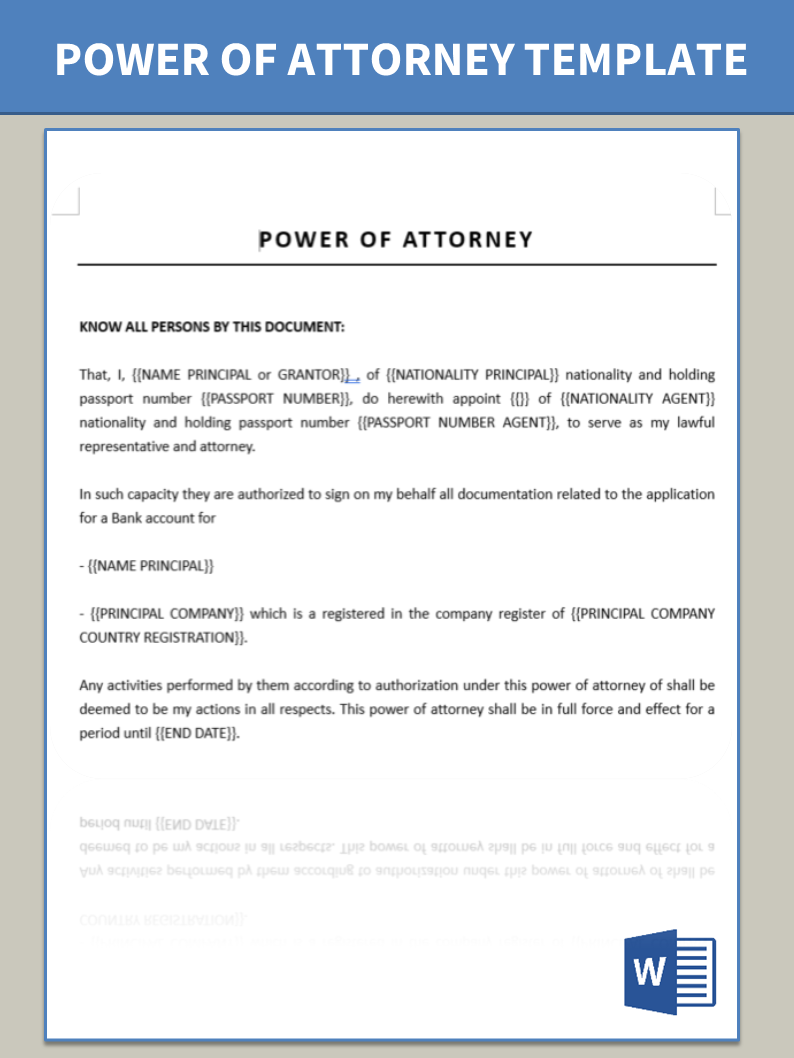

Power Of Attorney for Opening Bank Account

Enregistrer, Remplir les champs vides, Imprimer, Terminer!

What is the process for writing a Power of Attorney (POA) to open a bank account? How important is a power of attorney? Download our sample template now and use it to write your Power of Attorney.

Formats de fichiers gratuits disponibles:

.docx- Ce document a été certifié par un professionnel

- 100% personnalisable

Business Entreprise Finance La finance Legal Légal Life Privé power of attorney procuration management la gestion power of attorney example exemple de procuration authorization autorisation limited power of attorney pouvoir limité power of attorney sample échantillon de procuration poa limited durable power of attorney procuration durable limitée authorization letter lettre d'autorisation Standard la norme Limited Power Of Attorney Form Formulaire de procuration limitée Power Of Attorney Form Formulaire de procuration Authorisation Autorisation types of poa ordinary power of attorney lasting power of attorney enduring power of attorney non durable power of attorney durable power of attorney special or limited power of attorney medical power of attorney springing power of attorney create your power of attorney ordinary poa lasting poa enduring poa non durable poa durable poa special or limited poa medical poa springing poa create your poa authorization vs authentication autorisation vs authentification authorisation dictionary authorised or authorized in authorisation meaning authorising power of attorney meaning power of attorney letter power of attorney in power of attorney definition authorization letter vs poa lettre d'autorisation vs procuration authorization letter template modèle de lettre d'autorisation application for opening bank account letter to open maybank account for employee letter bank manager for opening a bank account how to write letter to open a bank account bank account open application write a letter to open a bank account application for current account opening bank account open karne ke liye application write letter to friend bank account application for opening bank account to letter to open bank account for employee application opening bank account letter to open account for employee limited power of attorney texas limited power of attorney florida limited poa eligible motor vehicle transactions limited power of attorney for vehicle limited power of attorney form california limited power of attorney georgia limited power of attorney real estate limited power of attorney form pa ga limited power of attorney free limited power of attorney form maryland statutory form limited power of attorney correction agreement limited power of attorney durable limited power of attorney limited special power of attorney

What is the process for writing a Power of Attorney (POA) to open a bank account? How important is a power of attorney? Download our sample template now and use it to write your Power of Attorney. Having a POA in place can save you time and hassle by allowing someone else to make decisions for you.

