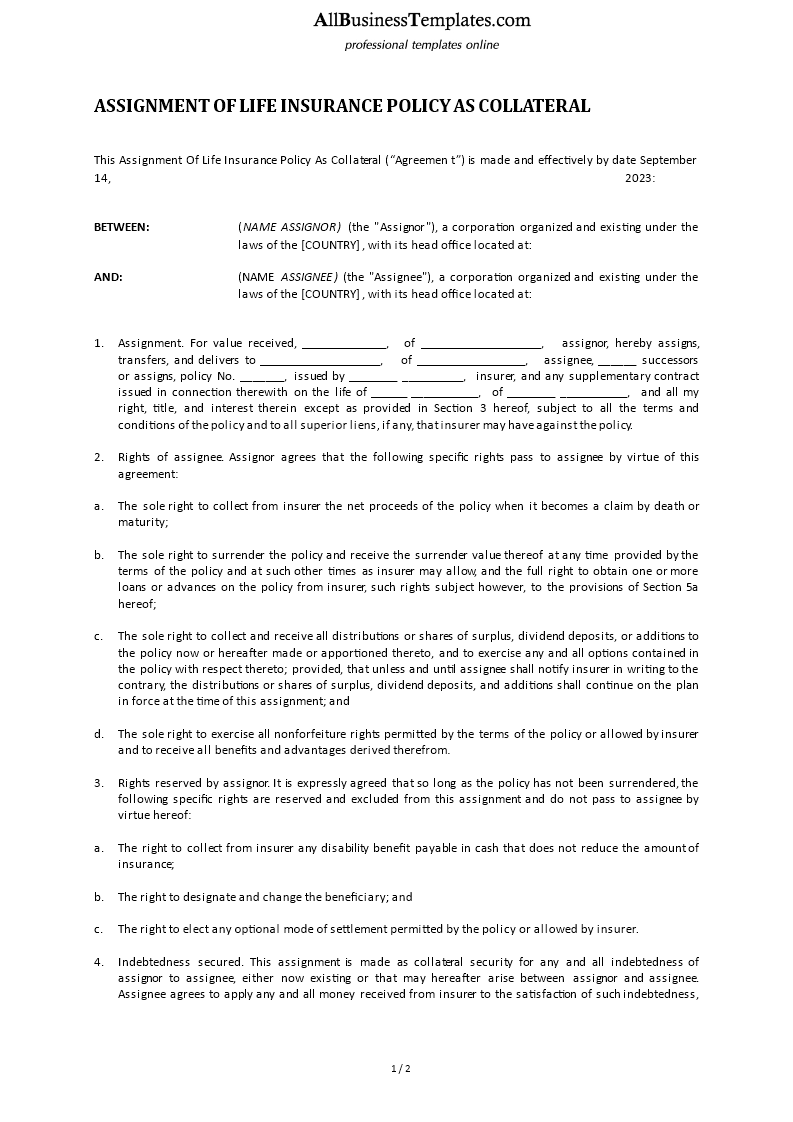

Life Insurance Policy As Collateral Assignment

Speichern, ausfüllen, drucken, fertig!

What is meant by a collateral assignment of a life insurance policy? Download our template which includes all the necessary elements for a properly executed collateral assignment of a life insurance policy.

Verfügbare Gratis-Dateiformate:

.doc- Dieses Dokument wurde von einem Professional zertifiziert

- 100% anpassbar

Finance Finanzen Life Privat life insurance policy Lebensversicherungspolice life insurance Lebensversicherung

What is meant by a collateral assignment of a life insurance policy? How important is a collateral assignment of a life insurance policy?

A "Life Insurance Policy as Collateral Assignment" refers to a legal arrangement in which the owner of a life insurance policy assigns a portion of the policy's rights and benefits to another party (the assignee) as collateral for a loan or another financial obligation. This collateral assignment is a contractual agreement that allows the assignee to access the policy's cash value or death benefit under certain conditions.

Here's how it typically works:

- Policy Owner: This is the individual who owns the life insurance policy and is the insured person. The policy owner may decide to use the policy as collateral for a loan or other financial arrangement.

- Assignee: The assignee is the party to whom the policy owner assigns the rights to a portion of the policy's benefits. This is usually a lender, a financial institution, or another party providing a loan or financial backing.

- Collateral Assignment Agreement: A formal written agreement, known as a "Collateral Assignment Agreement," is established between the policy owner and the assignee. This agreement outlines the terms and conditions of the assignment, including the amount of the policy's cash value or death benefit assigned as collateral.

- Loan or Financial Obligation: The policy owner typically uses the collateral assignment to secure a loan or meet a financial obligation. The assignee has the assurance that if the policy owner defaults on the loan or obligation, they can access the assigned portion of the policy's benefits to cover the debt.

- Conditions for Accessing Benefits: The collateral assignment agreement specifies the conditions under which the assignee can access the policy benefits. Common triggers include the policy owner's default on the loan, failure to repay the debt, or the policy's maturity.

- Release of Collateral Assignment: Once the policy owner fulfills their obligations, such as repaying the loan in full, the collateral assignment can be released, and the policy's benefits revert to the owner.

It's important to note that a collateral assignment does not transfer full ownership of the policy to the assignee. The policy owner retains ownership of the policy and can continue to pay premiums, make changes, and name beneficiaries. However, the assignee has a claim on the assigned portion of the policy's benefits if the specified conditions are met.

We provide a life insurance policy template that can be agreed between the Assignor and Assignee. Using our Templates guarantees you will save time, costs, and effort!

HAFTUNGSAUSSCHLUSS

Nichts auf dieser Website gilt als Rechtsberatung und kein Mandatsverhältnis wird hergestellt.

Wenn Sie Fragen oder Anmerkungen haben, können Sie sie gerne unten veröffentlichen.