Unsecured creditors request template

Sponsored Link免费模板 保存,填空,打印,三步搞定!

Download Unsecured creditors request template

微软的词 (.docx)免费文件转换

其他可用语言:

- 本文档已通过专业认证

- 100%可定制

- 这是一个数字下载 (12.61 kB)

- 语: English

Sponsored Link

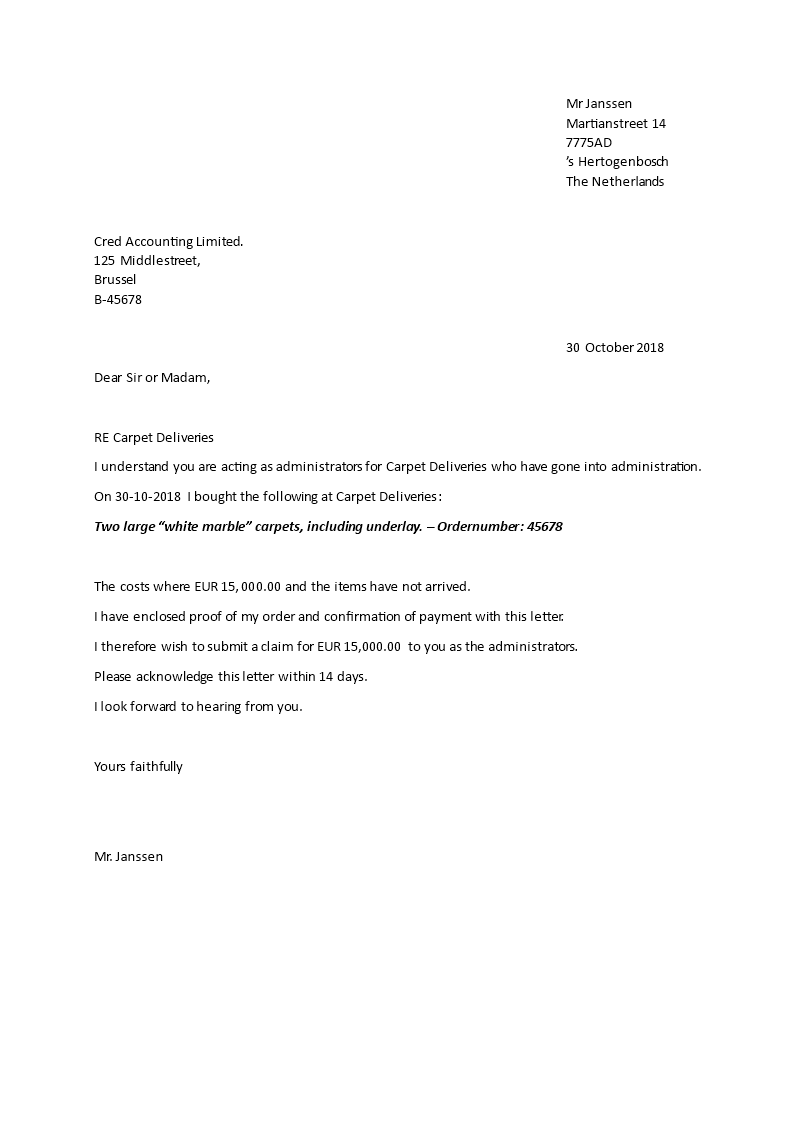

Use this letter if a trader has gone into administration or liquidation and you are owed money or want a refund. You should send it to the administrators or liquidators.

What is unsecured creditor?

An unsecured creditor is a lender or any entity to which a company or individual owes money for services provided. That creditor, however, does not have any collateral from the borrower.

Sample case:

If you borrow money from ABC Bank, ABC Bank becomes your creditor. Utility companies, health clubs, web stores, shops, phone companies, and credit card issuers can all be creditors if you have contracts with them or if they have performed services for which you have not yet paid.If the creditor has claim to some of your assets -- say, a deposit you made, a lien on your house, the title to your car -- that creditor is a secured creditor. If the creditor has no ability to claim some of your assets when you don’t pay (this is often the case with credit cards), the creditor is unsecured. If you have borrowed money from a bank, the bank may ask you for collateral as a way of securing the loan.

Why it is important?

An unsecured creditor takes on more risk than a secured creditor because it does not have the ability to seize an asset right away if a borrower fails to repay the debt. Creditors may of course sue to obtain access to accounts or other assets if the borrower has not paid, but that is more expensive than requiring collateral up front.

An unsecured creditor takes on more risk than a secured creditor because it does not have the ability to seize an asset right away if a borrower fails to repay the debt. Creditors may of course sue to obtain access to accounts or other assets if the borrower has not paid, but that is more expensive than requiring collateral up front.

Regardless, this lack of security increases the creditor’s risk, which in turn increases the interest rates on unsecured loans.

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

发表评论。 如果您有任何问题或意见,请随时在下面发布

相关文件

Sponsored Link