Proforma Invoice Template

Guardar, completar los espacios en blanco, imprimir, listo!

How to create a Proforma Invoice? Download this Proforma Invoice template and after downloading you will be able to change and customize every detail and appearance and finish it in minutes.

Formatos de archivo disponibles:

.xlsxOtros idiomas disponibles::

- Este documento ha sido certificado por un profesionall

- 100% personalizable

Business Negocio Finance Financiar Sales Ventas invoice factura accounting contabilidad proforma invoice Factura de proforma elaborate proforma invoice factura proforma elaborada excel proforma invoice factura proforma excel proforma invoice excel factura proforma excel official pi pi oficial official proforma invoice factura oficial proforma pi Pi template invoice Plantilla de factura bookkeeping teneduría de libros book keeping mantenimiento de libros download accounting descarga de contabilidad best bookkeeping mejor contabilidad top bookkeeping contabilidad superior small business pequeños negocios SME pme bookkeeping template bookkeeping templates for self employed double entry bookkeeping template excel accounting spreadsheet accounting in excel format free download

How to create a Proforma Invoice? Are you looking for a professional Proforma Invoice Template in Excel? Download our premium Proforma Invoice template now!

Using an invoice is important for several reasons, particularly in business transactions. An invoice is a formal document that provides a clear record of a sale or a transaction between two parties, typically a seller and a buyer.

We provide an invoice template that will professionalize your way of communication towards your customers. Our invoice templates are all used by professionals in several fields of industry. This specific Excel Proforma invoice template is also taking to account the following details:

Using an invoice is important for several reasons, particularly in business transactions. An invoice is a formal document that provides a clear record of a sale or a transaction between two parties, typically a seller and a buyer.

We provide an invoice template that will professionalize your way of communication towards your customers. Our invoice templates are all used by professionals in several fields of industry. This specific Excel Proforma invoice template is also taking to account the following details:

- Tax

- General Terms, Terms of Sale or Terms of Delivery

- Payment (Letter of Credit, Open Account or other terms)

- Quality or Inspection standards

- Freight costs

- Insurance

- Legal/Consular fees

- Inspection/Certifications

- etc.

Here's why using an invoice is important:

Legal and Financial Record: An invoice serves as a legally binding record of the goods or services provided, the agreed-upon terms, and the amount owed by the buyer. In case of any disputes or discrepancies, an invoice acts as evidence of the transaction.

- Proof of Transaction: An invoice provides proof that a transaction has taken place. It outlines the details of the goods or services exchanged, the date of the transaction, and the agreed-upon price. This helps prevent misunderstandings between the parties involved.

- Payment Tracking: Invoices include information about the payment terms, such as due date, payment methods, and any applicable discounts or late fees. This facilitates efficient tracking of payments and helps both parties manage their cash flow.

- Tax Compliance: Invoices play a crucial role in tax reporting and compliance. Businesses use invoices to calculate and report sales taxes, VAT (Value Added Tax), and other tax-related information to the relevant authorities.

- Professionalism: Providing a well-structured and accurate invoice demonstrates professionalism and transparency in business dealings. It conveys to the client that the seller is organized and committed to providing clear documentation of the transaction.

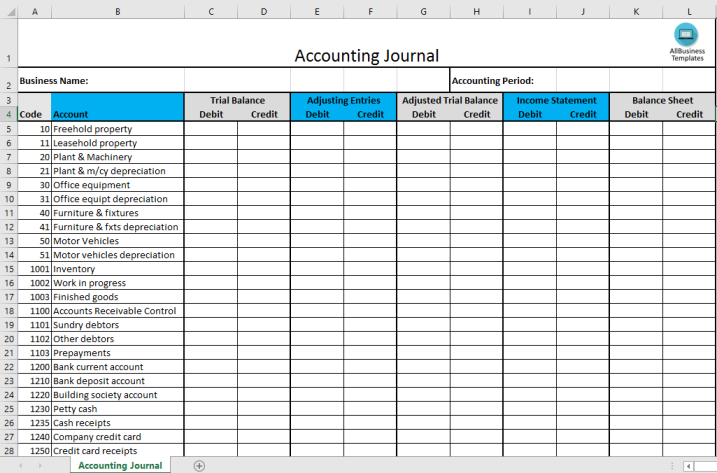

- Accounting and Bookkeeping: Invoices are essential for maintaining accurate financial records. Businesses need to keep track of their income and expenses for accounting and bookkeeping purposes, and invoices provide a key component of this record-keeping process.

- Budgeting and Planning: Invoices help businesses plan their budgets and financial projections. By knowing when payments are expected, businesses can anticipate their cash flow and make informed decisions about their operations.

- Customer Communication: Invoices serve as a formal communication tool between the seller and the buyer. They provide details about the transaction, including any terms and conditions, which helps avoid misunderstandings and ensures that both parties are on the same page.

- Dispute Resolution: In case of disputes, an invoice can help resolve issues quickly. It provides a clear reference point for discussions about the terms of the transaction and the agreed-upon price.

- Audit Trail: Invoices create an audit trail that can be used for internal and external audits. This is particularly important for larger businesses that need to ensure transparency and accuracy in their financial transactions.

In summary, using an invoice is important because it helps establish a clear and formal record of business transactions, facilitates payment tracking, ensures compliance with tax regulations, and contributes to professionalism and effective communication between parties. Whether you're a business owner or a consumer, understanding the importance of invoices is essential for maintaining transparent and accountable financial transactions.

Using our accounting and business invoice templates guarantees you will save time, cost and effort!

Download this Proforma Invoice template and after downloading you will be able to change and customize every detail and appearance and finish it in minutes.

DESCARGO DE RESPONSABILIDAD

Nada en este sitio se considerará asesoramiento legal y no se establece una relación abogado-cliente.

Deja una respuesta. Si tiene preguntas o comentarios, puede colocarlos a continuación.