Credit card payment calculator Excel

Guardar, completar los espacios en blanco, imprimir, listo!

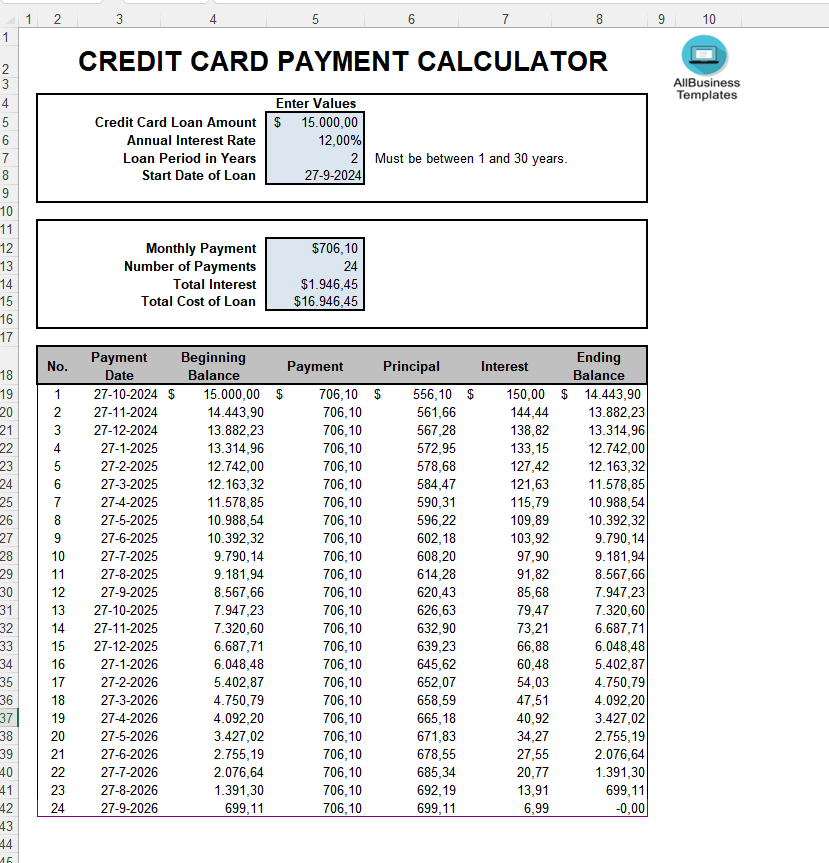

How to make a credit card payment spreadsheet? How to calculate monthly payments? Download this credit card payment calculator Excel and open it directly In Excel or in Google Sheets.

Formatos de archivo disponibles:

.xlsx- Este documento ha sido certificado por un profesionall

- 100% personalizable

Finance Financiar math mates xlsx credit card payoff planner

How to make a credit card payment calculator in Excel?

To create a credit card payment calculator in Excel or credit card payoff planner, follow these steps:

Manual Calculation Method:

- Start by entering the following column headings: Month, Payment, Interest, Balance.

- Input the necessary debt information: Product Price (total debt), Interest Rate (Yearly), and Monthly Payment.

- Use the formula =ROUNDUP(NPER(H5/12, -H6, H4), 0) to calculate the number of payments (the NPER function calculates the number of periods for the loan).

- Enter this sequence formula =SEQUENCE(ROUND(H7, 0)) in the Month column to auto-populate the number of months.

- To calculate the monthly balance, use the formula =H4-C5 and for interest, apply =ROUND((E5+C5)*$H$5/12, 0) in the interest column.

This method allows you to manually build your credit card payment calculator and adjust for different scenarios. You can also update values like the monthly payment, and Excel will automatically update the number of months needed to pay off the debt.

How to calculate credit card payment formula?

This is how calculate monthly credit card loan payments:

The formula is: M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1], where M is the monthly payment, P is the loan amount, i is the interest rate (divided by 12) and n is the number of monthly payments.

Example:

Let's go through the same example, but now with M = 100 (monthly payment):

Given:

M = 100 (monthly payment)

i = 5% annual interest rate, so the monthly interest rate (𝑖 = 5% 12=) 0.004167

n = 24 months (2 years)

We need to calculate P (the loan amount):

Calculate (1 + i)ⁿ: ( 1 + 0.004167 )24 = 1.104941 (1+0.004167) 24 =1.104941 Calculate the numerator:

0.004167 × 1.104941 = 0.004602

Calculate the denominator:

1.104941 − 1 = 0.104941

Calculate the fraction:

0.004602 / 0.104941 = 0.04385

Now, plug the values back into the equation:

100 = 𝑃 × 0.04385

To find P, divide 100 by 0.04385:

𝑃 = 100 / 0.04385 = 2,281.07

So, with a monthly payment of $100, an interest rate of 5%, and a 24-month payment period, the loan amount would be approximately $2,281.07.

Using this Credit card payment calculator Excel template:

Instead of manually creating a spreadsheet, you can use a template by searching for "Credit Card Payoff Calculator" in Excel’s online template gallery. This method provides a pre-built solution where you can input your debt amount, interest rate, and monthly payment, and the template will calculate the required payoff period and interest.

Both methods are effective for creating a credit card payment calculator. If you want more control, opt for the manual method. If you prefer a quicker solution, the Microsoft template is a great option.

So when you are creating your own credit card payoff planner, you can calculate your monthly credit card payment by multiplying the monthly interest rate by the outstanding balance. The monthly rate can be obtained by dividing your APR by 12 for the number of months in a year. The simplest way to do that is using a credit card calculator.

Download this Credit card payment spreadsheet and open it directly in Excel or in Google Sheets.

DESCARGO DE RESPONSABILIDAD

Nada en este sitio se considerará asesoramiento legal y no se establece una relación abogado-cliente.

Deja una respuesta. Si tiene preguntas o comentarios, puede colocarlos a continuación.