Sales Commission Agreement

Speichern, ausfüllen, drucken, fertig!

Sales Commission Agreement Guide and Template in Microsoft Word format

Verfügbare Gratis-Dateiformate:

.doc- Dieses Dokument wurde von einem Professional zertifiziert

- 100% anpassbar

Business Unternehmen Sales Vertrieb contract Vertrag agreement Zustimmung employment Beschäftigung company Unternehmen economy Wirtschaft employee Mitarbeiter commission Kommission government Regierung law Gesetz

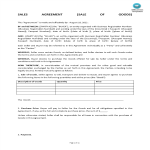

Commission Agreement Guide and Template Introduction Paying sales commissions has always been a tricky part of being an employer.. Setting a level of mileage reimbursement according to IRS rules, requesting detailed mileage logs, and ensuring that an employee s activity report matches the mileage report is a great way to remain compliant and monitor activity.. Minimum Sales Targets First 30 days: 250 in new monthly revenue 30 60 days: 500 in new monthly revenue 60 90 days: 1,000 in new monthly revenue 90 days 6 months: 2,000 in new monthly revenue Acceptable Sales Targets First 30 days: 250 in new monthly revenue 30 60 days: 750 in new monthly revenue 60 90 days: 1,500 in new monthly revenue 90 days 6 months: 2,500 in new monthly revenue Exceptional Sales Targets First 30 days: 500 in new monthly revenue 30 60 days: 1,500 in new monthly revenue 60 90 days: 2,000 in new monthly revenue 90 days 6 months 3000 in new monthly revenue Minimum and Acceptable Sales Targets are intended to describe what is the minimal expectation of the Company and should not be misconstrued as the ultimate goal of the Employee.. Tier 1: 3 of the gross revenue of all new monthly sales above 1,000 Tier 2: 5 additional commission on the gross revenue of all new monthly sales above 2,000 Tier 3: 10 additional commission on the gross revenue of all new monthly sales above 3,000 Residuals: 2 residual commission on cumulative revenue given each month acceptable levels of new sales is attained.. Expense Reimbursement (EXAMPLE) Employee shall be reimbursed for expenses related to travel and mileage at the current IRS rate for travel from the office to a sales appointment, between sales appointments, and from a sales appointment back to the office at the end of the day..

HAFTUNGSAUSSCHLUSS

Nichts auf dieser Website gilt als Rechtsberatung und kein Mandatsverhältnis wird hergestellt.

Wenn Sie Fragen oder Anmerkungen haben, können Sie sie gerne unten veröffentlichen.