Dream Home Calculator

I-Save, punan ang mga blanko, i-printa, Tapos na!

Are you planning to buy a house? What to do when planning to purchase a house for the first time? Check out this free Purchase House Calculator spreadsheet Excel or Google sheets template here.

Mga magagamit na premium na format ng file:

.xlsxIba pang magagamit na mga wika:

- Itong dokumento ay sertipikado ng isang Propesyonal

- 100% pwedeng i-customize

Finance Pananalapi budget home affordability calculator home budget template purchase house calculator house plans for purchase house plans to purchase pitfalls of purchasing online house plans house floor plans to purchase purchase house plans in housing purchase feasibility analysis purchase tiny house plans mortgage analysis you are planning to purchase a house that costs akiya akiya buy plan inaka inaka buy plan akiya house purchase plan tiny house purchase plans akiya property plan inaka property rural property plan house affordability calculator purchase house plans purchase house planning buy a house plan house budget template low budget house plans planner house dream home calculator house budget house purchase planner house purchase plan house planner when planning to buy a home your monthly principal interest taxes insurance piti pitiom akiya house japan buying a house in japan free houses in japan japan house japan abandoned house cheap houses japan diy home renovation old house restoration

What to do when planning to purchase a house for the first time? How Much House Can You Afford? How to budget for your house?

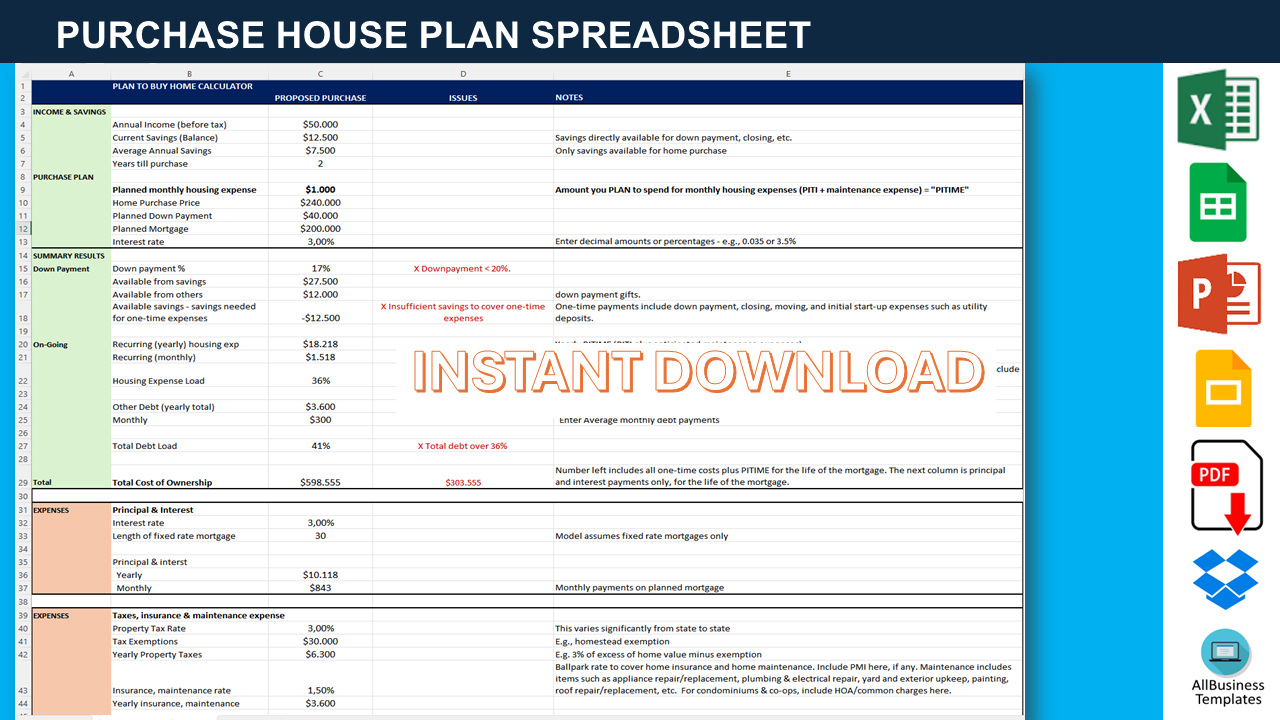

This housing purchase feasibility analysis is an interactive calculator is designed to help you answer essential questions about your home purchase, considering your assets and income:

- What price can I afford to pay for a house?

- What size home mortgage loan can I qualify for?

- How much will I be able to borrow?

- When will I be able to afford to buy?

Additionally, the calculator helps you navigate the complexities of budgeting for the total cost of homeownership. It ensures you account for housing expenses while keeping them within established income and debt-load guidelines. At the bottom of this post, you’ll find links to further help estimate these expenses.

Using the Calculator

- Scroll using arrows and sliders on the right side and bottom.

- Enter data in the blue cells.

- On some phones, double-click to enter data.

- On some computers, you may need to enter fields more than once.

Primary Inputs

The initial section contains the primary inputs. Enter these directly into the Orange cells with black borders:

- Annual gross salary

- Current and anticipated savings

- Planned monthly housing expenses (PITI + maintenance)

- Purchase price under consideration

- Planned down payment

- Expected mortgage interest rate

Additional Inputs

These inputs, in Orange cells may require scrolling:

- Mortgage length in years

- Property tax expenses

- Insurance and maintenance expenses

- One-time purchasing costs (other than the down payment)

- Example Scenario

A hypothetical buyer is considering a $220,000 home two years from now, planning a $50,000 down payment, and expecting a 3% mortgage. With a $55,000 annual salary and $1,100 monthly housing budget, the calculator helps outline this plan.

Expenses Section

- Principal & Interest: With a 30-year mortgage at 3%, the monthly principal and interest payments are $843.

- Taxes, Insurance & Maintenance: Estimated at $750/month based on the home price.

- One-Time Costs: Down payment plus miscellaneous costs total $61,000.

Summary Results

- Down Payment: Warns if the down payment is less than 20%. Smaller down payments usually require PMI (not included in calculations).

- Savings: Illustrates the total savings needed versus available funds, highlighting any shortfall.

- Ongoing Costs: Monthly PITIME (PITI + maintenance) costs are compared to the budget.

- Benchmarks: Housing expenses and total debt load are evaluated against standard benchmarks.

Total Cost of Ownership

The summary highlights that owning a home involves more than the purchase price. Over 30 years, the total cost of ownership, including principal and interest, will exceed $589,022. This includes more than $250,000 in interest on a $220,000 mortgage.

Fine-Tuning Monthly Expense Estimates

The model can help plan years in advance. Initial estimates can be refined with specific neighborhood and home details. Realtors can assist with precise mortgage rates, property taxes, and utility expenses.

Estimating One-Time Expenses

Consider all additional furniture and fixtures needed for each room. Account for items like new appliances, furniture, and maintenance tools. This list can be extensive, so it’s crucial to budget for these costs to avoid financial strain.

Download this free Purchase House Calculator spreadsheet Excel or Google sheets template here.

DISCLAIMER

Wala sa 'site' na ito ang dapat ituring na legal na payo at walang abogado-kliyenteng relasyon na itinatag.

Mag-iwan ng tugon. Kung mayroon kang anumang mga katanungan o mga komento, maaari mong ilagay ang mga ito sa ibaba.