Business Late Payment Letter

Guardar, completar los espacios en blanco, imprimir, listo!

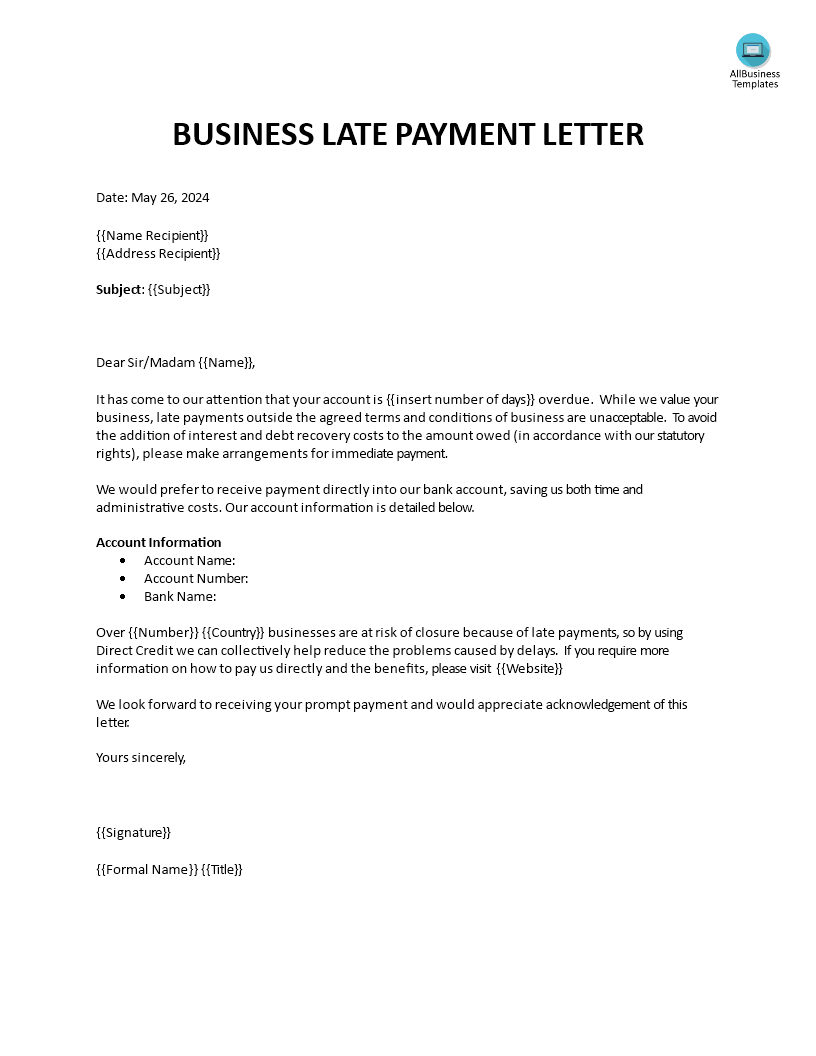

Would you like to download a late payment letter template for your business? Download this sample letter template now which can be used for sending letters to customers requesting payment.

Formatos de archivo disponibles:

.docx- Este documento ha sido certificado por un profesionall

- 100% personalizable

Business Negocio Finance Financiar payment pago late payment letter carta de pago atrasado letters letras Account Cuenta Late Tarde Address Dirección Overdue Atrasado

What is the purpose of a letter requesting payment after the due date for a business? Would you like to download a late payment letter template for your business? This template can be used for sending letters to customers requesting payment. Download this sample payment letter now.

A business late payment letter is a formal written communication sent by a business to a customer or client who has overdue payments. The purpose of the letter is to remind the recipient of their outstanding balance, request immediate payment, and outline any consequences of further delay. It is an important tool for managing accounts receivable and ensuring timely payments.

What is the use of a business late payment letter?

A business late payment letter is used to address overdue payments from clients or customers. Its primary purposes include:

- Reminder:

- The letter serves as a formal reminder to the client or customer that their payment is overdue. People can sometimes forget or overlook invoices, and a reminder helps bring the outstanding payment to their attention.

- Documentation:

- It provides a written record of the business's attempt to collect the debt. This documentation can be important for internal records and may be necessary if the matter escalates to legal action.

- Prompt Payment:

- By formally requesting payment, the letter encourages the recipient to settle their account promptly. Clear communication about due dates and consequences can motivate timely payment.

- Professionalism:

- Sending a late payment letter demonstrates professionalism and seriousness in managing the business’s finances. It shows that the business takes its accounts receivable seriously and has a formal process for handling overdue payments.

- Clarification:

- The letter can clarify the details of the overdue payment, such as the invoice number, amount due, and any late fees that have accrued. This ensures there is no misunderstanding about what is owed.

- Legal Protection:

- If the matter goes to court, the late payment letter can serve as evidence that the business made reasonable efforts to collect the debt. This can be crucial in legal disputes over non-payment.

- Customer Relationship Management:

- A professionally written late payment letter can help maintain a good relationship with the customer. It balances firmness with politeness, ensuring that the request for payment does not come across as overly aggressive.

- Cash Flow Management:

- Timely payments are crucial for maintaining healthy cash flow in a business. A late payment letter helps ensure that outstanding debts are paid, which is essential for meeting the business's financial obligations.

For greater efficiency, click the 'Open with Google Docs' button or you can download our sample business late payment letter template now as a Word document so you can add it to your existing document. With the right structure and the right approach, you will be able to send out a streamlined and effective payment letter.

DESCARGO DE RESPONSABILIDAD

Nada en este sitio se considerará asesoramiento legal y no se establece una relación abogado-cliente.

Deja una respuesta. Si tiene preguntas o comentarios, puede colocarlos a continuación.