Budgetplanner Excel

Opslaan, invullen, afdrukken, klaar!

De beste manier om een Budgetplanner Excel te maken? Check direct dit professionele Budgetplanner Excel template!

Beschikbare bestandsformaten:

.xlsx- Gevalideerd door een professional

- 100% aanpasbaar

- Taal: English

- Digitale download (175.86 kB)

- Na betaling ontvangt u direct de download link

- We raden aan dit bestand op uw computer te downloaden.

Zakelijk Privé begroting inkomen blad huishoudbudget Technologie Digitale media Maandbudget template terugkoppeling Begrotingsblad Begroting Excel uitgaven Tweewekelijks budget Maandelijkse budgetplanner begroting werkblad begroting sjabloon persoonlijk budget sjabloon wat is een budget Excel begroting sjabloon begroting spreadsheet template begroting sjabloon Excel persoonlijk budget tweewekelijks persoonsgebonden budget twee weken

Whether you manage the finances at your work or at home, adequate communication is essential. Accurately keeping track of financial data is not only critical for running the day-to-day operations of your small business, but it is also important when seeking funds from investors or lenders to grow your business to the next level. Having correct and accurate information exchange enables and ensures you, you can make the right decisions. For those working in Finance, it's important to be accurate and always double-check every detail.

- Begin by overestimating your expenditures – focus on wants as well as needs. Once you compare this with your income, make some decisions about where to cut back as needed. The fallback position is “What do I need?”

- Don’t make your budget too inflexible or too tight – if you do, the time will come when you won’t be able to stick to it any longer.

- Follow your budget for three months and then review – can it be improved?

- Budgets often fail because people don’t plan for irregular predictable expenses. Plan for unexpected costs (medical, car repairs, etc.) by regularly putting money aside for ‘emergencies’ (miscellaneous, unsure cost).

- If your budget ends up in the red, don’t panic!! Ask yourself the following questions and make the necessary adjustments:

- Can you remove any of the expenses?

- Can you reduce some of the expenses?

- Could you handle a part-time job?

- Could you ask your family for some (more) money?

- Would a Student Loan be of any help?

- Would you consider being a part-time student for a while and working fulltime? This may allow you to accumulate some savings.

- Housing (fortnightly) Rent/Board or Mortgage Electricity Gas Water Telephone

- Other Personal (fortnightly) Mobile Phone Cigarettes Hobbies/Sport Alcohol Entertainment Other Other

- Food (fortnightly) Lunches Supermarket Butcher Market Takeaway Pet food

- Debts (fortnightly) Personal loan Car loan Credit card Rent of TV/ fridge/computer Other

- Education (fortnightly) School books Stationery Photocopying Child Care Other Other

- Transport (fortnightly) Public transport Petrol

- Annual Expenses: calculate fortnightly costs of yearly and irregular expenses

- General Expenses (yearly) Car registration Car insurance Car maintenance House insurance Council rates Health insurance Other

- Education Expenses (yearly) University fees Textbooks Uniforms Course materials School fees

- Personal Expenses (yearly) Haircuts Clothes Shoes Medical Dental Other Other

- Calculate expenses. First, you need to determine exactly how much you're spending each month.

- Determine your income.

- Set savings and debt payoff goals.

- Record spending and track progress.

- Be realistic. Better to prepare for the most worse situation

- Include the following:

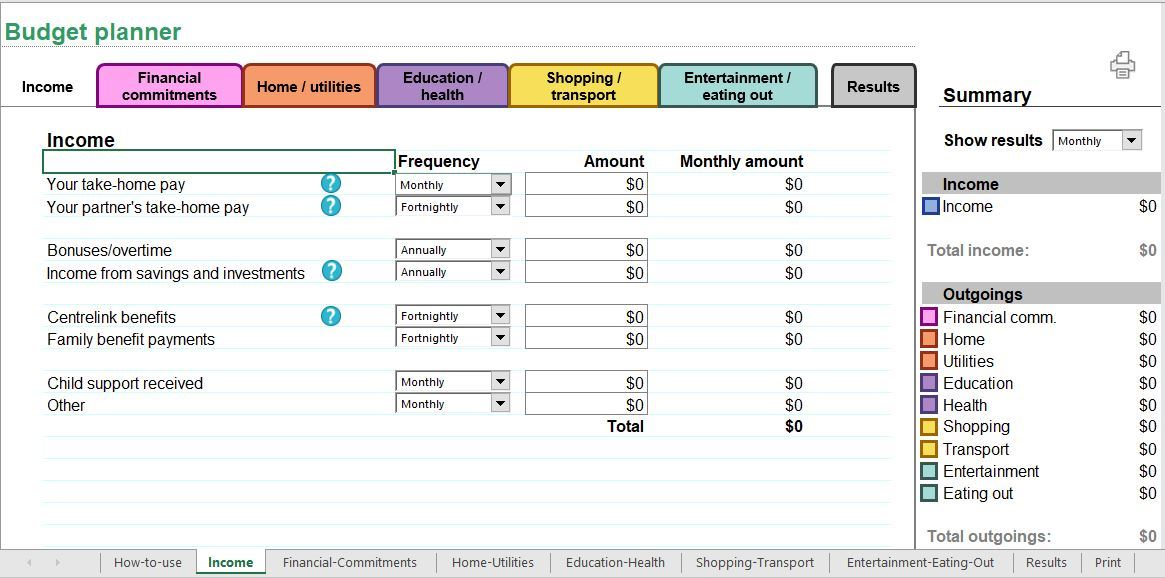

- Budget planner

- Summary

- Income

- Outgoings

- Programs

- Income

- Total income

- Customizing

- Outgoings

- Financials

- etc

Using this printable Budget Planner guarantees that you will save time, cost and effort and enables you to reach the next level of success in your project, education, work, and business! Download this Home Budget Planning template now!

Looking for more? Our collection of financial documents, templates, forms, and spreadsheets includes templates designed specifically for small business owners, private individuals, or Finance Staff. Find financial projections to calculate your startup expenses, payroll costs, sales forecast, cash flow, income statement, balance sheet, break-even analysis, financial ratios, cost of goods sold, amortization and depreciation for your company. These financial templates also work with OpenOffice and Google Spreadsheets, so if you are operating your business on a very tight budget, hopefully, you'll be able to make these financial templates work for you as well.

DISCLAIMER

Hoewel all content met de grootste zorg is gecreërd, kan niets op deze pagina direct worden aangenomen als juridisch advies, noch is er een advocaat-client relatie van toepassing.

Laat een antwoord achter. Als u nog vragen of opmerkingen hebt, kunt u deze hieronder plaatsen.