Debit Memo

Guardar, completar los espacios en blanco, imprimir, listo!

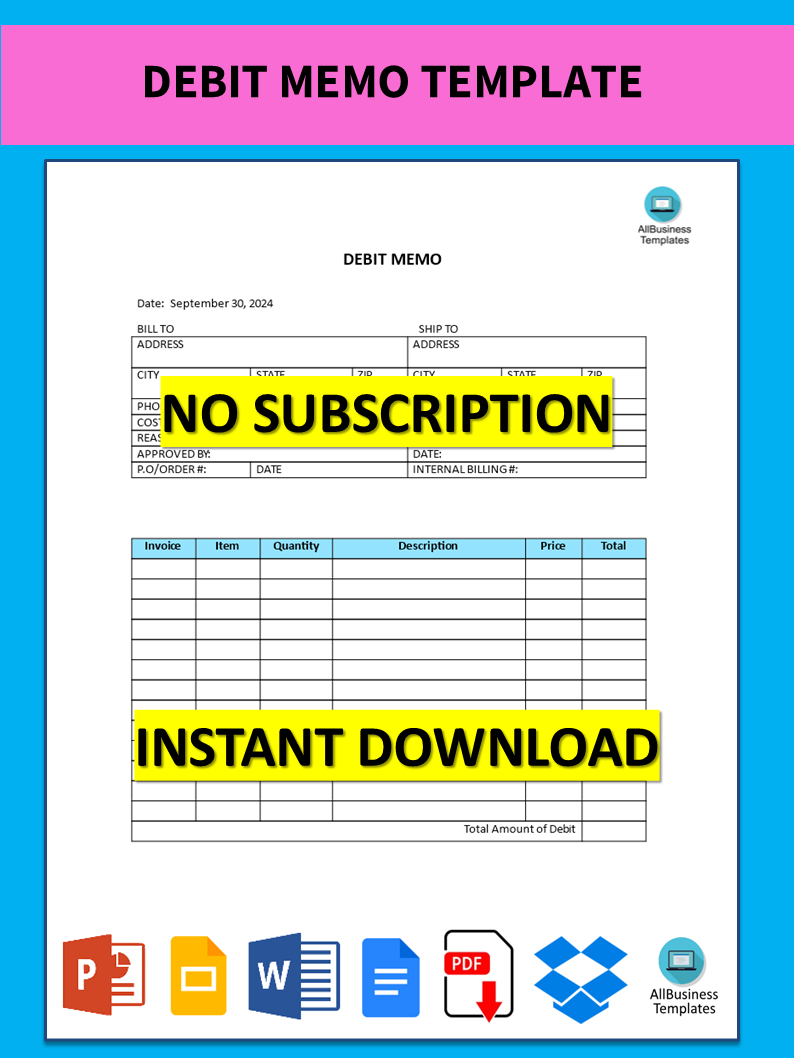

What are a debit memo and a credit memo? Are you looking for a sample template for creating a Debit Memo? Download our sample template now which is designed to help you quickly and easily create a Debit Memo.

Formatos de archivo disponibles:

.docx- Este documento ha sido certificado por un profesionall

- 100% personalizable

Business Negocio Debit Débito debit memo vs credit memo debit memo example debit template debit memo vs invoice debit memo in sap debit memo on bank statement debit memo in accounts payable 0431 debit memo what does debit memo mean accompanying the bank statement debit memo force pay debit memo 0431 debit memo txn after cut off bank debit memo journal entry chase debit memo debit memorandum debit pega memo

What are a debit memo and a credit memo? Are you looking for a sample template for creating a Debit Memo? Our sample template is designed to help you quickly and easily create a Debit Memo. It includes all the necessary fields and sections, as well as instructions on how to fill them out. You can also customize the template to fit your needs.

The terms debit memorandums and credit memorandums relate to two different styles of memos that are commonly employed to make amendments in a financial transaction. Such memos are very important in the accurate recording of financial activities as well as making sure that the account balance is correct.

- Debit Memo

- A debit memo is an internal document issued to a supplier or vendor to decrease the amount the customer owes. In this case, a buyer, or customer, will send this paperwork to the seller or supplier acknowledging that the buyer will not be paying the full amount. Businesses commonly implement in the following examples:

- Returns: whereby a customer sends products back to the supplier and issues a debit memo to lower the obligations from the customer to the supplier.

- Broken merchandise: whereby a debit memo is offered for broken goods in transit or substandard goods supplied to the client.

- Excess payment: when a client pays more than what is billed on an invoice, a deduction memo is prepared to avert such incidents.

- Credit Memo

- A credit memo, otherwise known as a credit note is a document that is prepared to decrease the amount raised in a customer's account. This is provided by the supplier or seller to the customer or buyer to indicate that there is an increase in the amount that is now owed. Companies usually process credit memos in any of the following situations:

- Price decreases: where the seller offers to sell the goods or services at a lower price, a credit memo is given to the buyer.

- Suppliers supplying more goods than ordered or services: where in addition to the ordered goods offered more, a credit memo is given to expand the debt.

- Accounting adjustments: when there is a mistake in the computation of the amount owed after an invoice has been prepared and already sent to the customer, a credit memo is raised to adjust the erroneous amount.

To conclude, debit memos offset amounts payable to a supplier whereas credit memos on the other hand add to the amounts payable by a company. These memos are both crucial for accurate bookkeeping and proper offsetting of accounts.

Whether you manage the finances at your work or home, adequate communication is essential in finance. Having a truthful and accurate financial overview enables and ensures, you can make the right decisions. For those working in Finance, it's important to be accurate and always double-check every detail. Feel free to download our basic or advanced finance templates, they are intuitive and in several kinds of formats, such as PDF, WORD, PPT, XLS (Excel includes formulas and can calculate sums automatically), etc.

When you make a debit note or debit memorandum, understand that it functions as a commercial document. It is generally issued by a buyer to a seller, as a means of formally requesting a credit note. Such debit notes act as the source document for the Purchase returns journal. Therefore, it's considered evidence for the occurrence of a reduction in expenses.

What kind of A/R adjustments are to be made:

- An Adjustment in AR is an amount added or subtracted from the amount due to an Invoice, Debit Memo, Chargeback, Deposit or Guarantee;

- For example, if your customer sends a payment of $85 for a $110invoice you apply the receipt to the invoice, then create an adjustment for the balance due;

- You can create multiple adjustments against each transaction, for positive or negative amounts;

- You can approve adjustments that are within your approval limits and give pending statuses to adjustments that are outside your approval limits.

Using this debit memo form template guarantees that you will save time, cost, and effort and enables you to reach the next level of success in your project, education, work, and business! Download this professional financial accounts receivable adjustment form template now!

Download this sample debit memo in the accounts payable template now for your reference.

DESCARGO DE RESPONSABILIDAD

Nada en este sitio se considerará asesoramiento legal y no se establece una relación abogado-cliente.

Deja una respuesta. Si tiene preguntas o comentarios, puede colocarlos a continuación.