Company Credit Reference Letter

Speichern, ausfüllen, drucken, fertig!

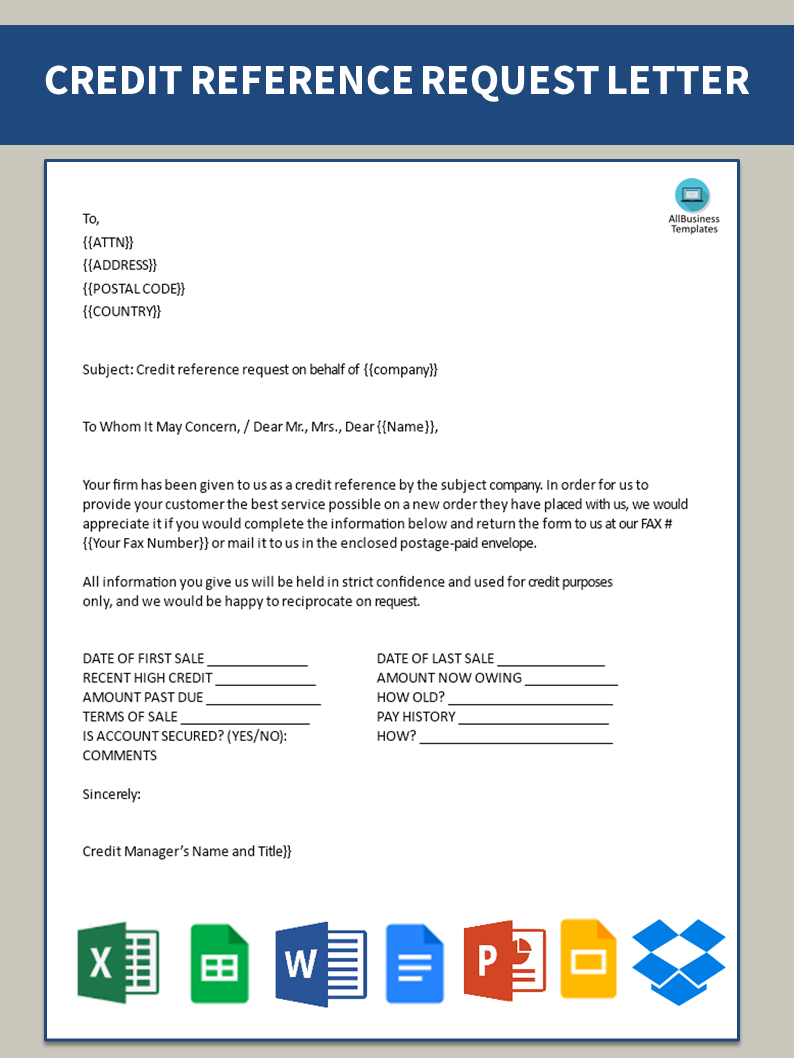

What is the purpose of a letter of reference for a company credit? Download and use our sample template to request a company credit reference letter from a potential lender or business partner.

Verfügbare Gratis-Dateiformate:

.docx- Dieses Dokument wurde von einem Professional zertifiziert

- 100% anpassbar

Business Unternehmen Finance Finanzen company Unternehmen accounting Buchhaltung credit Kredit sale Verkauf request anfordern recommendation letter Empfehlungsbrief credit reference Kredit Referenz reference letter empfehlungsschreiben letters briefe Reference Referenz Recommendation Empfehlung trade reference letter Handelsreferenzbrief overdue payment reminder letter überfälliges Zahlungserinnerungsschreiben Printable Credit Reference Letters Druckbare Gutschriftreferenzbriefe credit overdue credit overdue letter template credit request first overdue letter request first overdue letter credit request first overdue notification payment first overdue letter payment first overdue notification overdue letter credit hold letter to a customer credit overdue letter trading reference trade reference request form trade credit reference request form trade reference request form template free what is a trade reference request request for trade credit reference business credit reference request form request trade references trade reference request template

How to write a Company Credit Reference Letter to business relations? What is the purpose of a letter of reference for a company credit? You can use this template to request a company credit reference letter from a potential lender or business partner. The letter should include the company's contact information, the length of time they have been in business, and any outstanding debts or obligations. Download this template now and get started!

A company credit reference letter is a document that provides information about the creditworthiness and financial stability of a business. It is often requested by a company's suppliers, vendors, or financial institutions when the business is applying for credit or establishing new credit terms. This letter serves as a reference and helps the requesting party assess the credit risk associated with the business.

Key components of a company credit reference letter may include:

- Introduction:

- The letter typically starts with a formal introduction, including the name and address of the company providing the reference.

- Details of the Referenced Company:

- Include information about the company for which the credit reference is being provided. This may include the company name, address, industry, and any other relevant details.

- Length of Relationship:

- Indicate how long the reference provider has been in a business relationship with the company. A longer positive history often reflects favorably on the creditworthiness of the company.

- Credit Terms and Payment History:

- Describe the credit terms extended to the company, including any credit limits, payment terms, and the history of payments. Highlight the company's track record of paying bills on time.

- Financial Stability:

- Provide an assessment of the financial stability of the company. This may include information about the company's profitability, liquidity, and overall financial health.

- Business Practices:

- Comment on the business practices of the company. This could include reliability, consistency, and any other factors that might impact the credit relationship.

- Any Issues or Concerns:

- If there are any concerns or issues related to the company's creditworthiness, they should be mentioned in the letter. It's important to provide an honest assessment.

- Contact Information:

- Include the contact information of the person or department that can be reached for further clarification or additional information.

- Authorization:

- Sometimes, the reference letter includes a statement confirming that the information provided is accurate and that the reference provider has the authority to disclose it.

It's important for the Company Credit Reference Letter to be accurate, honest, and comprehensive. Businesses often rely on these letters to make informed decisions about extending credit, so providing a clear and thorough assessment is crucial. Additionally, the letter may be subject to legal and ethical considerations, so it's important to ensure that the information disclosed complies with applicable laws and regulations.

Feel free to download this intuitive Company Credit Reference Letter template that is available in several kinds of formats or try any other of our basic or advanced templates, forms or documents. Do not reinvent the wheel and start making your letter and form from scratch. Make sure you find useful resources, study them first, before you start your own letter. This ready-made Request For Credit Reference Letter example can help you to focus on those issues that are the most important. If you need more Request For Credit Reference Letters in DOCX format that you can easily customize, check out these templates:

This Company Credit Reference Letter and Trade reference form is easy to edit, fully customizable, and downloadable using various devices. After sending this Trade Reference Form, he/she will always be thankful to you for helping him/her. Download this Company Credit Reference Letter template now for your own benefit!

HAFTUNGSAUSSCHLUSS

Nichts auf dieser Website gilt als Rechtsberatung und kein Mandatsverhältnis wird hergestellt.

Wenn Sie Fragen oder Anmerkungen haben, können Sie sie gerne unten veröffentlichen.