Formulario de solicitud de crédito comercial imprimible plantillas, contratos y formularios.

How to create a professional Business Credit Application Form?

A Business Credit Application Form is a pre-designed document used by businesses to request credit from suppliers, financial institutions, or other lenders. This form collects detailed information about the applicant's business, financial status, and credit history, allowing the lender to evaluate the creditworthiness of the business. The form is essential for establishing trade credit lines, securing loans, and maintaining healthy financial relationships with suppliers.

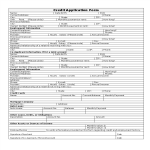

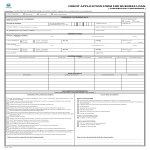

How to Read a Business Credit Application Form

- Title: The title at the top of the form typically states "Business Credit Application" or a similar designation, clearly indicating its purpose.

- Business Information: This section collects basic information about the business, including the legal name, address, phone number, email, and type of business structure (e.g., LLC, corporation, sole proprietorship).

- Owner/Principal Information: This section requires details about the owners or principals of the business, such as their names, Social Security numbers, addresses, and contact information.

- Financial Information: This part of the form requests financial data, including annual revenue, net income, total assets, and liabilities. It may also ask for recent financial statements or tax returns.

- Credit References: This section asks for references from other businesses or suppliers with whom the applicant has established credit. This helps the lender assess the business's payment history.

- Banking Information: Details about the business's bank accounts, including bank name, account number, and contact information for the bank representative.

- Terms and Conditions: This part outlines the terms and conditions of the credit agreement, including payment terms, interest rates, and penalties for late payments.

- Signature: The form typically requires the signature of an authorized representative of the business, certifying the accuracy of the information provided and agreeing to the terms and conditions.

How to Use Business Credit Application Forms?

- Gather Necessary Information: Collect all required details about your business, financial status, and credit history before filling out the form.

- Complete the Form: Accurately fill out each section of the form, providing truthful and detailed information to ensure a smooth credit evaluation process.

- Attach Supporting Documents: Include any requested documents, such as financial statements, tax returns, and credit references, to support your application.

- Review and Sign: Carefully review the completed form and the terms and conditions. Sign the form as an authorized representative of the business.

- Submit the Form: Submit the completed form and supporting documents to the lender or supplier. Follow their submission guidelines, which may include mailing, faxing, or uploading the documents online.

- Follow Up: After submission, follow up with the lender or supplier to confirm receipt and inquire about the status of your application.

By using such files helps to effectively communicate creditworthiness to the supplier, increasing the likelihood of obtaining the desired credit line.

This printable Business Credit Application Form is a crucial tool for businesses looking to establish credit relationships with suppliers and lenders. By accurately completing and submitting this form, businesses can demonstrate their creditworthiness, secure necessary credit, and maintain healthy financial relationships. Whether for securing trade credit or obtaining loans, this form plays a vital role in business finance management.