Childcare Voucher Scheme

Sponsored Link免费模板 保存,填空,打印,三步搞定!

Download Childcare Voucher Scheme

Adobe PDF (.pdf)- 本文档已通过专业认证

- 100%可定制

- 这是一个数字下载 (66.59 kB)

- 语: English

Sponsored Link

How to draft a Childcare Voucher Scheme? An easy way to start completing your document is to download this Childcare Voucher Scheme template now!

Every day brings new projects, emails, documents, and task lists, and often it is not that different from the work you have done before. Many of our day-to-day tasks are similar to something we have done before. Don't reinvent the wheel every time you start to work on something new!

Instead, we provide this standardized Childcare Voucher Scheme template with text and formatting as a starting point to help professionalize the way you are working. Our private, business and legal document templates are regularly screened by professionals. If time or quality is of the essence, this ready-made template can help you to save time and to focus on the topics that really matter!

Using this document template guarantees you will save time, cost and efforts! It comes in Microsoft Office format, is ready to be tailored to your personal needs. Completing your document has never been easier!

Download this Childcare Voucher Scheme template now for your own benefit!

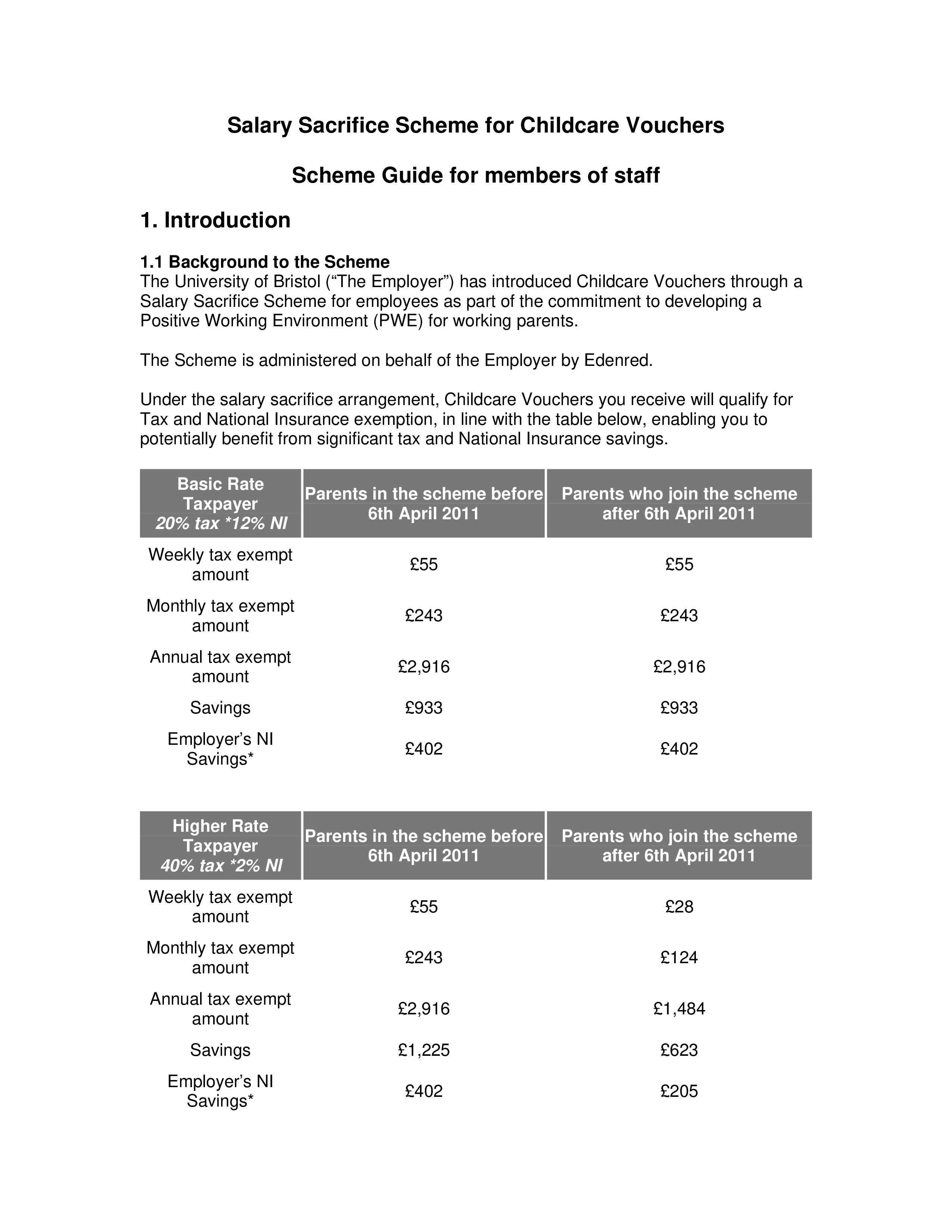

Basic Rate Taxpayer 20 tax 12 NI Parents in the scheme before 6th April 2011 Parents who join the scheme after 6th April 2011 Weekly tax exempt amount £55 £55 Monthly tax exempt amount £243 £243 Annual tax exempt amount £2,916 £2,916 Savings £933 £933 Employer’s NI Savings £402 £402 Higher Rate Taxpayer 40 tax 2 NI Parents in the scheme before 6th April 2011 Parents who join the scheme after 6th April 2011 Weekly tax exempt amount £55 £28 Monthly tax exempt amount £243 £124 Annual tax exempt amount £2,916 £1,484 Savings £1,225 £623 Employer’s NI Savings £402 £205 Additional Rate Taxpayer 50 tax 2 NI Parents in the scheme before 6th April 2011 Parents who join the scheme after 6th April 2011 Weekly tax exempt amount £55 £22 Monthly tax exempt amount £243 £97 Annual tax exempt amount £2,916 £1,166 Savings £1,516 £606 Employer’s NI Savings £402 £161 new NI rate applicable from April 2011 You can order vouchers for greater than this amount if that makes payment easier for you and your child care provider.. How to work out how much to sacrifice each month To help decide how much salary to sacrifice each month the Employee should: a) calculate the total amount spent on childcare annually b) divide this figure by 12 Whilst any value of childcare vouchers may be purchased through salary deduction, only up to £243 basic rate taxpayer per month will attract tax and National Insurance relief Each submitted Salary Sacrifice Agreement will be checked to ensure that the sacrifice value does not result in an Employee’s salary being less than the National Minimum Wage or the Lower Earnings Limit (this is one of the qualifications of the Scheme).. 3.3 Types of childcare valid for payment with Childcare Vouchers, subject at all times to holding valid registration or approval certification: Registered childminders, nurseries and playschemes Out of hours clubs on school premises run by a school or local authority Childcare Schemes run by school governing bodies under the extended sch

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

发表评论。 如果您有任何问题或意见,请随时在下面发布

相关文件

Sponsored Link