a snapshot of a company's financial position at a specific point in time, usually at the end of an accounting period, such as a month, quarter, or fiscal year.

- Assets: This section lists all the resources owned by the company, such as cash, accounts receivable, inventory, equipment, and investments. Assets are categorized into current assets (those expected to be converted into cash within one year) and non-current assets (those expected to provide value over a longer period).

- Liabilities and Equity: This section lists the company's obligations and sources of financing. Liabilities include accounts payable, loans, and other debts. Equity represents the ownership interest in the company, including common and preferred stock and retained earnings. The equation that defines a balance sheet is: Assets = Liabilities + Equity. This equation must always balance, hence the name "balance sheet."

General Ledger:

Key elements of the general ledger include:

The general ledger is crucial for maintaining accurate financial records, preparing financial statements like the balance sheet and income statement, and providing detailed financial data for internal and external reporting and analysis.

- A general ledger is a core component of an accounting system and serves as a detailed, chronological record of all financial transactions of a business. It's essentially a "book" or electronic record where all financial activities are recorded in the form of journal entries. Each journal entry includes information about the date, accounts affected, transaction amount, and a description of the transaction.

- The general ledger organizes financial transactions into various accounts, and it follows a double-entry accounting system. In double-entry accounting, every transaction has an equal and opposite effect on at least two accounts, ensuring that the accounting equation (Assets = Liabilities + Equity) remains in balance.

Key elements of the general ledger include:

- Chart of Accounts: A list of all the accounts used to record financial transactions, each assigned a unique account number and name.

- Journal Entries: Records of individual financial transactions that detail which accounts are debited (increased) and credited (decreased).

- Account Balances: The running balances of each account, which are updated after each transaction.

- Trial Balance: A summary of all account balances used to check that debits and credits are in balance.

In summary, a balance sheet is a financial statement that provides a snapshot of a company's financial position at a specific point in time, while a general ledger is a detailed record of all financial transactions used to maintain and track a company's financial activities over time.

Download this Balance Sheet and General Ledger template now and enhance your administration and business!

DISCLAIMER

Wala sa 'site' na ito ang dapat ituring na legal na payo at walang abogado-kliyenteng relasyon na itinatag.

Mag-iwan ng tugon. Kung mayroon kang anumang mga katanungan o mga komento, maaari mong ilagay ang mga ito sa ibaba.