Credit Application Rejection Letter

Guardar, completar los espacios en blanco, imprimir, listo!

How to create a Credit Application Rejection Letter? Download now and improve your credit application process!

Formatos de archivo disponibles:

.docx- Este documento ha sido certificado por un profesionall

- 100% personalizable

Business Negocio HR RH credit crédito business credit application form formulario de solicitud de crédito comercial bank banco Application Solicitud letters letras Rejection Rechazo Best Rejection Letter Mejor carta de rechazo Best Rejection Letters Mejores cartas de rechazo business credit application business credit application form template business credit application pdf business credit application form pdf blank credit application form for business business account credit application form business credit application form business credit application personal guarantee printable business credit application form free business credit application form credit application forms for business template business credit application forms form for applying a business credit application application form business credit

How to create a Business Credit Application Form? What is a Credit Application in Business?

Creating a Business Credit Application Form is vital for evaluating the creditworthiness of potential clients. This form collects crucial financial and personal information, helping to make informed decisions about extending credit. Download our professional Business Credit Application Form template now to simplify this process and ensure consistency and thoroughness.

Importance of Accurate Financial Communication

Accurate financial communication is essential, whether managing finances at work or home. Maintaining clear, easy-to-understand accounting records is critical for the daily operations of your business and for seeking funds from investors or lenders to grow your business. Using our Business Credit Application Form template will help you consistently understand your business's financial status.

Key Elements of a Business Credit Application Form

A Business Credit Application Form is used by lenders, financial institutions, suppliers, or vendors to collect information from individuals or other businesses applying for credit. The form evaluates the applicant's creditworthiness and determines suitable credit terms, such as credit limits and interest rates. Additionally, it establishes a formal agreement between the lender and the borrower regarding the terms of the credit granted.

Streamlined Credit Application Process

By utilizing a standardized Business Credit Application Form, businesses can streamline the credit application process. This form typically includes:

- Business Information: Business name, address, phone number, and industry type.

- Contact Information: Name, address, phone number, and email.

- Operational Details: Number of employees, trade payment references, and bank references.

- Principal Details: Identifying details of the business's owners or principals.

- Financial Information: Personal or business bankruptcy history, financial ratios, profitability, debt levels, and cash flows.

Using our Business Credit Application Form template will save you time, reduce costs and efforts, and enhance your chances of success. These templates assist in managing legal matters and provide up-to-date insights into your business's financial standing.