A Bank Power Of Attorney (POA) is often a multiple-page document that must comply with local or state laws, and that is used to open a bank account or perform banking services on behalf. The function is providing access rights/privileges to resources, which have to be accessed by another person on behalf of the owner.

Writing a Power of Attorney (POA) for opening a bank account involves specifying the authority you are granting to someone else to manage your financial affairs related to that specific account. Here are the steps and guidelines to create a POA for this purpose:

Note: Consult with a legal professional or an attorney in your jurisdiction to ensure your POA complies with local laws and meets your specific needs.

- Identify the Parties:

- Principal: You, the person granting the power.

- Agent/Attorney-in-fact: The person you are appointing to manage your bank account on your behalf.

- Determine the Scope of Authority:

- Clearly state what powers you are granting to your agent. In this case, it would be for managing and conducting transactions on your bank account. Be specific about the account details, including the account number and the name of the bank.

- Legal Language:

- Write the document using formal and legal language. You can start with a statement like: "I, [Your Name], of [Your Address], hereby appoint [Agent's Name], of [Agent's Address], as my attorney-in-fact to manage and conduct financial transactions on my behalf with respect to my bank account held at [Bank Name], account number [Account Number]."

- Specific Powers: Detail the specific powers granted to the agent. For example:

- Depositing and withdrawing funds.

- Transferring funds between accounts.

- Signing checks.

- Accessing account statements and online banking.

- Communicating with the bank on your behalf.

- Duration and Termination:

- Specify the duration of the POA. You can make it:

- Specific to a particular transaction.

- Limited to a certain period (e.g., for a year).

- Durable, meaning it remains in effect even if you become incapacitated (consult an attorney for this option).

- Terminable by you at any time by providing written notice to your agent and the bank.

- Witnesses and Notarization:

- In many jurisdictions, you may need to have the POA document witnessed and notarized for it to be legally valid. Check your local laws for requirements regarding the number of witnesses and notarization.

- Agent's Acceptance:

- Your agent should sign the document, accepting the responsibilities and powers granted to them.

- Keep Copies:

- Keep multiple copies of the signed and notarized document. Provide one to your agent, one to the bank where you have the account, and keep one for your records.

- Inform the Bank:

- Inform your bank about the POA and provide them with a copy. They may have their specific requirements or forms to complete.

- Review and Update:

- Periodically review and update your POA as needed, especially if there are changes in your financial situation, the agent's circumstances, or your wishes regarding the account.

Remember that a POA is a powerful legal document, and you should only grant these powers to someone you trust implicitly. Consulting with an attorney is advisable to ensure your document is legally sound and meets your specific needs.

A Power of Attorney (POA) is an important legal document, and its significance depends on your individual circumstances and objectives. In summary, a Power of Attorney is an essential legal tool that can provide protection, convenience, and control over your financial and legal matters. Its importance lies in its ability to ensure your wishes are carried out and to provide for decision-making in situations where you are unable to act on your own behalf. However, the importance of a POA depends on your individual needs and circumstances, and it should be used wisely and in consultation with legal professionals when necessary.

What are the Different Types of Power of Attorney?

- Non-Durable Power of Attorney.

- Lasting/Durable Power of Attorney.

- Special or Limited Power of Attorney.

- Springing Power of Attorney.

- Medical Power of Attorney.

We provide this professional POA template that will enable you to finish this Power of Attorney in minutes. Our POA templates are all screened by professionals. Using our legal templates will help you reach the next level of success in your education, work, and business! However, we still recommend you consider consulting a local law firm in case of doubt to support you in this matter.

AVERTISSEMENT

Rien sur ce site ne doit être considéré comme un avis juridique et aucune relation avocat-client n'est établie.

Si vous avez des questions ou des commentaires, n'hésitez pas à les poster ci-dessous.