Borrowing Resolution for a Corporation

Sponsored Link高级模板 保存,填空,打印,三步搞定!

下载 下载 How to write a borrowing resolution for a corporation? What are the advantages and disadvantages of corporate borrowing resolutions? Just it and use it to create your own Borrowing resolution.

只有今天: USD 2.99

点击购买

可用的免费文件格式:

微软的词 (.docx)- 本文档已通过专业认证

- 100%可定制

- 这是一个数字下载 (23.58 kB)

- 语: English

- 付款完成后,您将收到包含该文件的电子邮件。

Sponsored Link

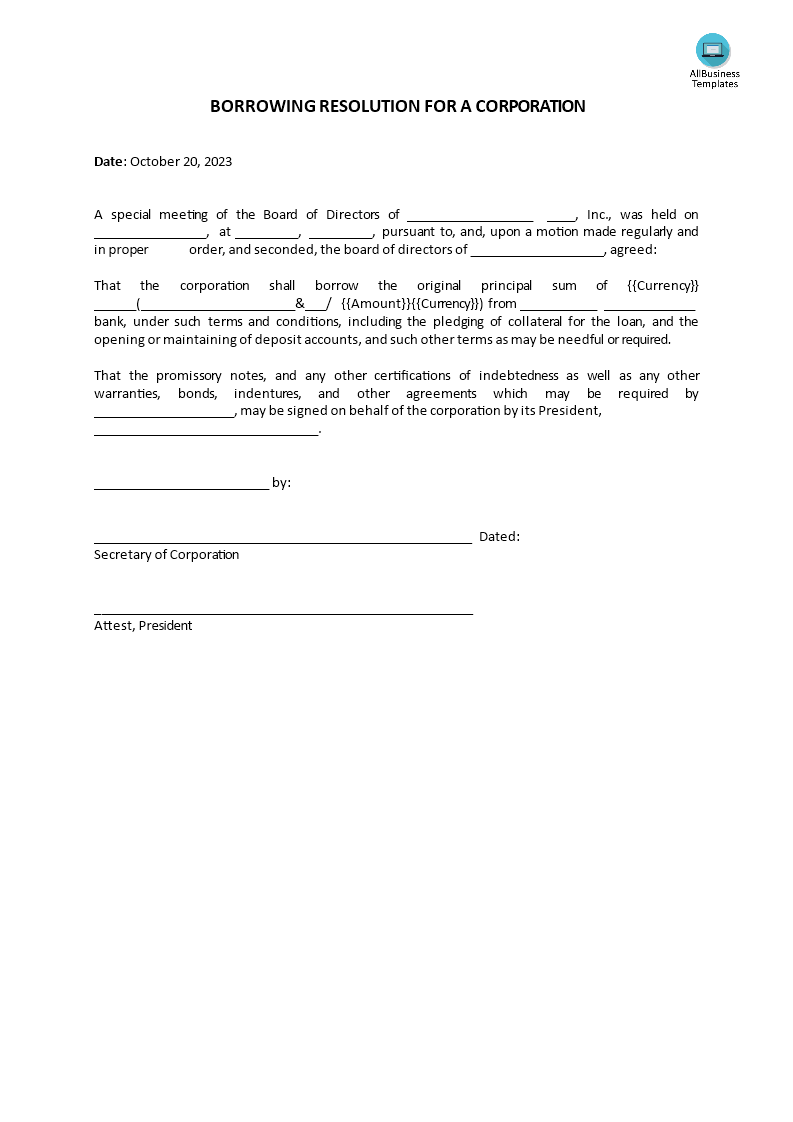

How to write a borrowing resolution for a corporation? What are the advantages and disadvantages of corporate borrowing resolutions? We have prepared a sample Borrowing Resolution for a Corporation template that you can use as a guide. It includes all the necessary information needed to authorize the corporation to borrow from a lender. Just download it and use it to create your own Borrowing resolution.

A Borrowing Resolution for a corporation is a formal document that authorizes the borrowing of funds or the issuance of debt by the corporation. This resolution is typically adopted by the corporation's board of directors and is an essential part of the corporate governance process. It outlines the terms, conditions, and limitations under which the corporation can borrow money or incur debt.

Key elements and information typically found in a Borrowing Resolution for a Corporation include:

- Identification of Corporation: The resolution begins by identifying the corporation by its legal name and may include its corporate registration number or other relevant identification.

- Authorization to Borrow: It explicitly states that the corporation is authorized to borrow money or incur debt up to a specified amount. This amount may be a specific dollar figure or a maximum borrowing limit.

- Purpose: The resolution should outline the purpose for which the borrowed funds will be used. Common purposes include financing operations, capital expenditures, acquisitions, or refinancing existing debt.

- Interest Rates and Terms: Details about the permissible interest rates, repayment terms, and any covenants or conditions associated with the borrowing. This may include provisions regarding the issuance of bonds, notes, or other debt instruments.

- Signatories: The resolution designates the individuals or officers of the corporation who are authorized to sign loan agreements, promissory notes, or other related documents on behalf of the corporation. This is often the CEO, CFO, or another authorized officer.

- Collateral: If applicable, the resolution may specify any assets or collateral that will secure the borrowed funds. This is common in secured loans.

- Approval by the Board of Directors: It should state that the Borrowing Resolution has been duly approved and adopted by the Board of Directors of the corporation, typically through a formal board meeting or written consent.

- Date of Resolution: The date on which the resolution was adopted.

- Expiration Date: If there is a time limit on the authorization to borrow, the resolution should include an expiration date.

- Amendment or Revocation: Provisions for amending or revoking the resolution, if necessary, and any requirements for such actions.

Download this professional legal Borrowing Resolution for a Corporation template if you find yourself in this situation and save yourself time, and effort and probably reduce some of the lawyer fees! Using our legal templates will help you reach the next level of success in your education, work, and business! However, we still recommend you to consider consulting a local law firm in case of doubt to support you in this matter.

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

发表评论。 如果您有任何问题或意见,请随时在下面发布

相关文件

Sponsored Link