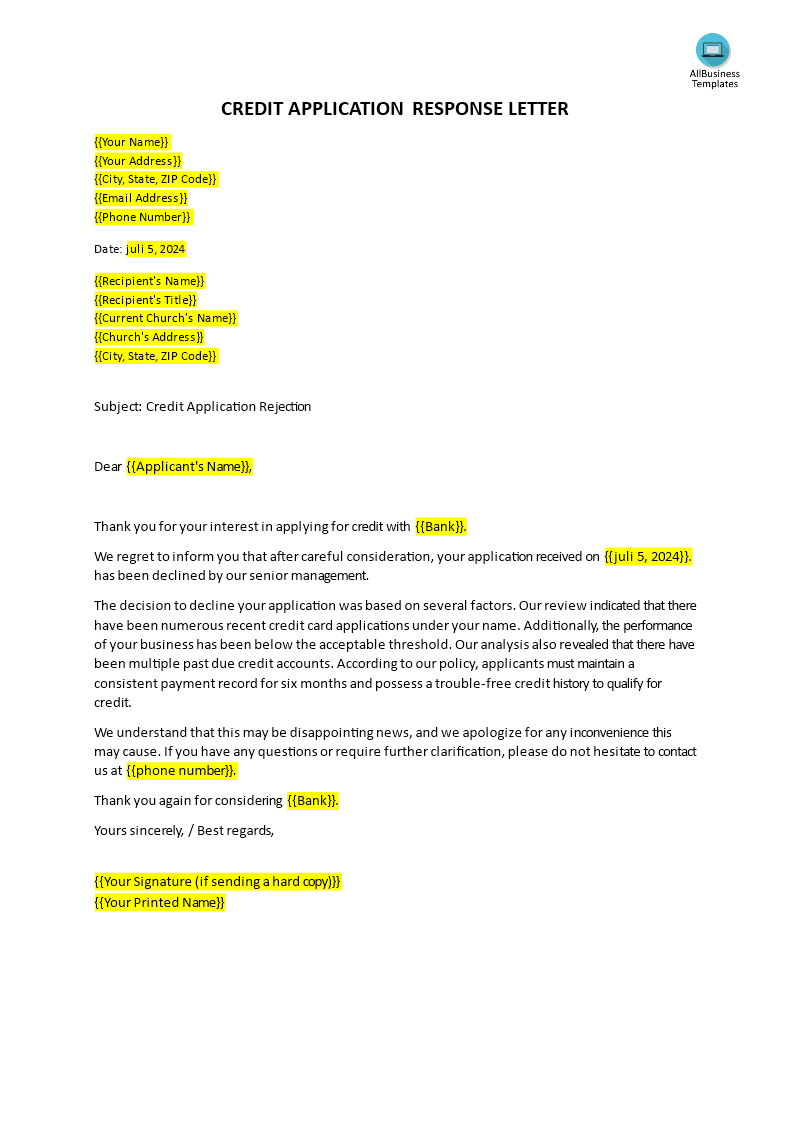

Subject: Credit Application Rejection

Dear {{Applicant's Name}},

Thank you for your interest in applying for credit with {{Bank}}.

We regret to inform you that after careful consideration, your application received on {{July 5, 2024}}, has been declined by our senior management.

The decision to decline your application was based on several factors. Our review indicated that there have been numerous recent credit card applications under your name. Additionally, the performance of your business has been below the acceptable threshold. Our analysis also revealed that there have been multiple past due credit accounts. According to our policy, applicants must maintain a consistent payment record for six months and possess a trouble-free credit history to qualify for credit.

We understand that this may be disappointing news, and we apologize for any inconvenience this may cause. If you have any questions or require further clarification, please do not hesitate to contact us at {{phone number}}.

Thank you again for considering {{Bank}}.

Best regards,

{{Your Signature (if sending a hard copy)}}

{{Your Printed Name}}

Utilizing Accounting Reports

Accounting reports are crucial for monitoring business activities and making strategic decisions. Common reports include:

- Balance Sheets: Show the financial health of a business at a specific moment.

- Profit and Loss Statements: Display the results of business operations over time.

- Cash Flow Statements: Highlight the flow of cash in and out of the business.

- Owner Equity Statements: Indicate the owner's equity in the business.

Benefits of Using Our Templates

Our templates are available in various formats, including PDF, Word, PPT, and Excel (with automated calculations). They are crafted by industry professionals to meet the needs of small business owners, individuals, and finance staff. These templates are designed to be intuitive, easy to customize, and ready to use.

Many companies are transitioning to digital workflows, including online credit applications. This shift offers several benefits:

- Efficiency: Streamlines the application process and reduces errors.

- Accessibility: Makes it easier for customers to apply and for businesses to manage applications.

- Cost-Effective: Reduces the need for paper-based processes.

- Review the Credit Agreement: Understand the terms and conditions before proceeding.

- Input Personal and Business Details: Provide accurate and complete information.

- Provide Employment and Financial Information: Demonstrate financial stability and capacity to repay.

- Submit the Application: Review for errors, sign, and submit.

- Wait for Feedback: The lender will review and respond with an approval, request for more information, or a rejection.

Download this Credit Application Form editable in Microsoft Word (.docx) or Google Docs template now and streamline your credit application process! For more templates, browse our website and gain instant access to thousands of ready-made, easy-to-find, and intuitive business documents, forms, and letters. Explore our range of free business credit application templates to find the one that suits your needs. Our templates are designed to be easy to use, customizable, and efficient.

DESCARGO DE RESPONSABILIDAD

Nada en este sitio se considerará asesoramiento legal y no se establece una relación abogado-cliente.

Deja una respuesta. Si tiene preguntas o comentarios, puede colocarlos a continuación.