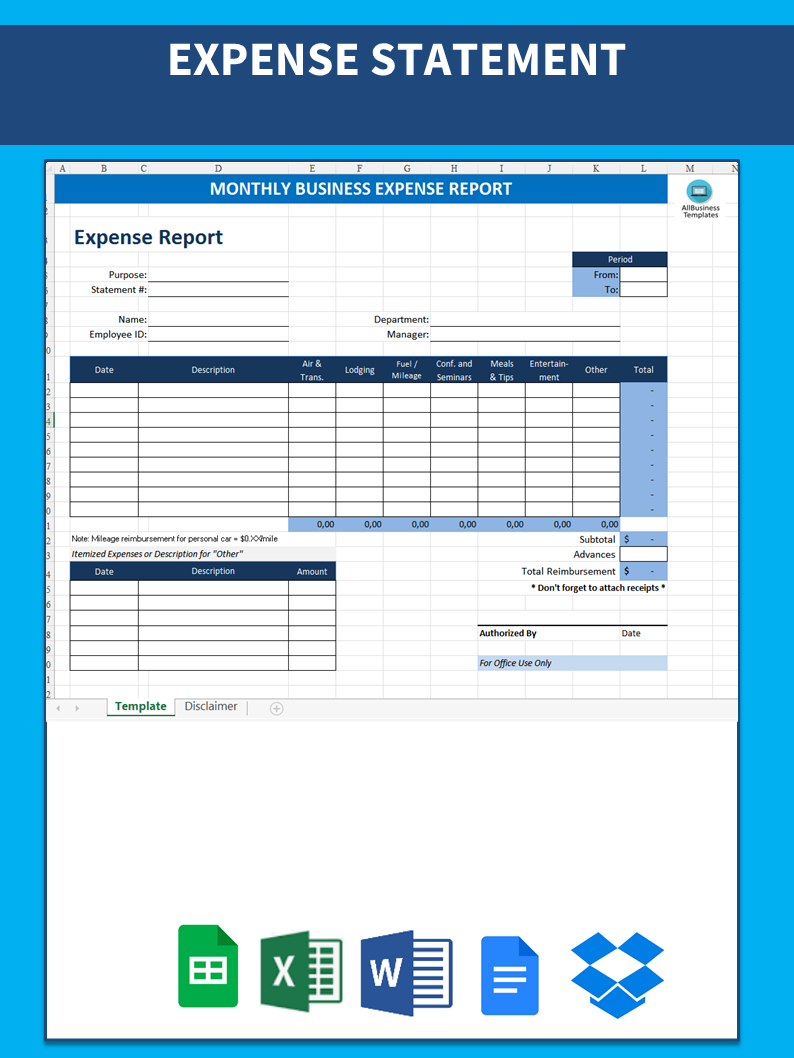

Monthly Business Expense Report

Sponsored Link高级模板 保存,填空,打印,三步搞定!

下载 下载 How to make an expense statement? What expenses can you write off as a business? this Monthly Business Expense Template (Excel) now!

只有今天: USD 3.99

点击购买

可用的免费文件格式:

微软电子表格 (.xlsx)- 本文档已通过专业认证

- 100%可定制

- 这是一个数字下载 (24.57 kB)

- 语: English

- 付款完成后,您将收到包含该文件的电子邮件。

Sponsored Link

How to make an expense statement? What expenses can you write off as a business? Download this Monthly Business Expense Template (Excel) now!

An easy way to keep track of those expenses is to create your own personalized business expenses template in Excel. It is one of the most popular and affordable ways to create a digital budget is with Microsoft Excel.

When you create a budget template in MS Excel, you can fully customize your budget to track your monthly income and expenses. As the budget process can feel slightly overwhelming at first, this guide will help create your own Excel budget.

The Excel sheet is a simple business budget that states all business expenses into categories. We provide an advanced Microsoft Excel template that enables you to manage twelve months business expense spreadsheets to keep track of your monthly (business) expenses.

This spreadsheet contains two parts. 1 part is a detailed page for each month. Another part is a full summary of each month with totals with expenses spend on items such as meals, hotel, transport, samples, misc, etc (which can be easily modified).

Keeping track of your business expenses is the foundation of a solid business record which enables you to keep learning to manage your expenses effectively. It’s a crucial step that allows you to monitor the growth of your business, build financial statements, keep track of deductible expenses, prepare tax returns, and support what you report on your tax return.

In the beginning, you should implement such a tracking system by providing it to your employees and monthly authorize the expenses you bring in. There are five types of expense receipts that you should pay extra attention to:

- Business travels: The authorities are always studying such business travels. They might ask for extra details to explain why those are not also personal activities, and merely business expenses. Therefore it’s important to keep track of your receipts, which also provide a paper trail of your business activities while your employees or yourself are away.

- Meals and entertainment: When you are conducting business meetings on a regular basis, in a hotel, cafe, or restaurant, it’s a pleasant option to discuss business and bond with relations as well. Just make sure that you keep track of these expenses (on a daily basis). A helpful suggestion is to write on the back of the receipt the basic information about the meeting or connection, in order to record who attended and the purpose of the meal or outing.

- Vehicle-related expenses: Make sure to record when, where, and why you used the automobile for business purposes, and then apply a percentage of the usage of this vehicle as related expenses.

- Receipts for gifts: When you buy gifts for your business relations, for example, tickets to a football match it matters whether the gift giver goes to the event with the recipient. If they do, it’s better to mention those expenses are categorized as “entertainment”, rather than a gift. Note these details on the back of the receipt as well.

- Home office receipts: Keeping your office receipts is similar to the vehicle expenses. You need to calculate what percentage of your home is used for business and then apply that percentage to home-related expenses. When you are starting your business from your own home, it provides a good way to keep your overhead low, and it also might qualify you for some unique tax breaks (depending on your country of residence and business). You’re able to deduct the portion of your home that’s used for business, as well as your internet connection, cell phone, and transportation to and from work sites and for business errands.

Make sure that any of those expenses that is used partially for private usage and business usage. For example: if you have a phone connection for a phone number that is used for private and business, you can deduct the percentage that you use this device for business. Also, fuel mileage costs are 100% deductible, just be sure to hold on to all the receipts and keep a log of your business mileage (where you’re going and the purpose of the trip).

This business expense spreadsheet generates automatically an annual report, each time you update the monthly expenses for all the subcategories that you defined. The subcategories are fairly comprehensive, but it is also easy to add, remove, and modify the categories.

Try out our online Free and Premium Professional templates, forms, and contracts today. By making your own version, based on this pre-made template, you can start tracking your finances directly! Save, fill-In the blanks, print …and done

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

发表评论。 如果您有任何问题或意见,请随时在下面发布

相关文件

Sponsored Link