Business Credit Application Form Template

Speichern, ausfüllen, drucken, fertig!

How to Create a Business Credit Application Form? What is a Credit Application in Business? Download now and improve your credit application process!

Verfügbare Gratis-Dateiformate:

.docx- Dieses Dokument wurde von einem Professional zertifiziert

- 100% anpassbar

Finance Finanzen business credit application Geschäftskreditantrag business credit application form Antragsformular für Geschäftskredite business credit application form template Vorlage für ein Geschäftskreditantragsformular business credit application pdf business credit application form pdf Antragsformular für Geschäftskredite PDF blank credit application form for business printable business credit application form druckbares Antragsformular für Geschäftskredite free business credit application form kostenloses Antragsformular für einen Geschäftskredit business credit application forms application form business credit credit application forms for business template business account credit application form business credit application personal guarantee form for applying a business credit application credit template

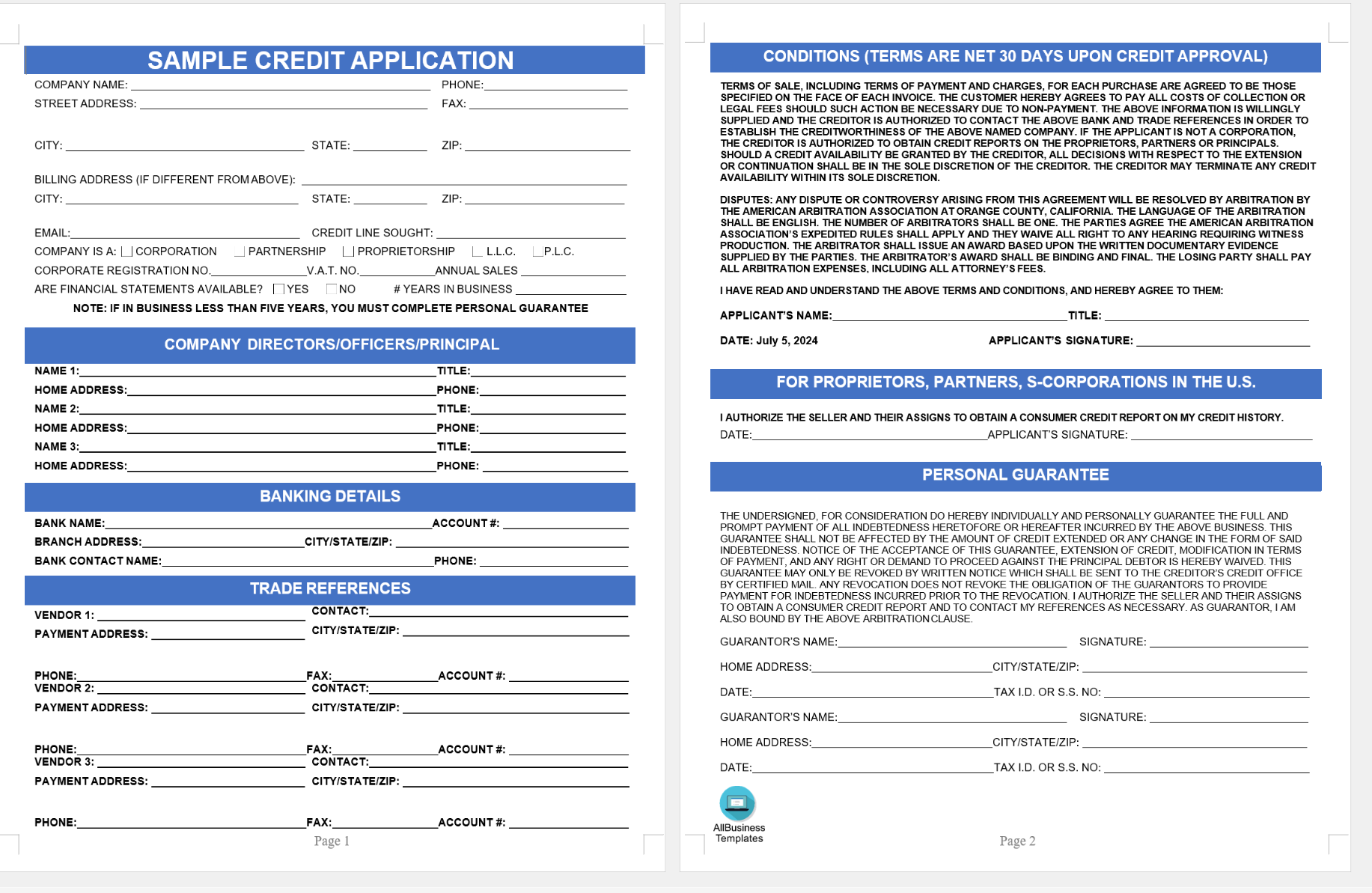

How to Create a Business Credit Application Form to streamline your business?

Creating a Business Credit Application Form is crucial for evaluating the creditworthiness of potential clients. This form gathers essential financial and personal information, helping to make informed decisions about extending credit. Download our professional template now to streamline this process and ensure consistency.

Importance of Accurate Financial Communication

Accurate financial communication is essential for managing finances and seeking funds from investors or lenders. Clear, easy-to-understand accounting records are critical for daily operations. Using our Business Credit Application Form template will help you maintain a consistent understanding of your business's financial status.

Key Elements of a Business Credit Application Form

A Business Credit Application Form is used by lenders, financial institutions, suppliers, or vendors to collect information from individuals or businesses applying for credit. It evaluates the applicant's creditworthiness and determines suitable credit terms. Additionally, it establishes a formal agreement between the lender and the borrower regarding the credit terms.

This Credit Application Form form typically includes:

- Business Information: Name, address, phone number, and industry type.

- Contact Information: Name, address, phone number, and email.

