Annual Review Meeting Agenda

Sponsored Link免费模板 保存,填空,打印,三步搞定!

Download Annual Review Meeting Agenda

Adobe PDF (.pdf)- 本文档已通过专业认证

- 100%可定制

- 这是一个数字下载 (260.08 kB)

- 语: English

Sponsored Link

How to draft a Annual Review Meeting Agenda? An easy way to start completing your document is to download this Annual Review Meeting Agenda template now!

Every day brings new projects, emails, documents, and task lists, and often it is not that different from the work you have done before. Many of our day-to-day tasks are similar to something we have done before. Don't reinvent the wheel every time you start to work on something new!

Instead, we provide this standardized Annual Review Meeting Agenda template with text and formatting as a starting point to help professionalize the way you are working. Our private, business and legal document templates are regularly screened by professionals. If time or quality is of the essence, this ready-made template can help you to save time and to focus on the topics that really matter!

Using this document template guarantees you will save time, cost and efforts! It comes in Microsoft Office format, is ready to be tailored to your personal needs. Completing your document has never been easier!

Download this Annual Review Meeting Agenda template now for your own benefit!

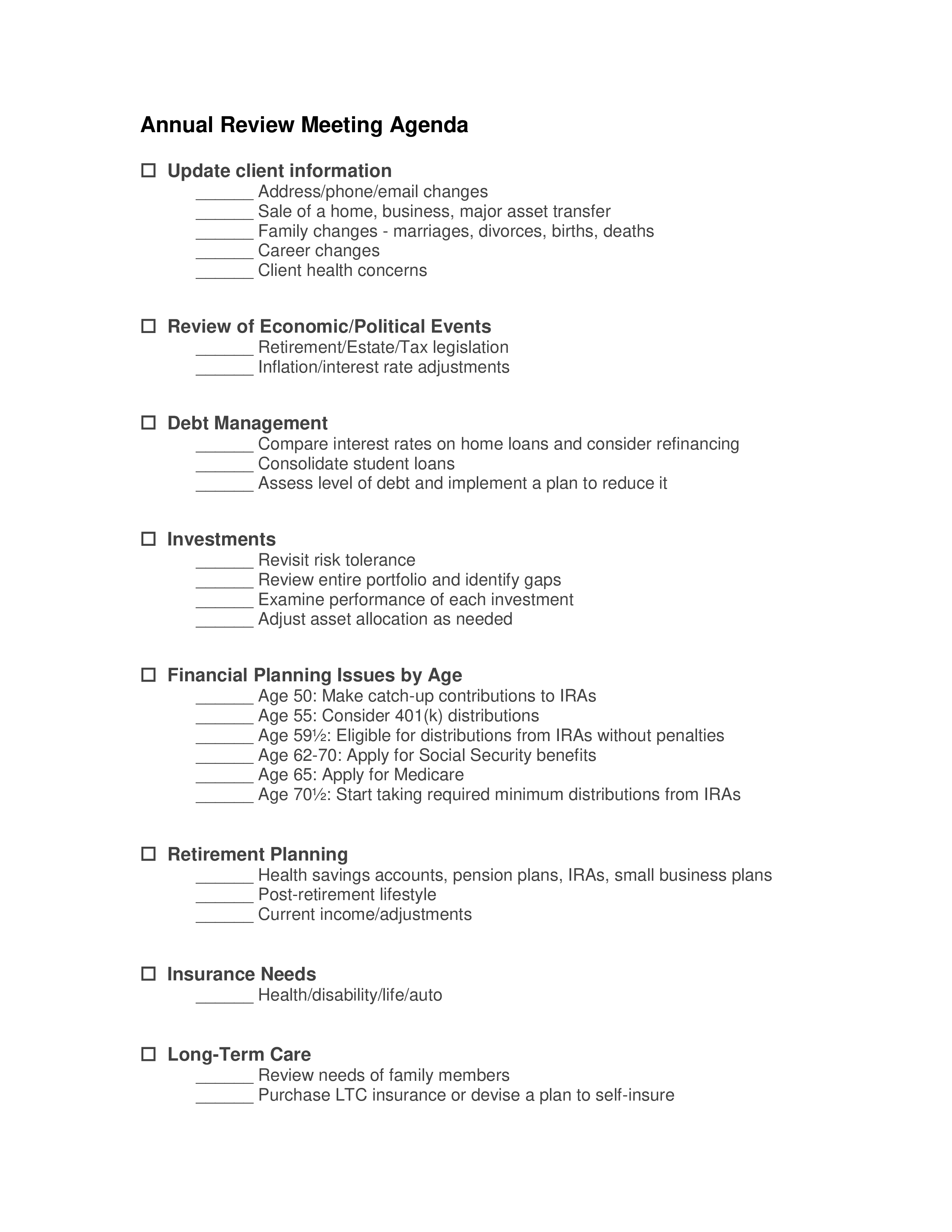

Annual Review Meeting Agenda Update client information Address/phone/email changes Sale of a home, business, major asset transfer Family changes - marriages, divorces, births, deaths Career changes Client health concerns Review of Economic/Political Events Retirement/Estate/Tax legislation Inflation/interest rate adjustments Debt Management Compare interest rates on home loans and consider refinancing Consolidate student loans Assess level of debt and implement a plan to reduce it Investments Revisit risk tolerance Review entire portfolio and identify gaps Examine performance of each investment Adjust asset allocation as needed Financial Planning Issues by Age Age 50: Make catch-up contributions to IRAs Age 55: Consider 401(k) distributions Age 59½: Eligible for distributions from IRAs without penalties Age 62-70: Apply for Social Security benefits Age 65: Apply for Medicare Age 70½: Start taking required minimum distributions from IRAs Retirement Planning Health savings accounts, pension plans, IRAs, small business plans Post-retirement lifestyle Current income/adjustments Insurance Needs Health/disability/life/auto Long-Term Care Review needs of family members Purchase LTC insurance or devise a plan to self-insure Education Planning Calculate how much children will need for college Establish a plan for disciplined saving Open a suitable account (529, Coverdell, UGMA) Estate Planning Review all beneficiary designations Action Items Do you have any questions for me What are your goals How am I doing Create a savings plan that lists goals, timetable for achieving them, and amount of savings necessary to reach them LPL Financial • Member FINRA/SIPC For broker/dealer use only..

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

发表评论。 如果您有任何问题或意见,请随时在下面发布

相关文件

Sponsored Link