Payslip template

Sponsored Link免费模板 保存,填空,打印,三步搞定!

Download Payslip template

微软的词 (.doc)免费文件转换

- 本文档已通过专业认证

- 100%可定制

- 这是一个数字下载 (181 kB)

- 语: English

Sponsored Link

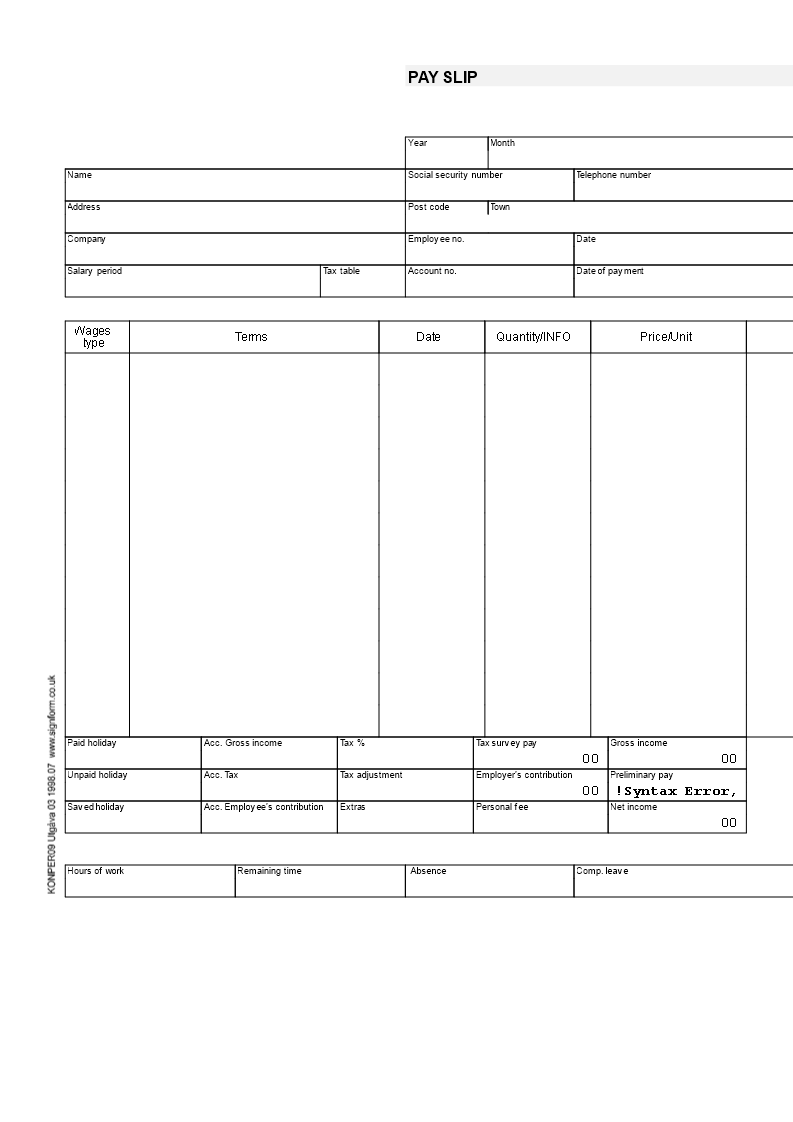

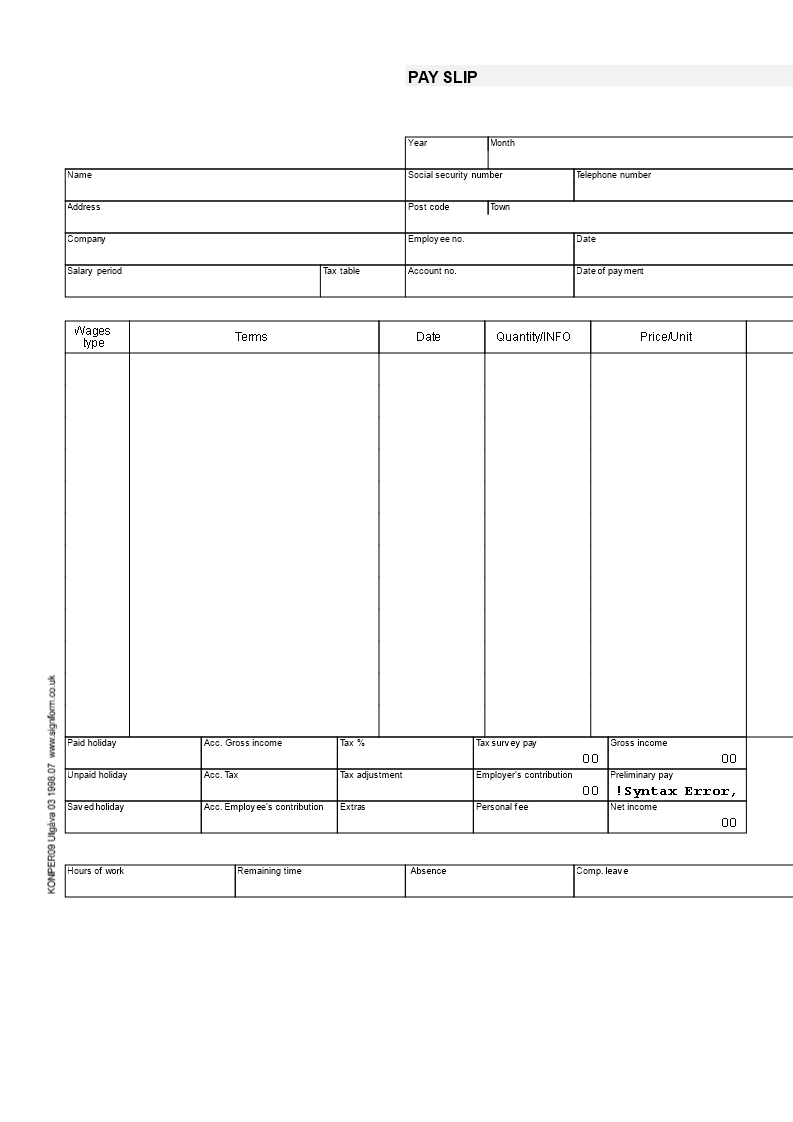

How to create a Payslip for a company? Looking for a professional payslip template? What is important to put on a payslip? Are you looking for a professional Payslip?

This pay slip template is perfect for businesses of all sizes. With a clean and simple design, it is easy to customize and personalize to your needs. Create professional looking payslips for your employees with our template. With its easy to use format, you can quickly generate payslips that are accurate and up to date.

We provide this Pay Slip template to help professionalize the way you are working. Our business and legal templates are regularly screened and used by professionals. If time or quality is of the essence, this ready-made template can help you to save time and to focus on the topics that really matter!

When people are referring to a payslip, they refer to a piece of paper provided to an employee to show the salary and payment, which includes earnings and any deductions applicable (= amounts taken off for income tax, etc.) in a particular period. This Payslip template can help you create one for your own employees, and includes helpful guidelines and suggestions.

This Payslip covers the most important topics that you are looking for and will help you to structure and communicate in a professional manner with your HR and staff. The following input fields are common on a pay slip:

Payslip template:

- Hours

- Total Hours

- Current Hours = hours from weeks 1 and 2 Current Amount

- How to Calculate Current Amounts

- Description

- Regular Hours

- Sunday Hours

- Worked

- Sick

- Vacation

- Holiday

- Exc With Pay Overtime

- Overtime Current Pay Current X = Hours Rate Amount

- Date of payment Wages

- Terms

- Date

- Quantity/INFO Price/Unit Amount

- Paid holiday Acc..

Feel free to download this intuitive template that is available in several kinds of formats, or try any other of our basic or advanced templates, forms or documents. Don't reinvent the wheel every time you start something new...

Download this example of a Payslip template and save yourself time and effort! You will see completing your payroll tasks has never been easier...

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

发表评论。 如果您有任何问题或意见,请随时在下面发布

Sponsored Link