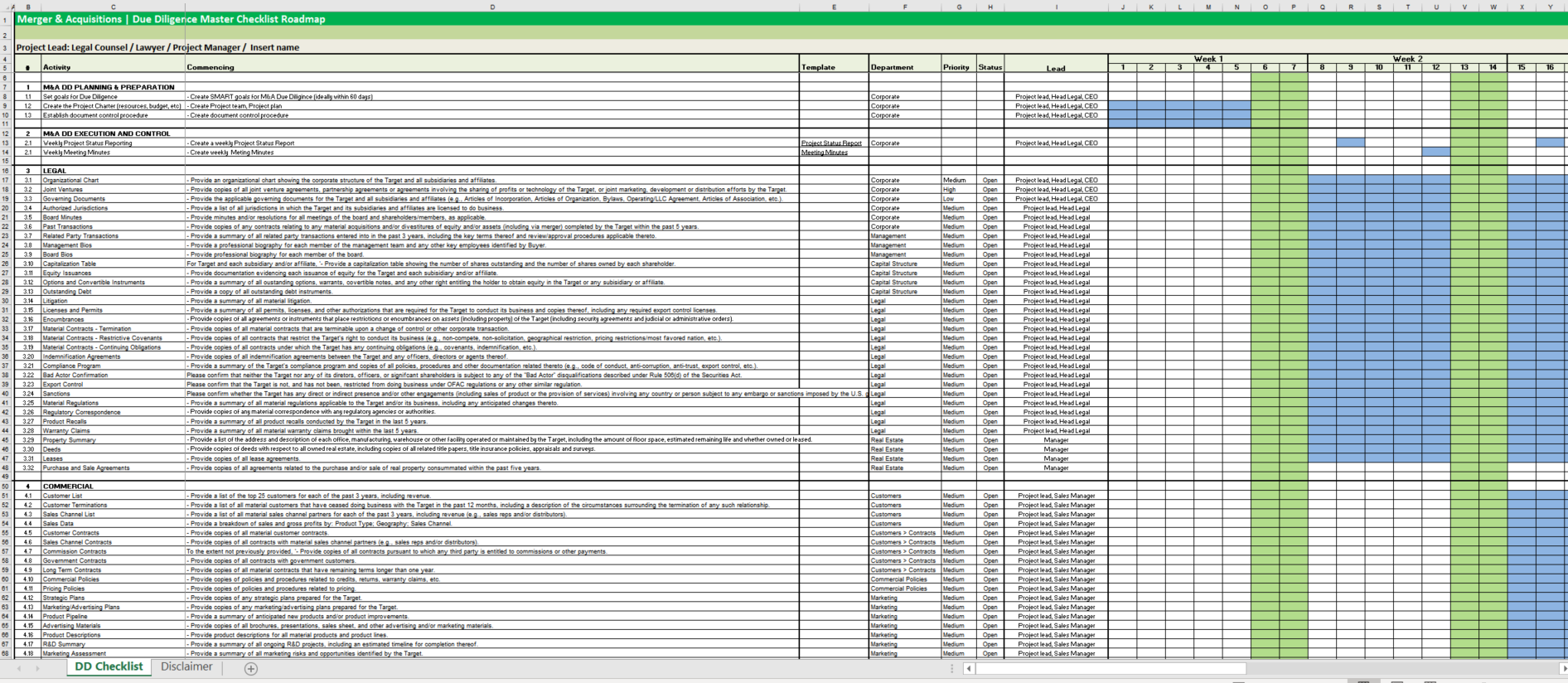

Merger & Acquisition Due Diligence Master Planning

Guardar, completar los espacios en blanco, imprimir, listo!

