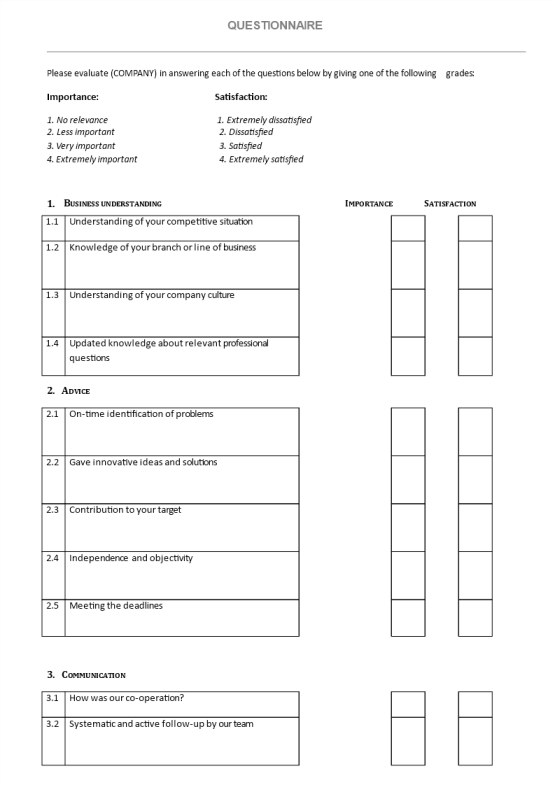

Banking Resolution

Guardar, completar los espacios en blanco, imprimir, listo!

What do you mean by banking resolution? Are you seeking a uniform applicability of banking resolutions? Download our sample template now and start making your resolution to the bank.

Formatos de archivo disponibles:

.docx- Este documento ha sido certificado por un profesionall

- 100% personalizable

Business Negocio

What do you mean by banking resolution? Are you seeking a uniform applicability of banking resolutions? Our bank resolution template is an effective instrument for developing workable and convincing banking resolutions. Download our sample template now and start making your resolution to the bank.

A banking resolution is a formally executed document that outlines the relationship, obligations, and privileges of a corporate body and a bank. It is usually done when a business entity opens a bank account and specifies who is in charge of the account, who carries out transactions, and other activities related to the bank.

Why is a banking resolution considered important?

A banking resolution is essential because it defines the financial hierarchy of a corporate organization in a way that gives confidence to the bank as to who can be permitted to handle transactions.

Components of a banking resolution:

- Title of the Document- A simple and appropriate heading that reveals the intent of the document.

- Board Resolution Confirmation- A declaration that expresses the resolution’s acceptance by all the members of the board of directors or the members of the company.

- Comprehensive List of Authorized Individuals- A list detailing the persons who can perform banking activities on behalf of the company.

- Constraints Placed on These Individuals- An outline of the constraints placed on each individual who has been granted authority.

- Geographical Limit of the Resolution: States how long the resolution will be applicable.

- Company Board and Members’ Signature: Signatures provided by the board of directors and or company members present that they have read, understood and agreed to the contents of the document.

You can just click ‘Open with Google Docs directly’ or download our sample banking solution template in a Word form now to save time! We are looking forward to your accomplishment in presenting a concise and functional bank resolution.

DESCARGO DE RESPONSABILIDAD

Nada en este sitio se considerará asesoramiento legal y no se establece una relación abogado-cliente.

Deja una respuesta. Si tiene preguntas o comentarios, puede colocarlos a continuación.