- Operational Details: Number of employees, trade payment references, and bank references.

- Principal Details: Identifying details of the business's owners or principals.

- Financial Information: Bankruptcy history, financial ratios, profitability, debt levels, and cash flows.

Our template saves you time, reduces costs, and enhances your success chances. It helps manage legal matters and provides up-to-date insights into your business's financial standing.

Accounting reports are crucial for monitoring business activities and making strategic decisions. Common reports include:

- Balance Sheets: Show the financial health of a business at a specific moment.

- Profit and Loss Statements: Display the results of business operations over time.

- Cash Flow Statements: Highlight the flow of cash in and out of the business.

- Owner Equity Statements: Indicate the owner's equity in the business.

Many companies are moving to digital workflows, including online credit applications. This shift offers several benefits:

- Efficiency: Streamlines the application process and reduces errors.

- Accessibility: Makes it easier for customers to apply and for businesses to manage applications.

- Cost-Effective: Reduces the need for paper-based processes.

- Steps to Fill Out a Business Credit Application

- Review the Credit Agreement: Understand the terms and conditions before proceeding.

- Input Personal and Business Details: Provide accurate and complete information.

- Provide Employment and Financial Information: Demonstrate financial stability and capacity to repay.

- Submit the Application: Review for errors, sign, and submit.

- Wait for Feedback: The lender will review and respond with approval, request for more information, or rejection.

For more templates, browse our website and gain instant access to thousands of ready-made, easy-to-find, and intuitive business documents, forms, and letters. Explore our range of free business credit application templates to find the one that suits your needs. Our templates are designed to be easy to use, customizable, and efficient.

Using a standardized Business Credit Application Form streamlines the credit application process. Download this Credit Application Form editable in Microsoft Word (.docx) or Google Docs template now and streamline your credit application process!

Or check out any of our other Business Credit Application Forms here.

HAFTUNGSAUSSCHLUSS

Nichts auf dieser Website gilt als Rechtsberatung und kein Mandatsverhältnis wird hergestellt.

Wenn Sie Fragen oder Anmerkungen haben, können Sie sie gerne unten veröffentlichen.