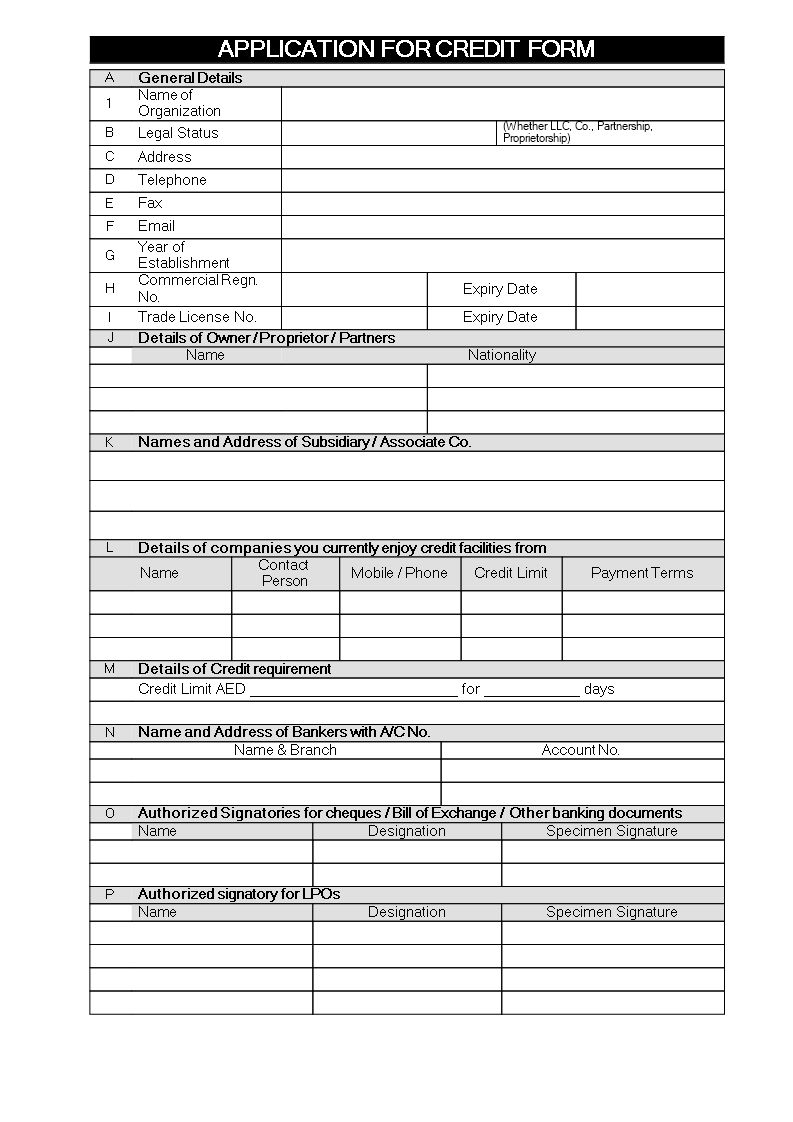

Blank credit application form for business

Opslaan, invullen, afdrukken, klaar!

How to create a credit application template? What is a Credit Application in Business? Download this Blank credit application form for business here today.

Beschikbare bestandsformaten:

.docx- Gevalideerd door een professional

- 100% aanpasbaar

- Taal: English

- Digitale download (21.75 kB)

- Na betaling ontvangt u direct de download link

- We raden aan dit bestand op uw computer te downloaden.

Financiën bedrijfskrediet aanvraag formulier

How to create a credit application template? What is a Credit Application in Business?

Creating a Business Credit Application Form is essential for evaluating the creditworthiness of potential clients. This form collects key financial and personal information, enabling informed decisions about extending credit. Download our professional template now to simplify this process and ensure consistency.

Importance of Accurate Financial Communication

Accurate financial communication is crucial for managing finances and seeking funds from investors or lenders. Maintaining clear accounting records is vital for daily operations and business growth. Our template will help you consistently track your business's financial status.

Key Elements of a Business Credit Application Form

A Business Credit Application Form is used by lenders, suppliers, and vendors to collect information from credit applicants. It evaluates creditworthiness and determines suitable credit terms, such as limits and interest rates, while establishing a formal agreement between the lender and borrower.

Streamlined Credit Application Process

A standardized form helps streamline the credit application process. Typical elements include:

- Business Information: Name, address, phone number, and industry type.

- Contact Information: Name, address, phone number, and email.

- Operational Details: Number of employees, trade payment references, and bank references.

- Principal Details: Identifying details of the business's owners or principals.

- Financial Information: Bankruptcy history, financial ratios, profitability, debt levels, and cash flows.

Transitioning to digital workflows, including online credit applications, offers several benefits:

- Efficiency: Streamlines the process and reduces errors.

- Accessibility: Makes it easier to apply and manage applications.

- Cost-Effective: Reduces the need for paper-based processes.

- Steps to Fill Out a Business Credit Application

- Review the Credit Agreement: Understand the terms and conditions.

- Input Personal and Business Details: Provide accurate information.

- Provide Employment and Financial Information: Demonstrate financial stability.

- Submit the Application: Review for errors, sign, and submit.

- Wait for Feedback: The lender will respond with approval, requests for more information, or a rejection.

Download this editable blank Credit Application Form in Microsoft Word (.docx) or open in Google Docs now and streamline your credit application process! For more templates, browse our website and gain instant access to thousands of ready-made, easy-to-find, and intuitive business documents, forms, and letters.

DISCLAIMER

Hoewel all content met de grootste zorg is gecreërd, kan niets op deze pagina direct worden aangenomen als juridisch advies, noch is er een advocaat-client relatie van toepassing.

Laat een antwoord achter. Als u nog vragen of opmerkingen hebt, kunt u deze hieronder plaatsen.