Fixed Asset template

Sponsored Link免费模板 保存,填空,打印,三步搞定!

Download Fixed Asset template

微软电子表格 (.xls)免费文件转换

- 本文档已通过专业认证

- 100%可定制

- 这是一个数字下载 (17.5 kB)

- 语: English

Sponsored Link

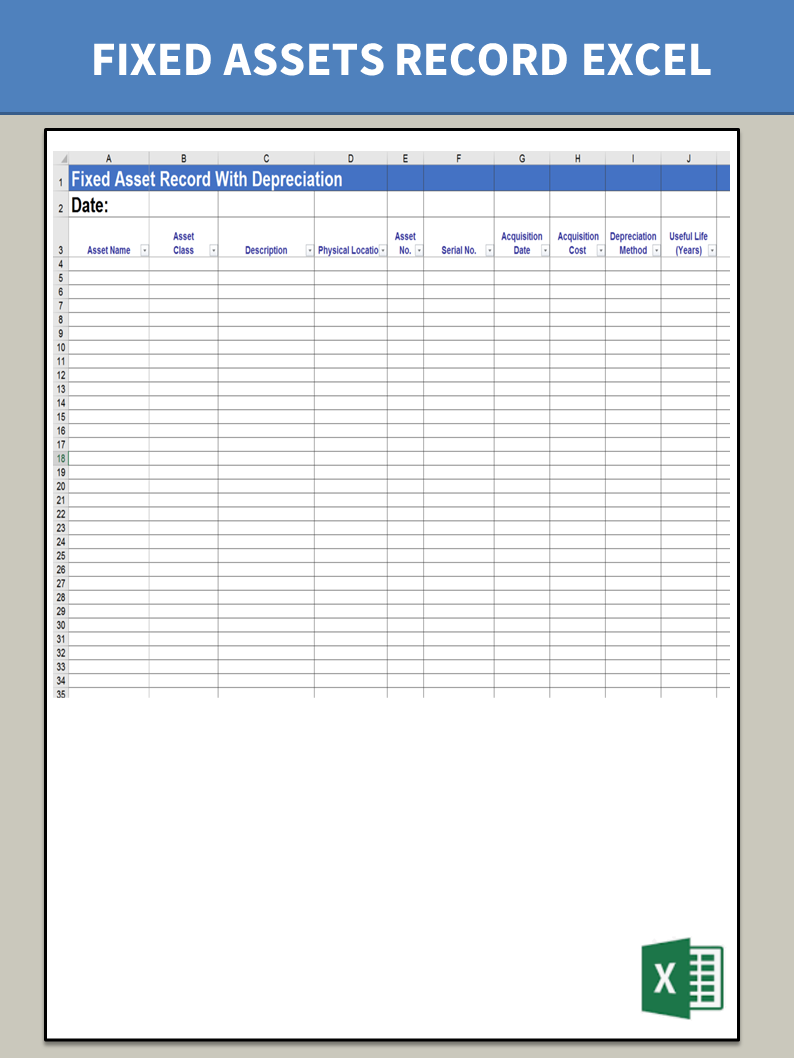

How to create a Fixed Asset in Excel? An easy way to start completing your document is to download this example Fixed Asset template now!

We provide this Fixed Asset template to help professionalize the way you are working. Our business and legal templates are regularly screened and used by professionals.

What is a fixed asset register format?

- Asset Name

- Asset Class

- Description

- Physical Location

- Asset Number

- Serial Number

- Acquisition Date

- Acquisition Cost

- Depreciation Method

- Useful Life (Years)

- Salvage Value

- Previous Depreciation

- First Year %

- Depreciation

- Period

If time or quality is of the essence, this ready-made template can help you to save time and to focus on the topics that really matter!

Abbreviation Depreciation Method descriptions:

- Straight-line depreciation: Calculates straight-line depreciation based on the asset's cost, salvage value, and estimated economic life.

- "150% declining balance depreciation" Calculates 150% declining balance depreciation based on the asset's cost, salvage value, and estimated economic life. It switches to straight-line depreciation at the point when straight-line depreciation exceeds declining balance depreciation.

- "200% declining balance depreciation" Calculates 200% declining balance depreciation based on the asset's cost, salvage value, and estimated economic life. It switches to straight-line depreciation at the point when straight-line depreciation exceeds declining balance depreciation.

Using this Fixed Asset template guarantees you will save time, cost and effort! Completing documents has never been easier!

Download this Fixed Asset template now for your own benefit!

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

发表评论。 如果您有任何问题或意见,请随时在下面发布

Sponsored Link