Business Income Statement

I-Save, punan ang mga blanko, i-printa, Tapos na!

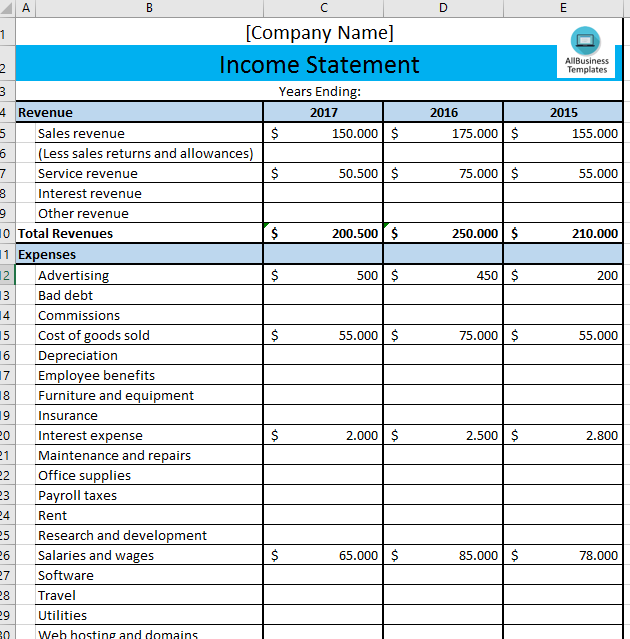

What is the format for a business income statement? In what ways does a business income statement include information? Download and use our template to track your monthly income and expenses.

Mga magagamit na premium na format ng file:

.xlsx- Itong dokumento ay sertipikado ng isang Propesyonal

- 100% pwedeng i-customize

Finance Pananalapi statement pahayag overview profit and loss profit loss income kita

What is the format for a business income statement? In what ways does a business income statement include information? Download and use our template to track your monthly income and expenses. It's easy to use and will help you stay organized and efficient. With this template, you can easily monitor your income and expenses to identify any areas of improvement.

A business income statement, often referred to as a profit and loss (P&L) statement or statement of earnings, is a financial document that provides a summary of a company's revenues, expenses, and net income (or net loss) over a specific period of time. This statement is a fundamental component of a company's financial reporting and is used to assess its financial performance.

Here are the key components and purposes of a business income statement:

- Revenue (Sales): This section includes the total revenue generated by the company during the specified time frame. Revenue typically comes from the sale of products, services, or other income sources related to the core business operations.

- Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing or purchasing the goods or services sold by the company. It includes expenses such as raw materials, labor, and manufacturing costs.

- Gross Profit: Gross profit is calculated by subtracting the COGS from the total revenue. It represents the profit generated from the core business operations before considering other operating expenses.

- Operating Expenses: This section lists various operating expenses incurred during the reporting period. Common operating expenses include salaries and wages, rent, utilities, marketing and advertising costs, depreciation, and other costs necessary to run the business.

- Operating Income (Operating Profit): Operating income is calculated by subtracting the total operating expenses from the gross profit. It represents the profit or loss generated from the company's primary business activities.

- Other Income and Expenses: This category accounts for any income or expenses that are not directly related to the core business operations. It may include interest income, interest expenses, gains or losses from asset sales, and other non-operating items.

- Income Before Taxes: Income before taxes is the company's profit or loss before accounting for income tax expenses.

- Income Tax Expenses: This section includes the income tax expenses that the company is liable for based on its taxable income.

- Net Income (Net Profit): Net income is the final figure on the income statement. It represents the company's profit or loss after accounting for all revenues, expenses, and taxes. It is often referred to as the "bottom line."

- Earnings Per Share (EPS): If the company is publicly traded, the income statement may include earnings per share, which is calculated by dividing the net income by the number of outstanding shares of common stock.

- Assessing Profitability: It provides a snapshot of whether the company is making a profit or incurring a loss during the reporting period.

- Evaluating Performance: Stakeholders, including investors, creditors, and management, use the income statement to assess the company's financial performance and make informed decisions.

- Budgeting and Planning: The income statement helps in budgeting and financial planning by highlighting areas of revenue growth or expense reduction.

- Financial Reporting: It is a key component of a company's financial statements, which are typically prepared on a quarterly and annual basis for external reporting.

The income statement, when reviewed in conjunction with other financial statements like the balance sheet and cash flow statement, provides a comprehensive view of a company's financial health and performance. It helps stakeholders understand how well a company is managing its revenue, expenses, and profitability.

Download this business income statement template now and easily create an accurate income statement for your business. Get your business income statement template now and start tracking your business's finances.

DISCLAIMER

Wala sa 'site' na ito ang dapat ituring na legal na payo at walang abogado-kliyenteng relasyon na itinatag.

Mag-iwan ng tugon. Kung mayroon kang anumang mga katanungan o mga komento, maaari mong ilagay ang mga ito sa ibaba.