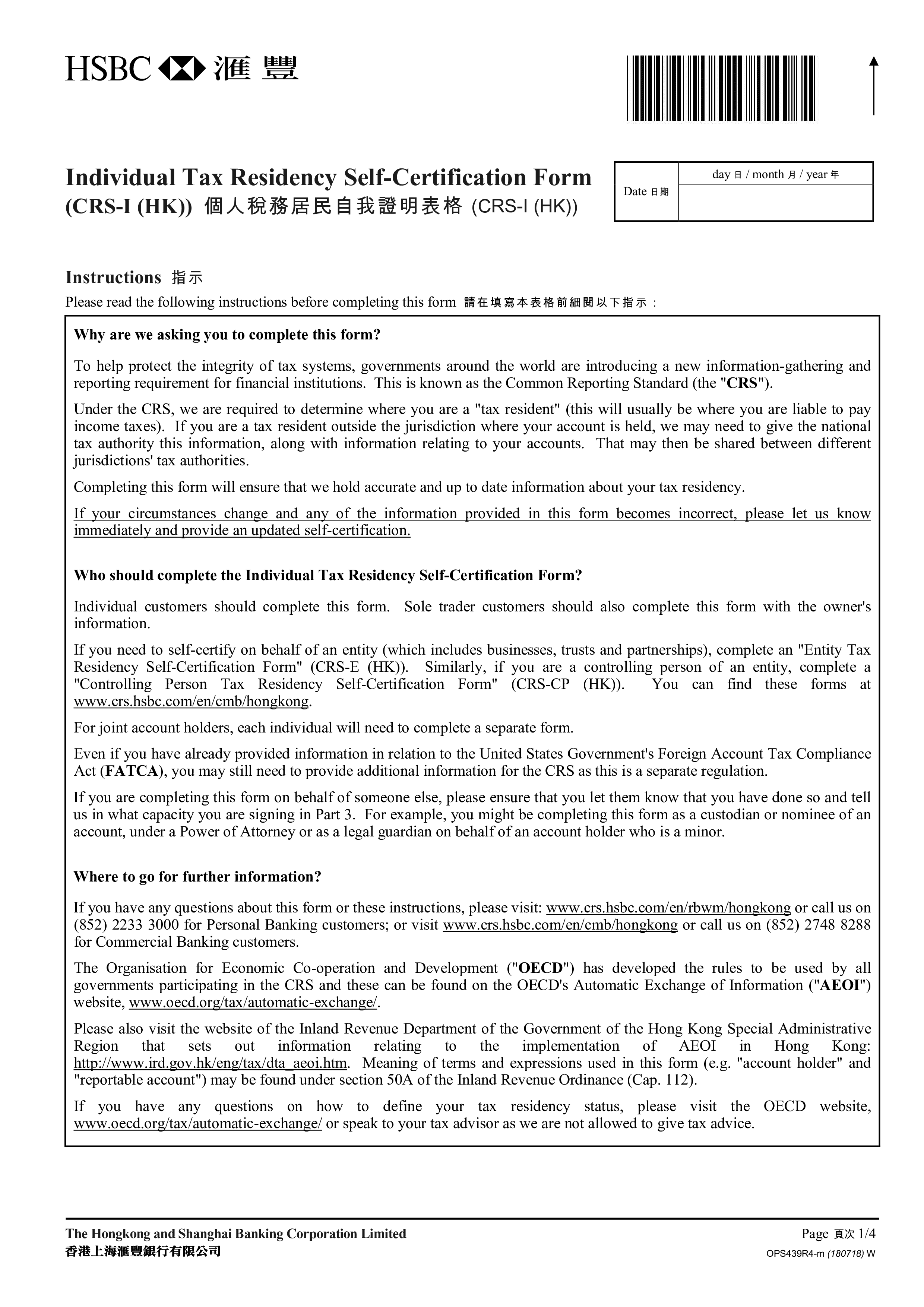

CRS Individual Tax Residency Hong Kong

Opslaan, invullen, afdrukken, klaar!

Do you need an Individual Tax Residency form to arrange the jurisdiction of tax residency for Hong Kong? This HSBC Hong Kong tax resident can help you out.

Beschikbare bestandsformaten:

.pdf- Gevalideerd door een professional

- 100% aanpasbaar

- Taal: English

- Digitale download (450.49 kB)

- Na betaling ontvangt u direct de download link

- We raden aan dit bestand op uw computer te downloaden.

Financiën bank belasting hk

Do you need an Individual Tax Residency form to arrange the jurisdiction of tax residency for Hong Kong? This HSBC Hong Kong tax resident can help you out.

According common reporting standard in Hong Kong, when you stay more than 183 days in HK, one way is to fill in the Individual Tax Residency Self-certification form in order to apply for the tax system.

If you are a civilian in Hong Kong you might need to fill in such a form or report. This form can be of

value. We support you with this CRS Individual Tax Residency Hong Kong, which will save your time, cost and efforts and help you to

arrange your status in the system.

This blank CRS Individual Tax Residency Hong Kong

is intuitive and ready to fill in. Try it now and let this form inspire you. We

certainly encourage you to use this CRS Individual Tax Residency in Hong Kong and are confident it will fit

your needs.

Download

this ready-to-use and easy customizable CRS Individual Tax Residency Hong Kong template that will perfectly suit your needs!

DISCLAIMER

Hoewel all content met de grootste zorg is gecreërd, kan niets op deze pagina direct worden aangenomen als juridisch advies, noch is er een advocaat-client relatie van toepassing.

Laat een antwoord achter. Als u nog vragen of opmerkingen hebt, kunt u deze hieronder plaatsen.