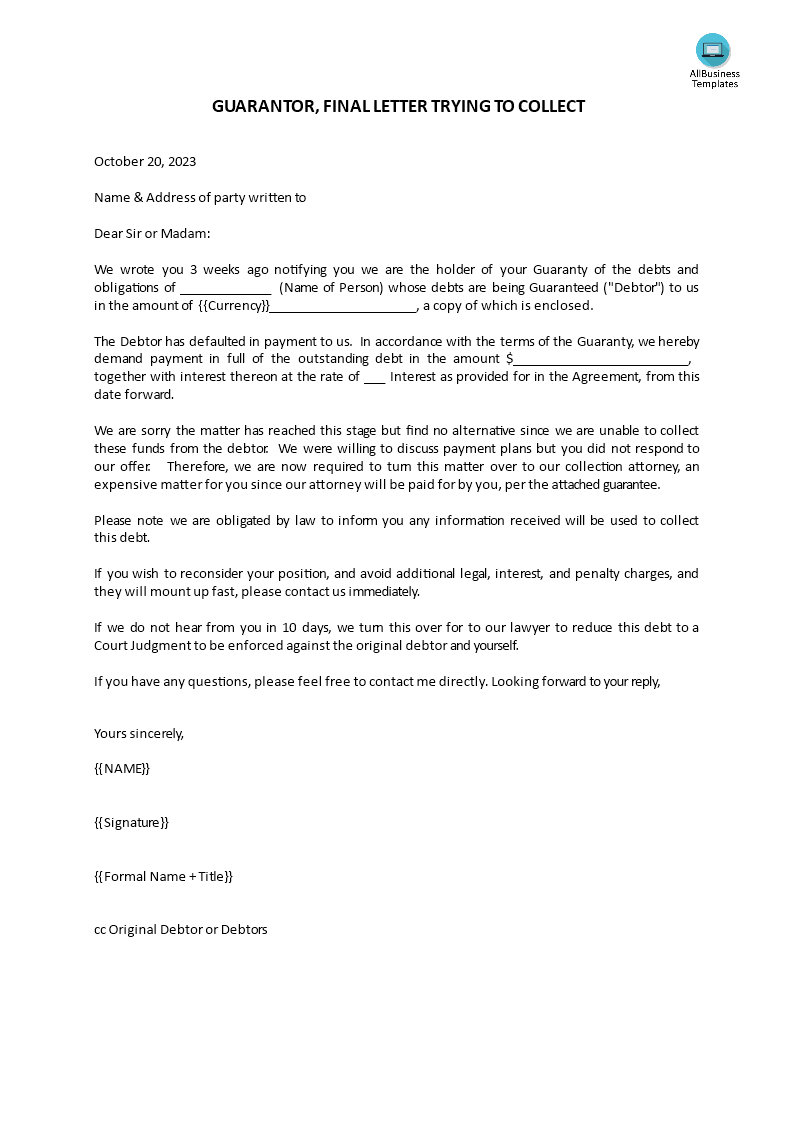

Final Letter to Collect

Enregistrer, Remplir les champs vides, Imprimer, Terminer!

How to write a final letter trying to collect from the debtor? What is the meaning of a collection letter? Download this Final Letter Trying to Collect now and get started!

Prix: USD 2.99

Téléchargez-le maintenant

Formats de fichiers premium disponibles:

.docx- Ce document a été certifié par un professionnel

- 100% personnalisable

Legal Légal debtor débiteur guarantor garant how to not pay a judgement judgment payment agreement request to pay judgment in installments request to pay judgment to court temporary judgement final judgement divorce form divorce stipulation agreement sample final judgement of divorce sample default with agreement

How to write a final letter trying to collect from the debtor? What is the meaning of a collection letter? This letter template will help you thank and recognize the hard work of your employees. It should also include any rewards or bonuses that will be awarded. Finally, it should thank them for their contribution to the company. Download this Final Letter Trying to Collect now!

A "Final Letter to Collect" is a formal written communication sent by a creditor or a collection agency to a debtor as part of the debt collection process. This letter serves as a last attempt to collect an outstanding debt before the creditor or collection agency considers more serious actions, such as legal action or reporting the debt to credit bureaus.

Here are the key points to understand about a final letter to collect:

- Purpose: The primary purpose of a Final Letter to Collect is to request payment of an overdue debt. It notifies the debtor that the debt remains unpaid and provides a final opportunity for the debtor to resolve the matter without further consequences.

- Clarity: The letter typically clearly states that it is the final notice and warns of potential legal actions or credit reporting if the debt is not settled promptly.

- Debt Details: It includes details about the debt, such as the original amount owed, the outstanding balance, and any accrued interest or fees.

- Payment Options: The letter may outline various payment options available to the debtor, including payment in full, settlement offers, or payment plans.

- Contact Information: It provides contact information for the creditor or collection agency, making it easy for the debtor to respond or seek clarification.

- Deadline: The letter often specifies a deadline by which the debtor must respond or make payment to avoid further actions.

- Consequences: It may inform the debtor of the potential consequences of not resolving the debt, which can include legal action, wage garnishment, or damage to their credit score.

- Legal Compliance: Final Letters to Collect are subject to various federal and state laws, such as the Fair Debt Collection Practices Act (FDCPA) in the United States, which govern the conduct of debt collectors and protect the rights of debtors. These laws outline rules and restrictions on communication, harassment, and misrepresentation in debt collection.

It's important for debtors to take Final Letters to Collect seriously and to respond promptly. Ignoring such a letter can have negative consequences, including legal actions and damage to one's credit history. Debtors who receive such letters and believe there is a legitimate dispute regarding the debt should consider seeking legal advice and may have the right to dispute the debt in writing.

Download this professional legal Final Letter Trying to Collect template if you find yourself in this situation and save yourself time, and effort and probably reduce some of the lawyer fees! Using our legal templates will help you to reach the next level of success in your education, work, and business! However, we still recommend you to consider consulting a local law firm in case of doubt to support you in this matter.

AVERTISSEMENT

Rien sur ce site ne doit être considéré comme un avis juridique et aucune relation avocat-client n'est établie.

Si vous avez des questions ou des commentaires, n'hésitez pas à les poster ci-dessous.