How to make a Merger & Acquisition Due Diligence Planning in Excel? An easy way to create one is by downloading this example Merger Acquisition DD Excel spreads

Formatos de archivo disponibles:

.xlsxOtros idiomas disponibles::

- Este documento ha sido certificado por un profesionall

- 100% personalizable

Legal Jurídico due diligence master planning due diligence master plan real estate due diligence checklist difference between due diligence and diligence property development due diligence checklist land acquisition due diligence checklist construction project due diligence checklist site development feasibility study land development feasibility study checklist land due diligence due diligence meaning due diligence real estate checklist due diligence period commercial real estate m&a due diligence checklist due diligence m&a checklist financial due diligence legal due diligence m&a bring down due diligence m&a acquisition due diligence checklist excel financial due diligence checklist m&a due diligence report sample due diligence checklist pdf post acquisition checklist m&a legal due diligence m&a due diligence services benefits of due diligence due diligence in mergers and acquisitions pdf advantages of due diligence due diligence process 5 stage model of merger process transaction diligence due diligence report financial due diligence report financial due diligence checklist excel acquisition due diligence report sample quality of earnings excel template scope of work for due diligence how long does due diligence take due diligence report template corporate governance due diligence checklist sales and marketing due diligence checklist pitchbook m&a 101 corporate governance due diligence due diligence phase of m&a involves challenges of due diligence due diligence in mergers and acquisitions importance of legal due diligence scope of due diligence financial due diligence balance sheet finance dd

How to make a Merger & Acquisition Due Diligence Planning in Excel? An easy way to create one is by downloading this example Merger Acquisition DD Excel spreadsheet template now!

This Excel spreadsheet is a grid-based planning file and designed to organize an M&A due diligence project with all parties involved. This overview is created by M&A professionals from all over the world and gives a generic roadmap that is according to business needs. The planning period is 60 days, which is a common timeframe for an M&A due diligence.

This Due Diligence Checklist is intended to provide a thorough wide-ranging list of initial due diligence requests that can be used for any target in any type of transaction. The timeframe is 60 days. However, due to all the information needs, this can take longer. Especially for that reason, it's important to make a good project planning, so you will be able to ask all necessary details in time and can finish a successful Due Diligence within the estimated lead time. The following activities have to be considered:

M&A DD PLANNING & PREPARATION

- Set goals for Due Diligence

- Create the Project Charter (resources, budget, etc)

