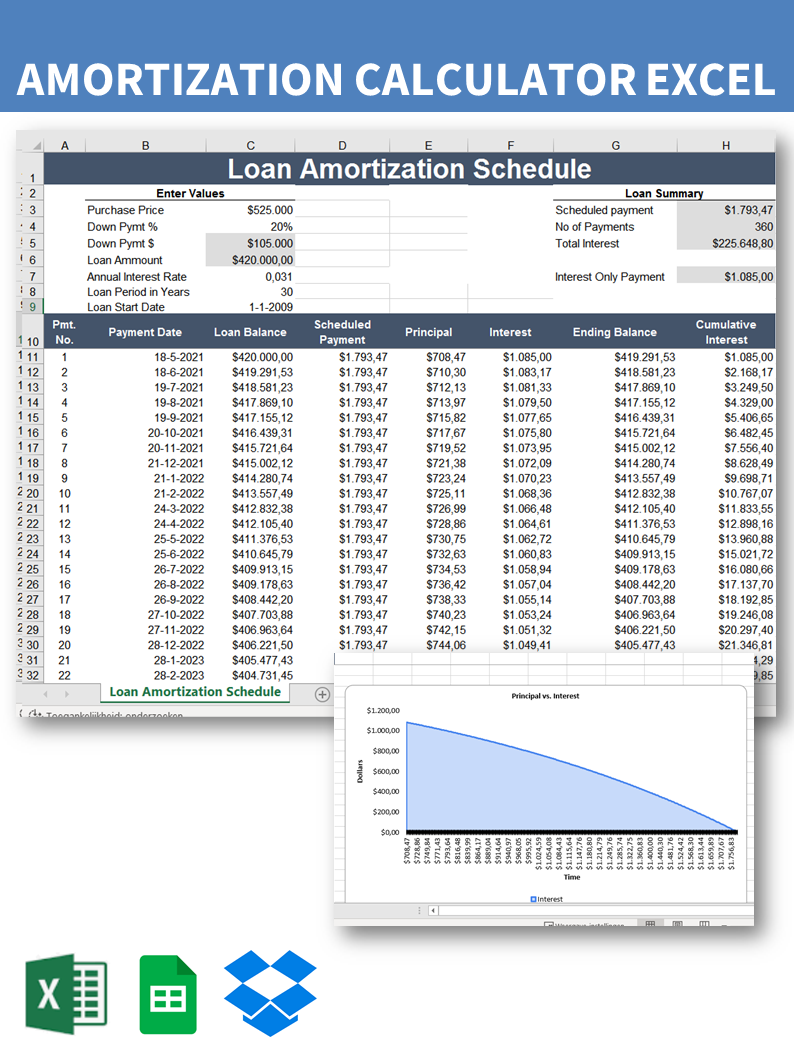

Loan Amortization Schedule Template

Opslaan, invullen, afdrukken, klaar!

How to make a Loan Amortization calculation? An easy way to create your personalized spreadsheet is by downloading this Excel sheet now! Download this financial Loan Amortization Schedule Template now!

Beschikbare bestandsformaten:

.xlsxTemplate in andere talen beschikbaar:

- Gevalideerd door een professional

- 100% aanpasbaar

- Taal: English

- Digitale download (94.2 kB)

- Na betaling ontvangt u direct de download link

- We raden aan dit bestand op uw computer te downloaden.

Financiën bank betaling lening Interesseren spreadsheet Afschrijvingen geplande Aflossingstabel Excel Excel werkblad Excel sjabloon beste excel templates sjabloon Excel spreadsheet loan amortization template spreadsheet loan amortization template sample loan amortization template template

Whether you manage the finances at your work or at home, adequate communication is essential and important. Accurately keeping track of financial data is not only critical for running the day-to-day operations of your small or medium-sized business, but it is also important when seeking funds from investors or lenders to grow your business to the next level.

- No.

- Payment

- Date

- Loan Balance

- Scheduled Payment

- Principal

- Interest

- Ending Balance

- Cumulative Interest

Using this Loan Amortization guarantees that you will save time, cost and efforts and enables you to reach the next level of success in your project, education, work, and business. Download it now!

Looking for more? Our collection of financial documents, templates, forms, and spreadsheets includes templates designed specifically for small business owners, private individuals, or Finance Staff. Find financial projections to calculate your startup expenses, payroll costs, sales forecast, cash flow, income statement, balance sheet, break-even analysis, financial ratios, cost of goods sold, amortization and depreciation for your company. These financial templates also work with OpenOffice and Google Spreadsheets, so if you are operating your business on a very tight budget, hopefully, you'll be able to make these financial templates work for you as well.

DISCLAIMER

Hoewel all content met de grootste zorg is gecreërd, kan niets op deze pagina direct worden aangenomen als juridisch advies, noch is er een advocaat-client relatie van toepassing.

Laat een antwoord achter. Als u nog vragen of opmerkingen hebt, kunt u deze hieronder plaatsen.