Excel Capital Budgeting Analysis

Sponsored Link免费模板 保存,填空,打印,三步搞定!

Download Excel Capital Budgeting Analysis

微软电子表格 (.xls)免费文件转换

- 本文档已通过专业认证

- 100%可定制

- 这是一个数字下载 (212.5 kB)

- 语: English

Sponsored Link

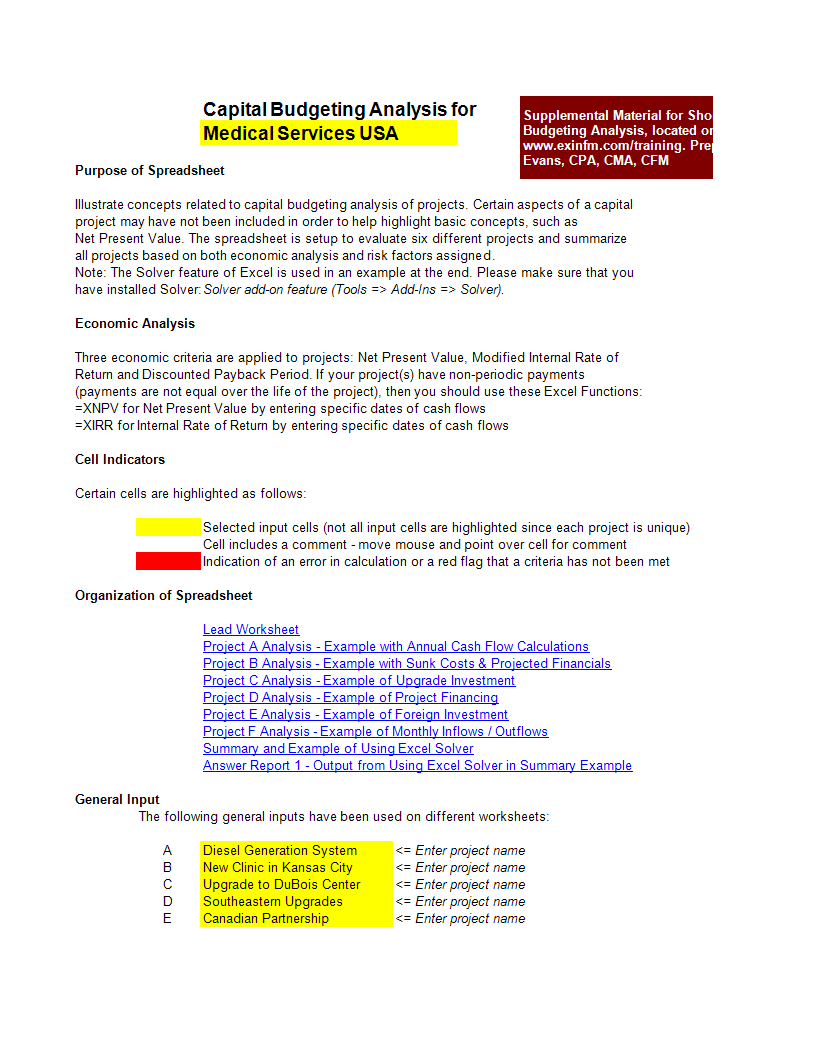

Do you need an Excel Capital Budgeting Analysis? How does Excel help you to create a capital budget? What are the steps I need to take in order to make a budget analysis in Excel? Excel capital budgeting analysis templates are an excellent tool for businesses to plan and analyze their capital projects and investments. Download this sample template now! Download this Capital Budgeting Analysis Excel template now!

An Excel capital budgeting analysis, often referred to as a capital budgeting spreadsheet or model, is a financial tool created using Microsoft Excel or similar spreadsheet software to evaluate and analyze potential capital investment projects within a business or organization. Capital budgeting is the process of making decisions regarding significant investments in long-term assets or projects, such as machinery, equipment, facilities, or new product lines. The goal of capital budgeting is to determine whether these investments will generate sufficient returns to justify their costs.

Here are the key components and steps involved in an Excel capital budgeting analysis:

- Project Information:

- Start by providing details about the proposed capital investment project, including its name, description, and expected duration.

- Cash Flow Projections:

- Create a timeline that spans the expected life of the project, broken down into time periods (usually years or months).

- Estimate the project's cash flows for each period, including initial investments (e.g., purchase of equipment), operating cash flows (revenues, expenses, and taxes), and terminal cash flows (e.g., salvage value at the end of the project's life).

- Apply appropriate financial formulas and calculations to determine net cash flows for each period.

- Discount Rate:

- Specify the discount rate, also known as the required rate of return or the cost of capital. This rate is used to discount future cash flows back to their present value to account for the time value of money.

- Net Present Value (NPV):

- Calculate the NPV of the project by discounting all expected cash flows to their present value and subtracting the initial investment cost. A positive NPV indicates that the project is expected to generate returns greater than the required rate of return and is generally considered a favorable investment.

- Internal Rate of Return (IRR):

- Determine the IRR, which is the discount rate that makes the NPV of the project equal to zero. The IRR represents the project's expected return on investment, and it should be compared to the cost of capital to assess the project's viability.

- Payback Period:

- Calculate the payback period, which represents the time it takes for the project's cumulative cash flows to recoup the initial investment. A shorter payback period is generally more favorable.

- Profitability Index (PI):

- Compute the profitability index by dividing the present value of future cash flows by the initial investment. A PI greater than 1 indicates a potentially profitable investment.

- Sensitivity Analysis:

- Conduct sensitivity analysis by changing key variables (such as sales volume, costs, or discount rate) to assess how variations in these factors impact the project's financial metrics.

- Decision Criteria:

- Make a decision based on the calculated NPV, IRR, payback period, PI, and sensitivity analysis. Determine whether the project should be accepted, rejected, or further evaluated.

- Final Report and Presentation:

- Present the findings and analysis in a report format, summarizing key financial metrics, assumptions, and recommendations.

Excel is a popular choice for conducting capital budgeting analyses because it allows for easy organization, calculation, and presentation of financial data. Excel's built-in functions and formulas make it a versatile tool for evaluating the financial viability of investment projects and helping organizations make informed decisions about allocating their capital resources.

Download this Excel Capital Budgeting Analysis template now and enhance your business!

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

发表评论。 如果您有任何问题或意见,请随时在下面发布

相关文件

Sponsored Link