Loan Amortization Table

Sponsored Link免费模板 保存,填空,打印,三步搞定!

Download Loan Amortization Table

微软的词 (.doc)免费文件转换

- 本文档已通过专业认证

- 100%可定制

- 这是一个数字下载 (78 kB)

- 语: English

Sponsored Link

How to create a Loan Amortization Table? An easy way to do it is with this example Loan Amortization Table template.

We provide this template to help professionalize the way you are working. Our business and legal templates are regularly screened and used by professionals. If time or quality is of the essence, this ready-made template can help you to save time and to focus on the topics that really matter!

AMORTIZATION TABLE FOR MORTGAGES: EXPLANATORY NOTES, ,

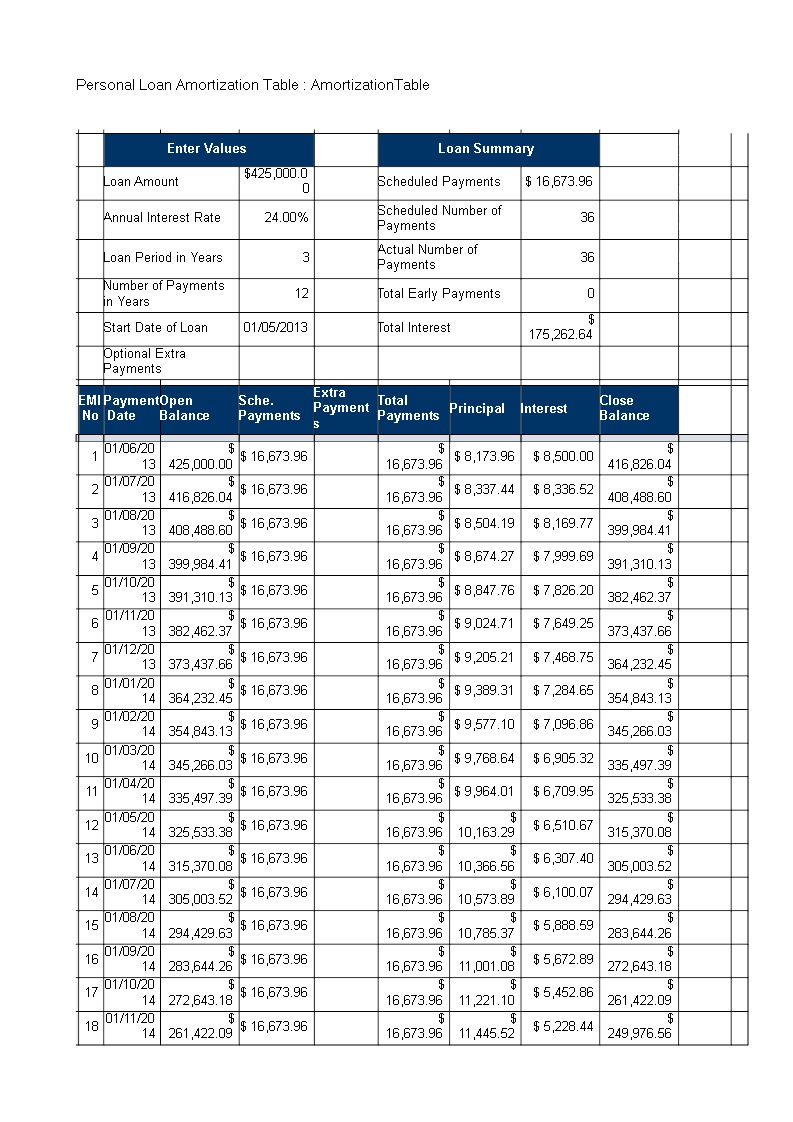

This program calculates the monthly mortgage payment PMT that is required to pay off a mortgage loan of $L with equal monthly payments over Y years.

Click on the worksheet named "TABLE" at the bottom of this worksheet to go to the sheet with the required calculations and the amortization table. You are required to enter numerical values for L, Y, and rate, the latter being the annual interest rate (in decimal form) the bank charges on the loan. The bank will convert it to a monthly compound rate simply by dividing RATE by 12. The monthly rate is calculated by the program, as shown. The number sired are those you must submit.

The number in black are calculated by the program. In order to calculate the monthly mortgage payment PMT, the program uses the equation I had used in class, with:

The program will, first, draw a graph showing you what the monthly mortgage payment PMT would be at different values for the annual borrowing rate (RATE). And given the values for L (the loan) and Y (the years over which it is to be paid back) that you have submitted to the program. Beneath the graph, you will then see the amortization table for the particular payment PMT implied by the values of L, Y, and RATE that you have submitted.

This amortization table assumes N to be 30 years. Therefore it has 360 rows. If you submit a value of, say, Y =15, then the program will still calculate values for 360 rows, but the entries for any row beyond the 180th payment will be meaningless. The row for the 180th payment should have a 0 in the right-most cell.

Usually, mortgages do not exceed 30 years. If you submitted Y = 40, the program would still calculate the correct payment and draw the proper graph, but the amortization table would go only to the 360th payment, not all the way to the 480th payment.

If you ever take out a mortgage loan, you should insist that the banker extending the loan print out for you an amortization table that shows exactly how much you still owe after having made the nth payment. In the table shown here, that amount is in the right-most column of the row for the nth payment. If the banker won't provide the table, prepare one yourself and have them sign off on it. It is the best protection against unpleasant surprises. As we have learned in the past half-decade, the world of finance appears to be run on sometimes dubious ethical standards. (I personally have had the experience of being told that I owed more after paying N payments than I knew I did. ) Knowing something about the technical aspects of finance is the best protection against being fleeced in the world of finance. It has helped me on more than one occasion.

Payments Extra Payments Total Payments Principal Interest Close Balance

Using this loan amortization schedule calculator template guarantees you will save time, cost and effort! Completing documents has never been easier!

Download this template now for your own benefit!

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

发表评论。 如果您有任何问题或意见,请随时在下面发布

相关文件

Sponsored Link