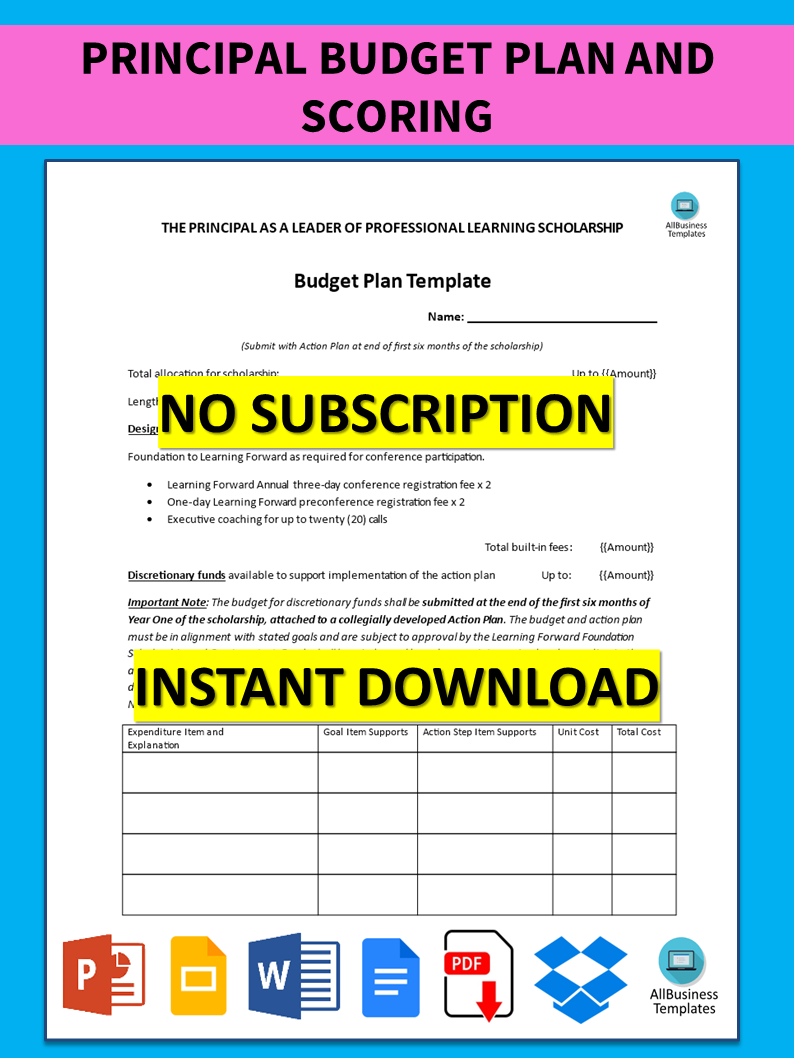

Principal Budget Plan and Scoring

I-Save, punan ang mga blanko, i-printa, Tapos na!

How to write a budget plan template? Do you need a budget plan and scoring template for the principal's budget? Download this sample template will help you create a comprehensive budget plan and track your budget goals.

Mga magagamit na premium na format ng file:

.docx- Itong dokumento ay sertipikado ng isang Propesyonal

- 100% pwedeng i-customize

Business Negosyo Finance Pananalapi budget scholarship plan Learning Action The Essential Guide To Making A Business Plan

Whether you manage the finances at your work or home, adequate communication is essential. Accurately keeping track of financial data is not only critical for running the day-to-day operations of your small business, but it is also important when seeking funds from investors or lenders to grow your business to the next level. Having correct and accurate information exchange enables and ensures you, you can make the right decisions. For those working in Finance, it's important to be accurate and always double-check every detail.

Principal Budget:

A central financial instrument with a components plan and a means of assessing its effects-(the scoring aspect) is called a principal budget (and scoring plan). This paper will elaborate on these constituents in more extensive terms. It is the fundamental budget that serves as a major financial booklet or roadmap featuring projected revenue, spending, and fiscal aims for an entire fiscal term. It functions as an essential compass in matters of money management and choices concerning it.

Features of the budget:

- Expected Revenue: It is the nominal amount of money that is likely to be generated from taxes, fees, grants or sales.

- Use of Money: The expenditures that deal with programs, services, and projects involved in running a business.

- Predictions on Unsustainable Changes in the Budget Balance: This will enable one actively involved in preparing the budget to know whether it will be a deficit (a condition where outflow exceeds inflow) or surplus (in which case inflow exceeds outflow).

- Financial Priorities: This indicates priorities or goals for funding certain areas.

- Debt Management: Suggestions that concern either managing an already acquired debt or borrowing again.

The main budget exists to guarantee that resources are utilized cost-effectively, that expenses correspond with the ambitions of the organization, and that the organization is still financially secure during fiscal years.

Scoring Plan:

A scoring plan gauges the financial effects of a budget by evaluating its estimated expenses and advantages over a specified period. This generally includes working out how the economic impacts of the budget affect the overall financial well-being of an organization or government.

- Components: Cost Estimation: This involves a detailed calculation of what proposed policies, programs or items in the budget would cost.

- Revenue Impact: This analyzes how the budget will impact tax income, grants, and other forms of income.

- Economic Assumptions: Growth rates, inflation rates, and interest rates are among the economic factors on which the scoring plans are based.

- Time Horizon: Scoring is typically done for certain periods such as five years or ten years to obtain long-term effects.

- Budgetary Impact: Proposed budgets evaluation in terms of their effects on the overall state of finances including deficits, debts as well as spending levels

- Purpose: One of its importance lies in an understanding of the fiscal impact of budgets through their growth prospects and sustainability assessment; this helps one to make rational decisions about costs versus benefits via objective examination.

Principal Budget and Scoring Plan combined

Together they say a principal budget for a scoring plan seems like giving out cash in a very thorough allowance that is later examined in terms of what will happen financially. This kind of approach does not only involve thoughtful arrangement of the finances but also knowing if there would be any positive or negative future outcomes.

Importance:

- It promotes fiscal responsibility: Understands financial implications that enable maintenance of a balanced budget

- It helps in policy decisions: It helps to understand how certain choices regarding budgeting will have different ramifications on finances.

- It provides long-term planning support: This understanding could enable entities to make plans for their future based on possible economic effects.

In summary, the principal budget and scoring plan is a holistic practice for planning budgets and estimating their effects financially, thus ensuring fiscal discipline as well as enabling rational decision-making processes.

DISCLAIMER

Wala sa 'site' na ito ang dapat ituring na legal na payo at walang abogado-kliyenteng relasyon na itinatag.

Mag-iwan ng tugon. Kung mayroon kang anumang mga katanungan o mga komento, maaari mong ilagay ang mga ito sa ibaba.