- Establish document control procedure

- M&A DD EXECUTION AND CONTROL

- Weekly Project Status Reporting

- Weekly Meeting Minutes

- LEGAL M&A ACTIVITIES

- Organizational Chart

- Joint Ventures

- Governing Documents

- Authorized Jurisdictions

- Board Minutes

- Past Transactions

- Related Party Transactions

- Management Bios

- Board Bios

- Capitalization Table

- Equity Issuances

- Options and Convertible Instruments

- Outstanding Debt

- Litigation

- Licenses and Permits

- Encumbrances

- Material Contracts - Termination

- Material Contracts - Restrictive Covenants

- Material Contracts - Continuing Obligations

- Indemnification Agreements

- Compliance Program

- Bad Actor Confirmation

- Export Control

- Sanctions

- Material Regulations

- Regulatory Correspondence

- Product Recalls

- Warranty Claims

- Property Summary

- Deeds

- Leases

- Purchase and Sale Agreements

INTELLECTUAL PROPERTY

- Patents and Trademarks

- Domain Names

- Licensing Agreements - Incoming

- Licensing Agreements - Outgoing

- Jointly-Owned IP

- Infringement

- IP Restrictions

- IP Litigation

- IP Development

IT INFRASTRUCTURE M&A ACTIVITIES

- IT Projects

- Key IT Resources

- Software

- Material Software

- Hardware

- Material Hardware

- Technical Architecture

- System Networks

- Hardware Configurations

- IT Support Services

- IT Maintenance

- IT Contracts

- IT Services

- Growth

- IT Acquisition

- Help Desk

- IT Strategy

- Automation

- Web-based Applications

- Security Protocols

- Disaster Recovery

- Data Privacy

- Sensitive Information

- Stress Test Results

- Other IT Security Testing

- Summary of Security Issues

- Data Storage

- Data Encryption

- E-mail Vulnerabilities

- Anti-Virus Protection

- Attacks/Intrusions

- Mobile Device Security

- COMMERCIAL M&A ACTIVITIES

- Customer List

- Customer Terminations

- Sales Channel List

- Sales Data

- Customer Contracts

- Sales Channel Contracts

- Commission Contracts

- Government Contracts

- Long Term Contracts

- Commercial Policies

- Pricing Policies

- Strategic Plans

- Marketing/Advertising Plans

- Product Pipeline

- Advertising Materials

- Product Descriptions

- R&D Summary

- Marketing Assessment

- Supplier List

- Supplier Contracts

- Subcontractor Contracts

- Supplier Onboarding Process

FINANCIAL M&A ACTIVITIES

- Financial Statements - Audited

- Financial Statements - Unaudited

- Off-Balance Sheet Transactions

- Contingent Liabilities

- Prepaid Expenses

- Audit Letters

- Accounting Policies

- Changes to Accounting Policies

- Budgets

- Projections

- Cash Management

- Investment Policies

- Hedging

- Accounts Receivable - Aging

- Inventory

- Bad Debts

- Reserves

- Credit Support Obligations

- Bank Statements

- Capital Expenditures - Past

- Capital Expenditures - Planned

- Fixed Assets

- Equipment

- Insurance Policies

- Insurance Claims Summary

HUMAN RESOURCES M&A ACTIVITIES

- Employment Agreements

- Consulting Agreements

- Compensation Arrangements

- Collective Bargaining Agreements

- Confidentiality and IP Agreements

- Severance Agreements

- Recruiting Arrangements

- Benefits Summary

- Benefit Plans

- Compensation Policy

- Bonus Plans

- Stock Option Plans

- Stock Option Awards

- Pension Plans

- Employee Litigation

- Judgments and Awards

- Disciplinary Proceedings

- Investigations

- Headcount

- Suspended Employees

- Dismissed Employees

- Absentee Reports

- Disabled Employees

- Employee Policies

- Hiring Policies

- Changes to Employee Policies

- Employee Loans

ENVIRONMENTAL & SAFETY M&A ACTIVITIES

- Environmental Summary

- Environmental Litigation

- Environmental Remediation

- Enforcement Actions

- Environmental Reserves

- Hazardous Substances

- Regulatory Correspondence

- Material Losses

- Audit Results - Environmental

- Environmental Reports

- Off-site Liabilities

- Environmental Permits

- Storage Tanks

- Waste Management

- Employee Safety

- Employee Litigation

- Audit Results - Safety

- Accidents

- Workers' Compensation Claims

- Material Safety Data Sheets

- Emergency Response Procedures

TAX M&A ACTIVITIES

- Audit Results

- Property Tax Summary

- Tax Returns

- Correspondence with Taxing Authorities

- Tax Sharing Arrangements

- Deferred Taxes

- Tax Policies

- R&D Credits

- Tax Assets

- Sale and Leaseback Transactions

- Overseas Tax

- Base Cost Adjustments

- Tax Planning

- Employment Taxes

M&A PROJECT CLOSURE

- Address any remaining areas with questions

- Perform post-project review

Initial requests solicit general information to provide a broad overview of the target and it's business and operations and planning is customizable to meet the specific circumstances of your M&A deal. This M&A spreadsheet helps to turn effort into results, for yourself or your organization, by making everything a little easier to increase your productivity! Especially, if time or quality is of the essence, this ready-made worksheet certainly helps you out! Just download this file directly to your computer, open it, modify it, save it as an XLSX or PDF or print it directly.

You will see that finishing such an Excel spreadsheet has never been easier and a great way to increase your performance.

Download this Merger & Acquisition Due Diligence Master Planning Excel sheet now!

DESCARGO DE RESPONSABILIDAD

Nada en este sitio se considerará asesoramiento legal y no se establece una relación abogado-cliente.

Deja una respuesta. Si tiene preguntas o comentarios, puede colocarlos a continuación.