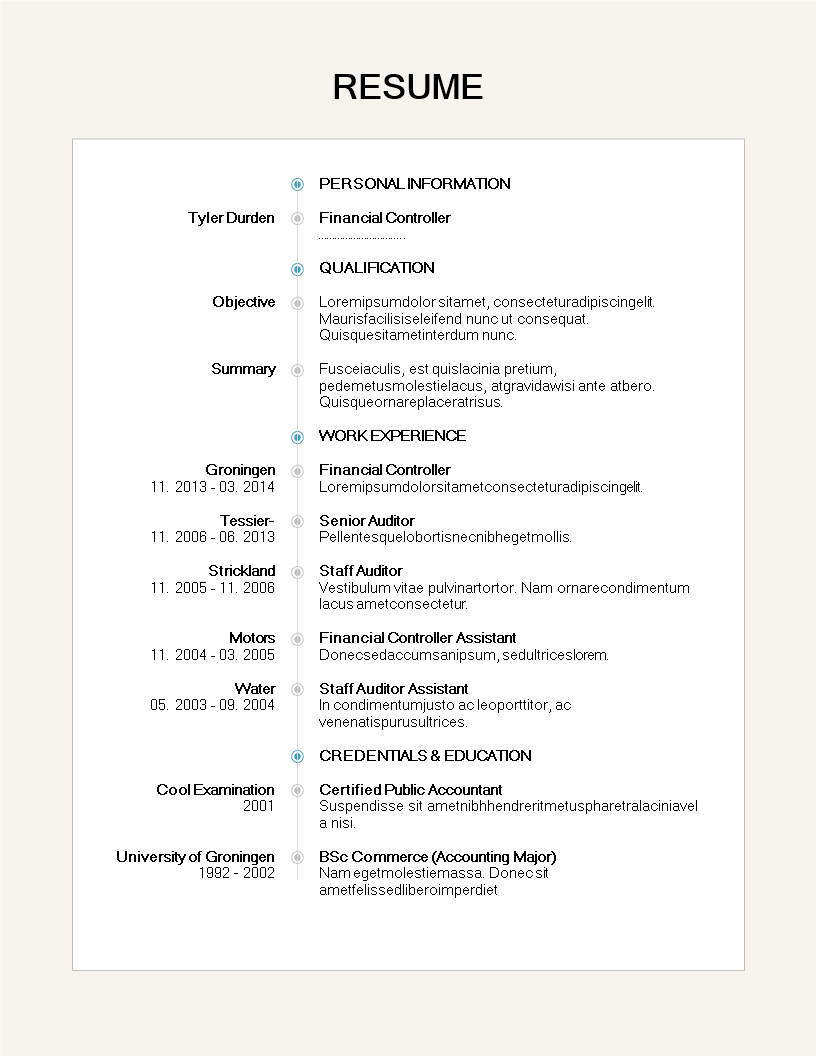

Creative Resume Financial Professional

Guardar, completar los espacios en blanco, imprimir, listo!

Looking for a resume template for a Financial Professional? How should you format your finance resume? Download our template now which is professionally designed and includes all the necessary information you need to impress potential employers.

Formatos de archivo disponibles:

.docx- Este documento ha sido certificado por un profesionall

- 100% personalizable

HR RH Resume Currículum financial financiero creative resume curriculum vitae creativo

Looking for a resume template for a Financial Professional? How should you format your finance resume? Download our template now which is professionally designed and includes all the necessary information you need to impress potential employers. Get this template and start writing the perfect resume for your financial professional job.

A Financial Professional is a broad term that encompasses individuals who work in various capacities within the financial services industry. These professionals are typically responsible for providing financial advice, services, and expertise to individuals, businesses, or organizations to help them manage their financial affairs, achieve their financial goals, and make informed financial decisions. Financial professionals can work in different sectors of the financial industry, and their roles may vary based on their specialization. Here are some common types of financial professionals:

- Financial Advisors/Planners: These professionals provide comprehensive financial planning services to individuals and help them create and execute financial plans. They may advise on investments, retirement planning, tax strategies, insurance, and estate planning.

- Investment Bankers: Investment bankers work with corporations and institutions to facilitate financial transactions, such as mergers and acquisitions, initial public offerings (IPOs), and raising capital through debt or equity offerings.

- Portfolio Managers: Portfolio managers oversee investment portfolios, making investment decisions on behalf of clients or organizations to achieve specific financial objectives, such as capital appreciation or income generation.

- Stockbrokers: Stockbrokers buy and sell securities, such as stocks, bonds, and mutual funds, on behalf of clients, either on the client's instructions or as part of a managed investment strategy.

- Financial Analysts: Financial analysts evaluate financial data and market trends to provide recommendations for investment decisions. They may work for financial institutions, investment firms, or corporations.

- Insurance Agents/Brokers: These professionals help individuals and businesses select appropriate insurance policies to protect against financial risks, such as health, life, property, and casualty insurance.

- Certified Public Accountants (CPAs): CPAs are trained to provide accounting, auditing, and tax services to individuals, businesses, and organizations. They ensure compliance with tax laws and financial reporting requirements.

- Estate Planners: Estate planners specialize in helping individuals and families create estate plans, including wills, trusts, and other strategies to manage and transfer wealth to heirs.

- Loan Officers: Loan officers work in financial institutions and assist individuals and businesses in obtaining loans, including mortgages, personal loans, and business loans.

- Financial Educators/Counselors: These professionals focus on educating individuals and families about personal finance, budgeting, debt management, and financial literacy.

- Risk Managers: Risk managers assess and mitigate financial risks within organizations. They develop strategies to protect against potential losses due to various factors, including market fluctuations, accidents, or disasters.

- Private Equity Professionals: Private equity professionals work in the private equity industry, which involves investing in and managing private companies or taking them public through various strategies.

The specific qualifications, certifications, and responsibilities of financial professionals can vary widely based on their specialization.

Our trustworthy resume templates are crafted and screened by finance and HR professionals. After downloading and filling in the blanks, you can customize every detail and appearance of your visually appealing creative resume in minutes!

Download our financial professional resume template, fill in the blanks, print ...done!

DESCARGO DE RESPONSABILIDAD

Nada en este sitio se considerará asesoramiento legal y no se establece una relación abogado-cliente.

Deja una respuesta. Si tiene preguntas o comentarios, puede colocarlos a continuación.