Gratis debetnota

Opslaan, invullen, afdrukken, klaar!

De beste manier om een Gratis debetnota te maken? Check direct dit professionele Gratis debetnota template!

Beschikbare bestandsformaten:

.docx- Gevalideerd door een professional

- 100% aanpasbaar

- Taal: English

- Digitale download (32.82 kB)

- Na betaling ontvangt u direct de download link

- We raden aan dit bestand op uw computer te downloaden.

Zakelijk Notitie Debet Note Debiteren Debetnota sjablonen Voorbeelden van voorbeelden Debetnota monster Debet Note Voorbeeld Gratis debetnota

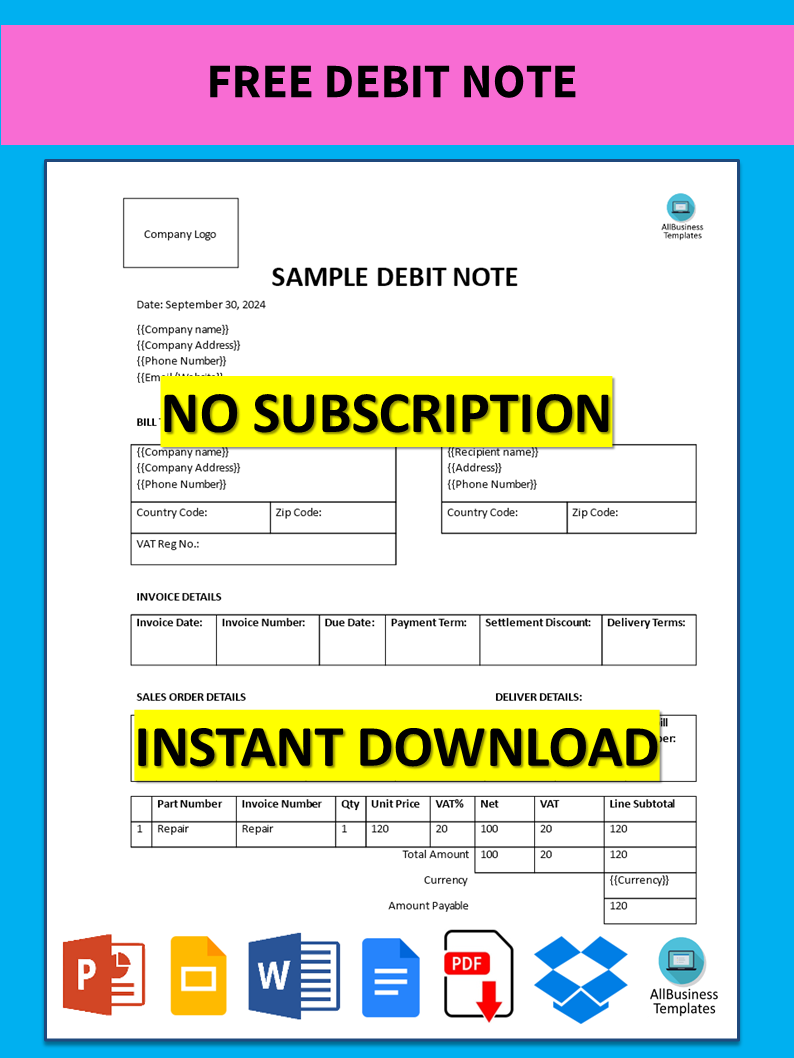

What details must a debit note contain? Are you searching for a sample debit note format? Download this sample debit note template now for your use. It contains all relevant fields and directions for you to be able to come up with a debt note with ease. Simply modify it according to your preferences and apply it to your work.

A debit note is a commercial document that is delivered to the seller by the buyer in which the buyer informs the seller that the fixer intended for him ought to be decreased because the amount the buyer owes him has been reduced. It is a polite way of asking the supplier why outstanding invoices ‘should be’ less than expected, in most cases on reasonable grounds like defective products, waste, or payment made on excess invoice.

What Is the need of a debit note:

Hence, a debit note is mainly issued to the seller as:

- A communication that a certain amount of money has been debited or deducted

- A written communication of the same, concerning the said debit or deduction

- An instruction requesting the seller to make, such changes in the seller’s books of accounts.

- It helps in clearing out differences or mistakes in transactions that have occurred earlier.

A debit note more often than not contains:

- Date of issue

- Number relating to a debit note

- Name and physical address of the buyer

- Name and physical address of the seller

- Previous invoice number with date

- The reason for this debit can be composed of: returns, damage, or overpayment

- Value of debit

- The new remaining amount payable to the seller

Difference between debit Notes and memos:

Generally speaking, both debit notes and debit memos facilitate a decrease in the payable amount to a supplier, but they differ in the following ways:

- Generally In a standard business transaction, a buyer tends to draw up a debit memo, then the seller does not issue an invoice on the purchase at all. This is where a debit note comes in.

- In practice, a debit memo is commonly for use between departments of the same organization, while a debit note is a letter addressed to a supplier.

In summary, a debit note is a formal document used by a buyer to notify a seller of a debit or deduction in the amount owed, providing a clear and transparent way to correct errors or discrepancies in previous transactions.

When you make a debit note or debit memorandum, understand that it functions as a commercial document. It is generally issued by a buyer to a seller, as a means of formally requesting a credit note. Such debit notes act as the source document for the Purchase returns journal. Therefore, it's considered evidence for the occurrence of a reduction in expenses. What kind of A/R adjustments are to be made:

- An Adjustment in AR is an amount added or subtracted from the amount due to an Invoice, Debit Memo, Chargeback, Deposit, or Guarantee;

- For example, if your customer sends a payment of $85 for a $110invoice you apply the receipt to the invoice, then create an adjustment for the balance due;

- You can create multiple adjustments against each transaction, for positive or negative amounts;

- You can approve adjustments that are within your approval limits and give pending statuses to adjustments that are outside your approval limits.

Instead, we provide this standardized free debit note template with text and formatting as a starting point to help professionalize the way you are working. Our private, business, and legal document templates are regularly screened by professionals. If time or quality is of the essence, this ready-made template can help you save time and focus on the topics that matter!

Using this document template guarantees you will save time, cost, and effort! It comes in Microsoft Office format, is ready to be tailored to your personal needs. Completing your document has never been easier!

Download this free debit note template now for your benefit!

DISCLAIMER

Hoewel all content met de grootste zorg is gecreërd, kan niets op deze pagina direct worden aangenomen als juridisch advies, noch is er een advocaat-client relatie van toepassing.

Laat een antwoord achter. Als u nog vragen of opmerkingen hebt, kunt u deze hieronder plaatsen.