Credit Application For A Business Account Template

Opslaan, invullen, afdrukken, klaar!

How to make a Credit Application For A Business Account? Download this Credit Application For A Business Account Template here!

Beschikbare bestandsformaten:

.docx- Gevalideerd door een professional

- 100% aanpasbaar

- Taal: English

- Digitale download (36.21 kB)

- Na betaling ontvangt u direct de download link

- We raden aan dit bestand op uw computer te downloaden.

Financiën bedrijfskrediet aanvraag formulier

How to make a Credit Application For A Business Account?

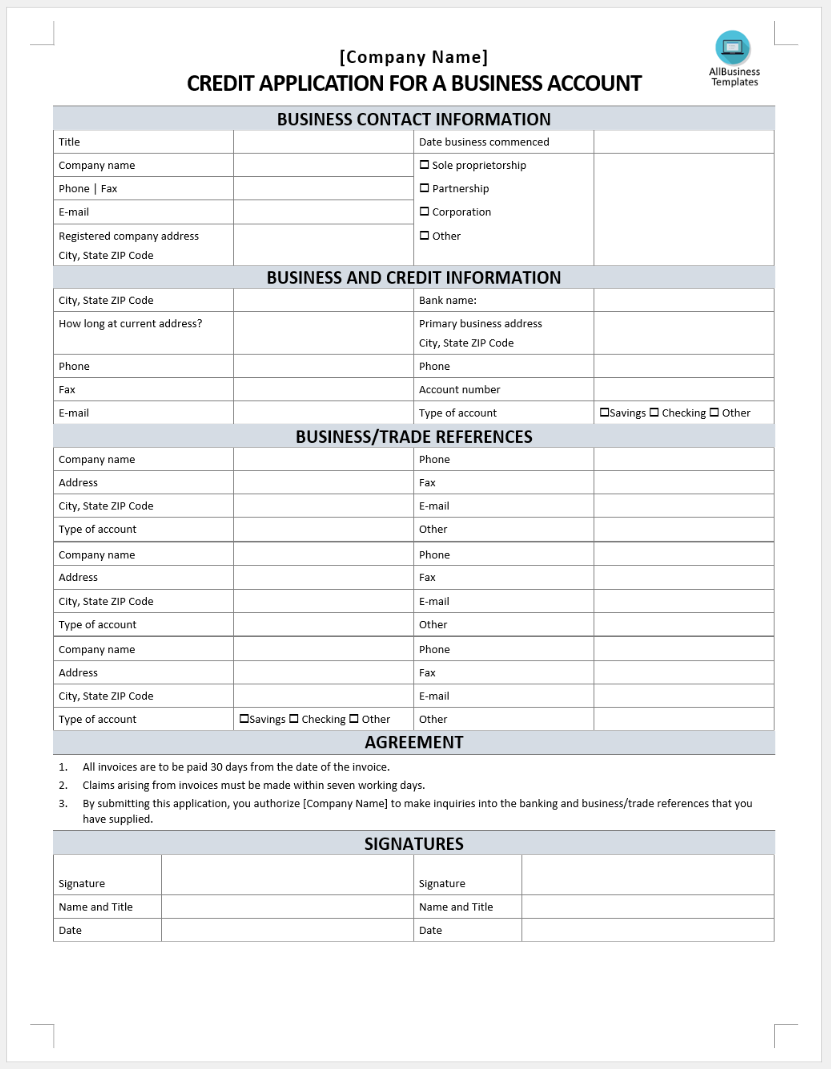

A Credit Application Form for a Business Account is a crucial form that allows for assessing the creditworthiness of potential clients. It collects essential financial and personal information to help businesses make informed decisions about extending credit.

Key Components of a Credit Application For A Business Account Template:

Business Information:

- Business name, address, phone number, and email address.

- Type of business (corporation, partnership, sole proprietorship, LLC).

- Years in business and relevant tax IDs.

Owner/Principal Information:

- Personal details of the business owner(s) or principal(s), including social security numbers and home addresses.

Banking Information:

- Details of the business’s bank accounts, including account numbers and bank contact information.

Trade References:

- Contact information for trade references that can vouch for the business’s credit history.

- Amount of credit requested and its intended use.

Legal Clauses and Agreements:

- Terms and conditions, including payment deadlines, interest rates, and credit limits.

- A personal guarantee clause ensuring repayment, enhancing the security of the credit extended.

- Consent for credit checks and authorization to verify the provided information.

Download this Credit Application For A Business Account Template here or check out any of our other Business Credit Application Forms here.

DISCLAIMER

Hoewel all content met de grootste zorg is gecreërd, kan niets op deze pagina direct worden aangenomen als juridisch advies, noch is er een advocaat-client relatie van toepassing.

Laat een antwoord achter. Als u nog vragen of opmerkingen hebt, kunt u deze hieronder plaatsen.