Bank Guarantee Letter

Guardar, completar los espacios en blanco, imprimir, listo!

How to write a Bank Guarantee Letter? Have you been looking for a sample bank guarantee letter? Bank guarantee letters are used in a variety of business situations, including providing security for a loan or settling a debt.

Formatos de archivo disponibles:

.docxOtros idiomas disponibles::

- Este documento ha sido certificado por un profesionall

- 100% personalizable

Business Negocio Finance Financiar Letter carta request solicitud bank banco guarantee garantía letters letras Date Fecha Guarantee Letter Carta de garantía Bank Guarantee Letter Sample Ejemplo de carta de garantía bancaria Bank Guarantee Letter Carta de garantía bancaria Bank Guarantee Letter Example Ejemplo de carta de garantía bancaria bank guarantee bank guarantee sample bank guarantee template guarantee letter bank bank guarantee letter format word types of bank guarantee

How to write a Bank Guarantee Letter? Have you been looking for a sample bank guarantee letter? Bank guarantee letters are used in a variety of business situations, including providing security for a loan or settling a debt. A bank guarantee letter template should include the details of the loan, the amount, and the guarantee period. It should also clearly state the bank's obligations and rights in the event of a default.

When you request a bank guarantee, you refer to a letter that provides assurance that a bank will cover any losses incurred by a customer in the event that they default on a contract. This type of guarantee can be useful for businesses that are entering into new contracts or agreements, as it provides some financial protection in the event that things go wrong.

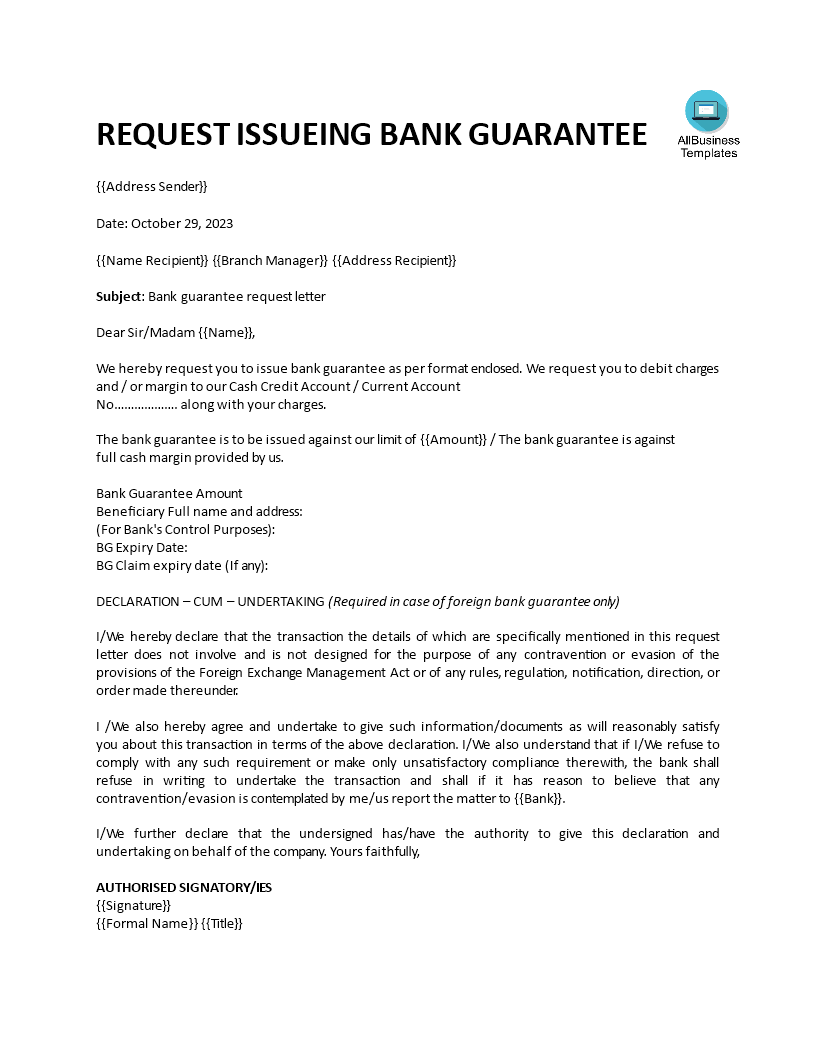

Bank Guarantee Letter

We hereby request you to issue bank guarantee as per format enclosed. We request you to debit charges and / or margin to our Cash Credit Account / Current Account

No………………. along with your charges.

The bank guarantee is to be issued against our limit of {{Amount}} / The bank guarantee is against

full cash margin provided by us.

Bank Guarantee Amount

Beneficiary Full name and address:

(For Bank's Control Purposes):

BG Expiry Date:

BG Claim expiry date (If any):

DECLARATION – CUM – UNDERTAKING (Required in case of foreign bank guarantee only)

I/We hereby declare that the transaction the details of which are specifically mentioned in this request letter does not involve and is not designed for the purpose of any contravention or evasion of the provisions of the Foreign Exchange Management Act or of any rules, regulation, notification, direction, or order made thereunder.

I /We also hereby agree and undertake to give such information/documents as will reasonably satisfy you about this transaction in terms of the above declaration. I/We also understand that if I/We refuse to comply with any such requirement or make only unsatisfactory compliance therewith, the bank shall refuse in writing to undertake the transaction and shall if it has reason to believe that any contravention/evasion is contemplated by me/us report the matter to {{Bank}}.

I/We further declare that the undersigned has/have the authority to give this declaration and undertaking on behalf of the company.

When you draft a request letter to your bank for such a bank guarantee, have a look at this standardized Bank Guarantee Letter template with text and formatting as a starting point to help professionalize the way you are working. Our private, business and legal document templates are regularly screened by professionals. When you are using this Bank Guarantee Letter template it guarantees you will save time, cost and effort! It comes in Microsoft Office format, is ready to be tailored to your personal needs.

Download this Bank Guarantee Letter template now for your own benefit.

DESCARGO DE RESPONSABILIDAD

Nada en este sitio se considerará asesoramiento legal y no se establece una relación abogado-cliente.

Deja una respuesta. Si tiene preguntas o comentarios, puede colocarlos a continuación.