Sales Tax.pdf

Sponsored Link免费模板 保存,填空,打印,三步搞定!

Download Sales Tax.pdf

Adobe PDF (.pdf)- 本文档已通过专业认证

- 100%可定制

- 这是一个数字下载 (22.73 kB)

- 语: English

Sponsored Link

Great sales efforts can make a business! However, the opposite is also true. Therefore, it's important to take your sales serious right from the start. Certainly, have a look at this . This sales template will capture your audience's attention.

For those who work in Sales, it's important that they always work with the latest updated sales templates in order to grow the business faster! Therefore we invite you to check out and download our basic or advanced sales templates. They are intuitive and in several kinds of formats, such as PDF, WORD, XLS (EXCEL including formulas and can calculate sums automatically), etc.

Using this template guarantees that you will save time, cost and efforts and enables you to grow the business faster! After downloading and filling in the blanks, you can easily customize e.g. visuals, typography, details, and appearance of your .

Download this template now!

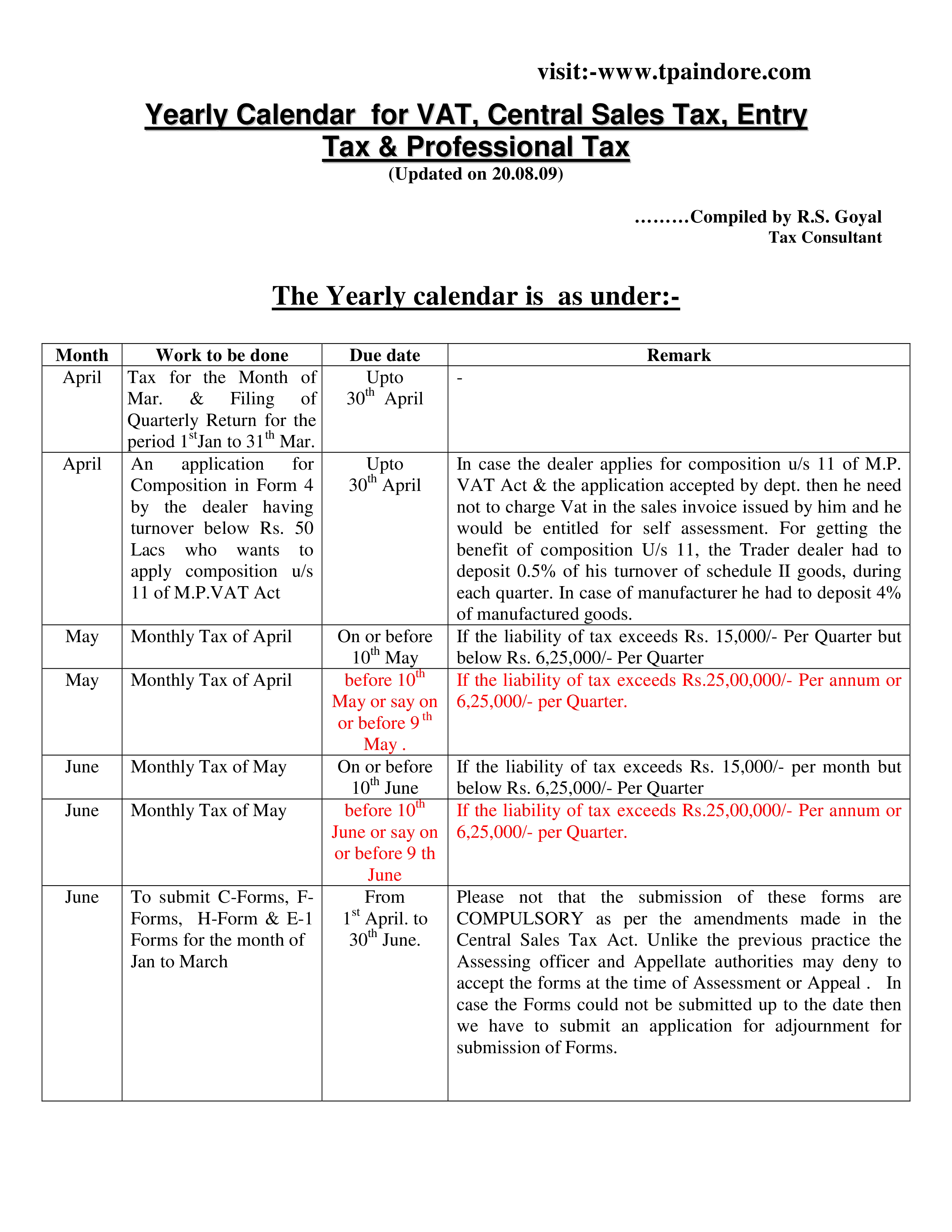

visit:-www.tpaindore.com Yearly Calendar for VAT, Central Sales Tax, Entry Tax Professional Tax (Updated on 20.08.09) ………Compiled by R.S.. 40 Lacs Monthly Tax of Oct. On or before 10th Nov. Monthly Tax of Oct. before 10th Nov or say on or before 9 th Nov. Monthly Tax of Nov. On or before 10th Dec. Monthly Tax of Nov. before 10th Dec. or say on or before 9 th Dec. To submit C-Forms, F- From 1st Oct. Forms, H-Form E-1 to th Forms for the month of 30 Dec. July to Sept.. Quarterly Tax Filing of Quarterly Return for the period 1st Oct to 31th Dec.. Upto 30th Jan Remark Please note that if there is any mistake in filing of all the four quarters filed by the dealer, it can be rectified by filing revised quarterly returns along with tax due thereon.. - visit:-www.tpaindore.com Month Feb. Work to be done Monthly Tax of Jan. Due date On or before 10th Feb before 10th Feb. or say on or before 9 th Feb. On or before 10th March before 10th Mar. or say on or before 9 th Mar. to Upto 31st March Feb. Monthly Tax of Jan. March Monthly Tax of Feb March Monthly Tax of Feb March Tax from 1st Mar. 25th March March To submit C-Forms, FForms, H-Form E-1 Forms for the month of Oct. to Dec.. From 1st Jan. to 30th March Remark If the liability of tax exceeds Rs..

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

发表评论。 如果您有任何问题或意见,请随时在下面发布